Clear Air

Markets out to ATHs

Markets broke out to ATHs to end last week, and futures have opened even higher this evening in New York.

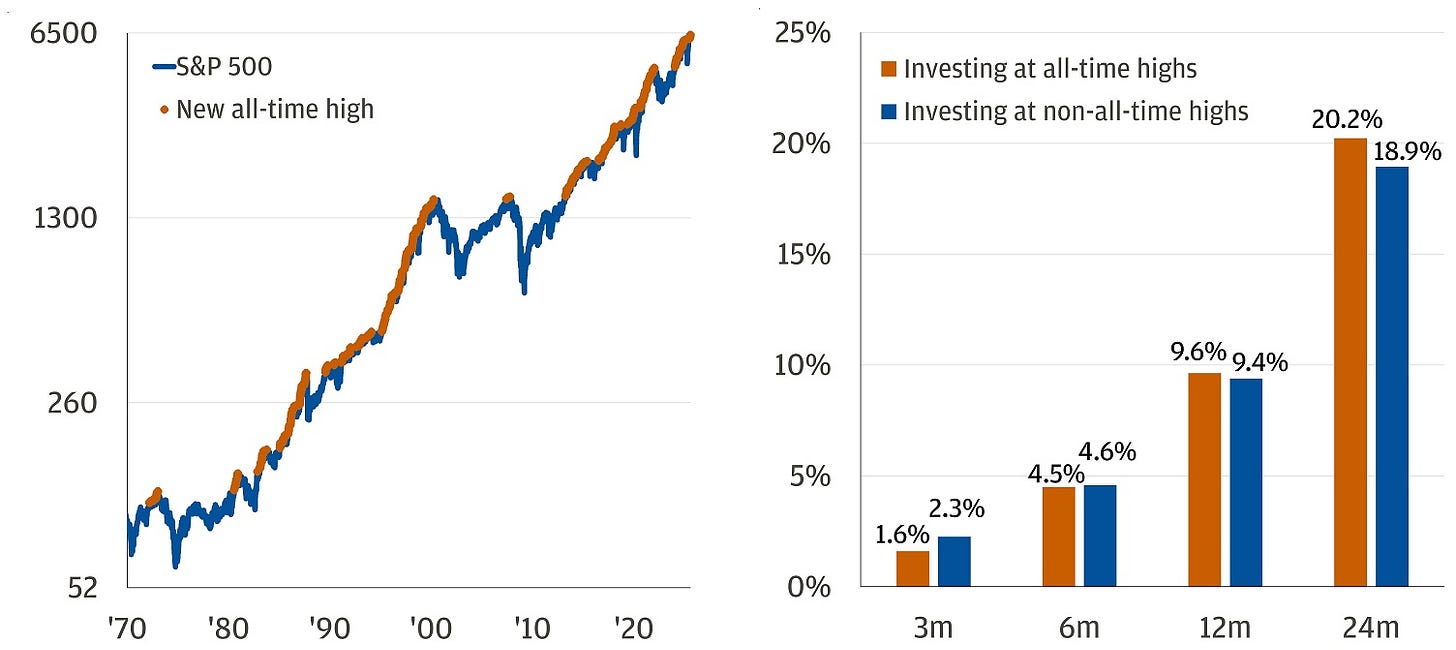

There are two common narratives I hear surrounding “ATH breaks” in equities. Some people claim that ATH breaks are bullish and should be bought, others see high prices and think they want to wait and buy lower.

JPM did an analysis of past ATH breaks since 1970 and discovered that buying them is basically the same as buying at any other time. They are ever so slightly more bullish than average on a long-term basis, and slightly less bullish than average on a short term basis. More importantly the data is close enough so as to likely be just noise.

Don’t fear the ATHs.

