A Case For The Blood Being Over

Buy, Baby, Buy (?)

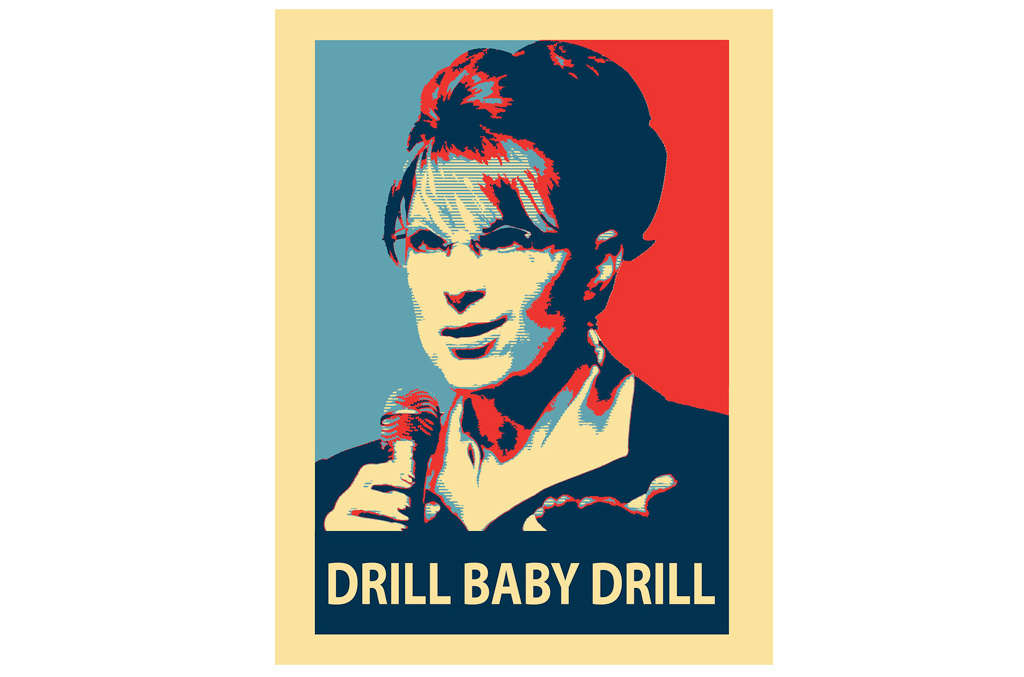

First of all, I’m sorry for triggering any PTSD by having to think about Sarah Palin again. I’m sure we are all happy to have that particular quirk of American history well behind us.

I’ve been thinking a lot all weekend, particularly today, about whether or not we are truly heading for a recession. Friday, the market and I were convinced …