And Now My Recession Watch Is Ended

The economy is screaming "No Recession" and Regime Change is in the air

Author’s Note: I will continue releasing free content where I can provide value to everyone. Posts will include premium content for paid subscribers at the end of emails or as separate write-ups. Free content will focus on macro views, whereas the paid content will focus more on the tactical trades I’m making.

Serious traders or investors should join Premium to get the best information.

We had an eventful week last week, just not in the way you might have guessed.

I’m going to break down what happened last week, the state of recession fears, discuss the Israel v. Iran situation, and then close with my thoughts on the week ahead.

This is a meaty one, so let’s dive in.

Recession Watch

For the last few months, the dominant narrative has been that our economy is deteriorating, led by a worsening labor market and a growing risk of a hard landing.

The data has been so bad that the first week of August and the first week of September, ISM and Non-Farm/UE data weeks saw an 11% and a 6% peak-to-floor fall in the NDX, respectively.

We’ll call the highlighted period the “Growth Scare” or, as I prefer, the period of “No Good, Very Bad Data.”

Like the last period of No Good, Very Bad Data (NGVBD), Powell rode to the rescue.

On September 18th, the Fed cut 50bps, and this week, about two weeks later, we got the best economic data of the year, blowing expectations out of the water.

Note the Citi Economic Surprise Index has turned solidly positive again.

At the same time, central banks are easing, and monetary conditions indexes are returning to levels that are about as high as they ever were, with the notable exception of China.

But even China is ticking upwards and has signaled a desire to ease. Whether they will follow through on it is anyone’s guess.

Taken as a whole, the data looks suddenly much more like Goldilocks than it does Recession.

Just How Far Away Is a Recession?

In the past, a job print that is this strong has meant no recession for at least 5-6 months. I’ve marked the relevant job prints on the chart with vertical lines.

It has also meant that we are at least 3 months away from a market top in SPX.

ISM Services paints an even rosier view, with no recession for a minimum of 6 months and an average of almost 10 months following data this strong.

The current ISM Services level also implies we are at least 4 months away from a market top.

The emphasis here is on “at least” because these all reference instances where we had a recession. Most of the time, especially with this strong data, there’s no recession in sight.

Regime Change is in The Air

Politicians love nothing more than regime change in the Middle East and the dream of a lasting legacy it offers.

Somehow, the fact that it never works out isn’t considered.

The siren’s call for regime change is sounding once again, representing a threat to markets.

Meanwhile, Biden has shown a shocking inability to exert any control over the Israelis.

No one in the world wants this conflict to escalate (especially not Iran) except for the Israelis and a few hard-liners in Washington who see their chance to remake the Middle East.

A severe retaliation from Israel that targets Iranian oil facilities could lead to Iran striking other Gulf State oil infrastructure as they did in 2019.

Markets will likely remain jittery so long as the specter of escalation hangs over the region, but the longer-term threat is one of regional conflict that disrupts oil markets. Such a disruption could lead to long-term higher prices, just as the fear of recession is put to rest.

And that risk is only exacerbated by rhetoric like Kushner’s and Netanyahu’s.

A strong and growing economy coupled with high oil prices could put us back on track towards 2021, when inflation got away from the Fed and kicked off the tightening cycle of 2022.

This is a risk to watch, and the deeply bearish case would take a long time to materialize.

Last Week’s Trades and The Week Ahead

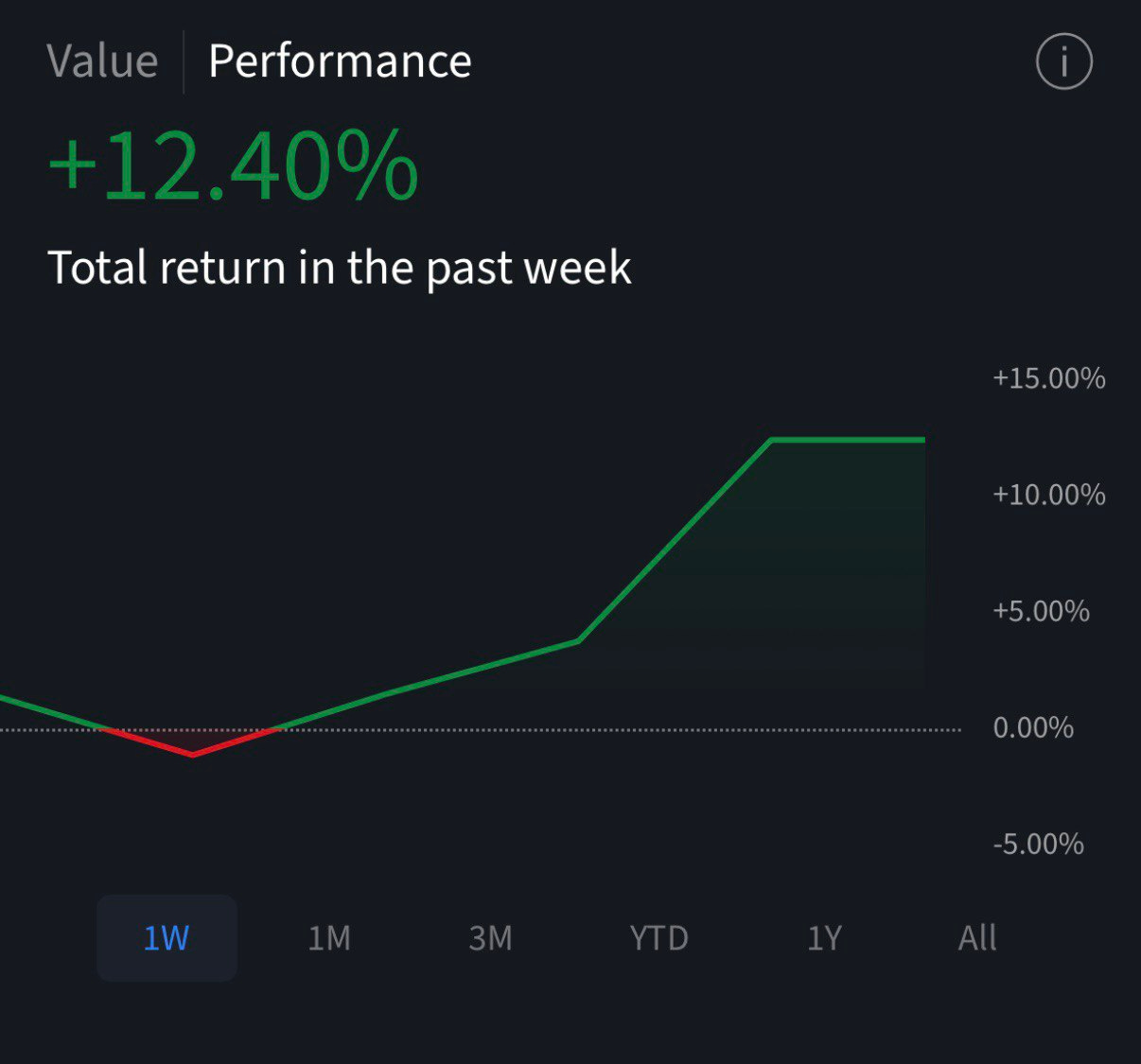

We had an excellent week in the tactical portfolio.

I posted those trades in the chat almost in real-time, so make sure you’ve joined. The chat is available to everyone, although the calls will eventually be Premium-only.