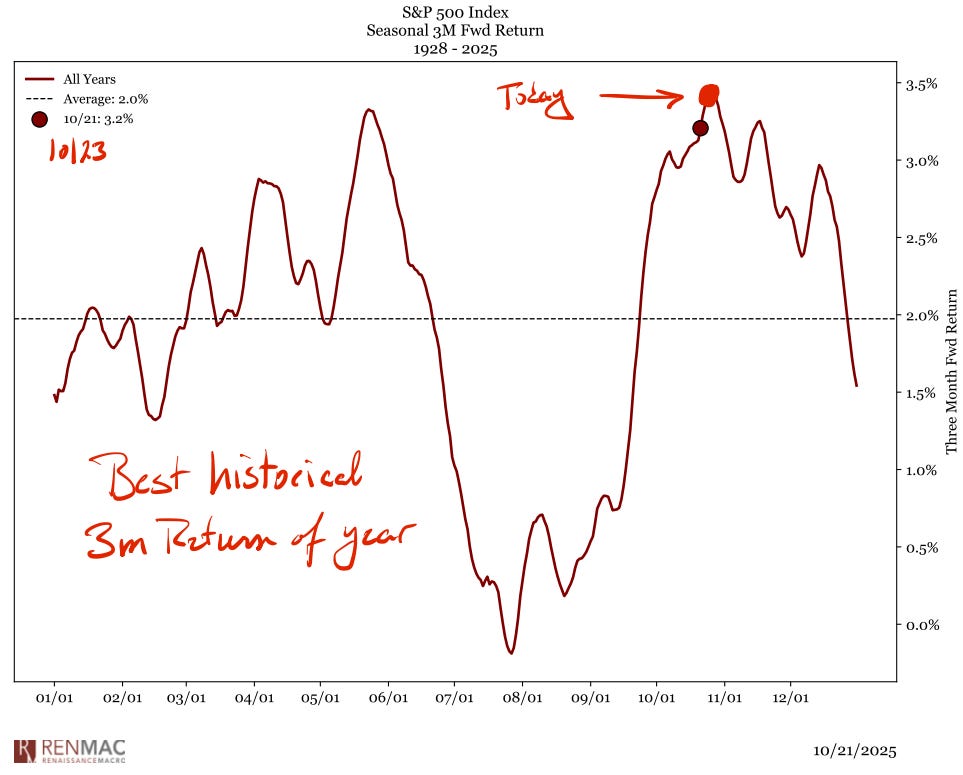

On the seasonality front, last Thursday was the single best day of the year (historically) to buy stocks on a 3-month forward return basis.

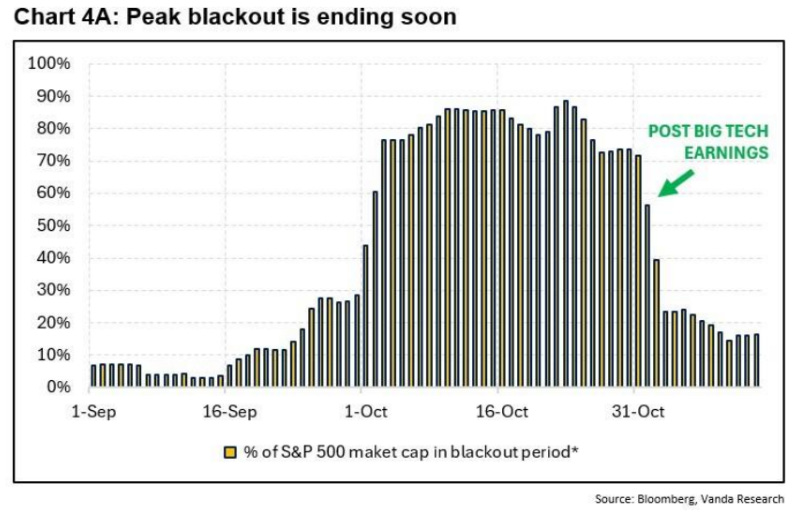

Seasonality is very bullish here, with a huge number of S&P stocks coming out of their blackout periods and beginning to repurchase their shares into EoY.

Positioning

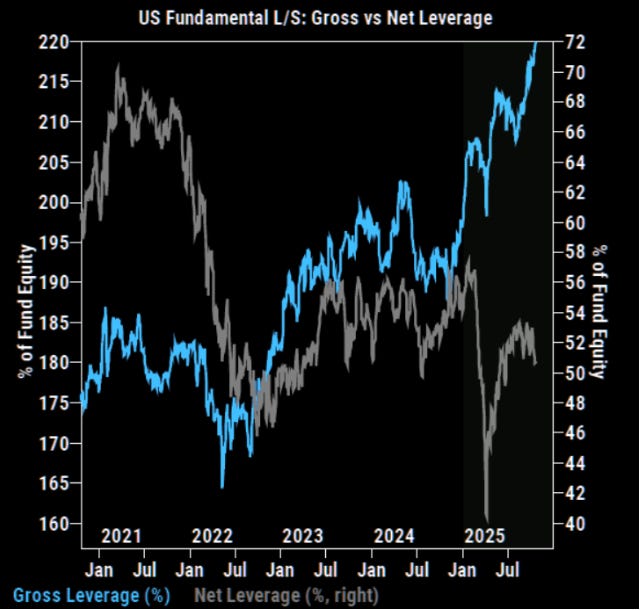

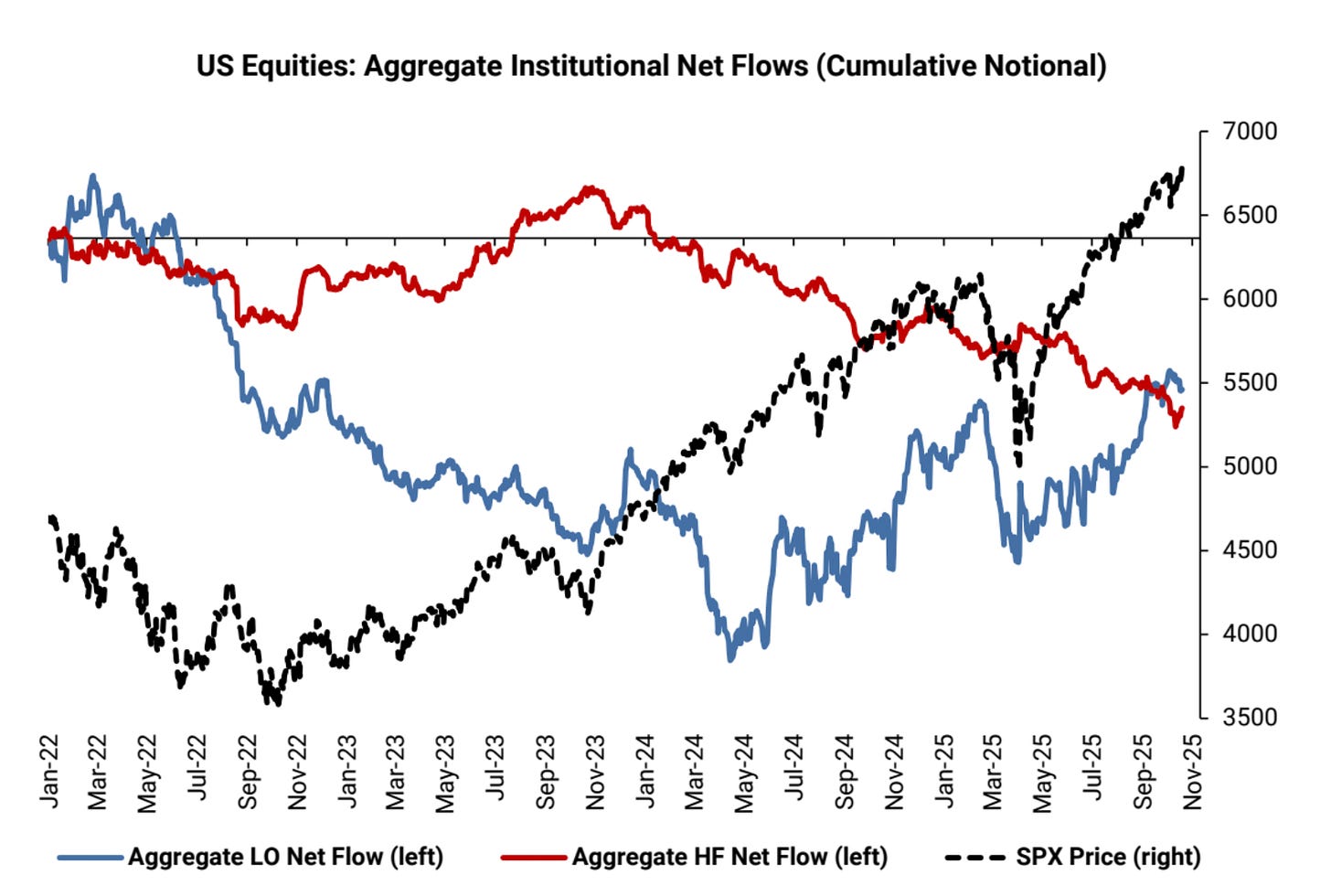

Positioning continues to surprise me. Goldman is modeling L/S investors as having high gross exposure but quite low net exposure. This is interesting because a high gross exposure implies that they are confident of a lower volatility regime (bullish) but are choosing to keep net exposure low (bearish).

Meanwhile, long only investors have been buyers since the April bottom but not at extreme levels. Hedge funds continue to doubt the rally and continue to be net sellers.

This has really been a retail-driven market, and that trend seems likely to continue into Q4 and even into 2026 if Goldman’s forecast is right.

Earnings Season

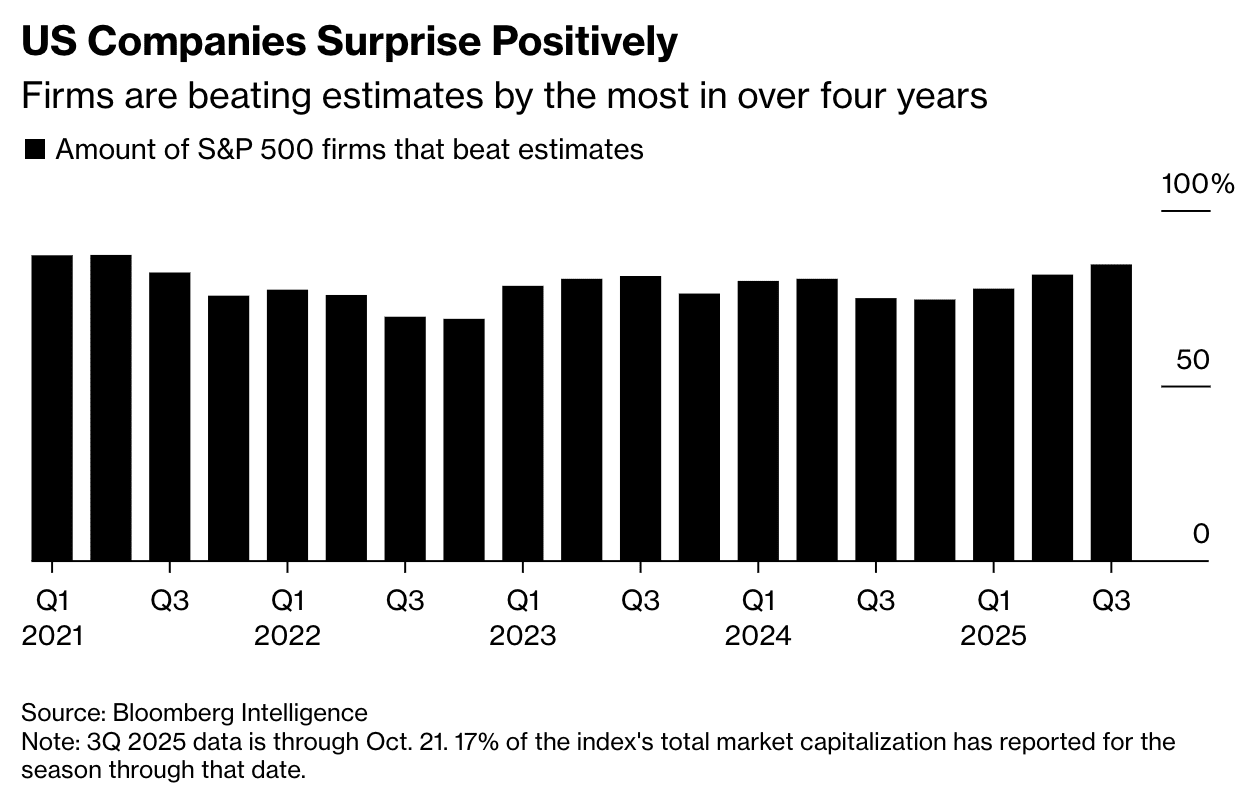

Earnings season is well under way and this week is a big one with ~35% of the S&P 500 reporting.

So far we’ve seen a steady string of earnings beats, although I would say that was largely expected by the investors I talk to.

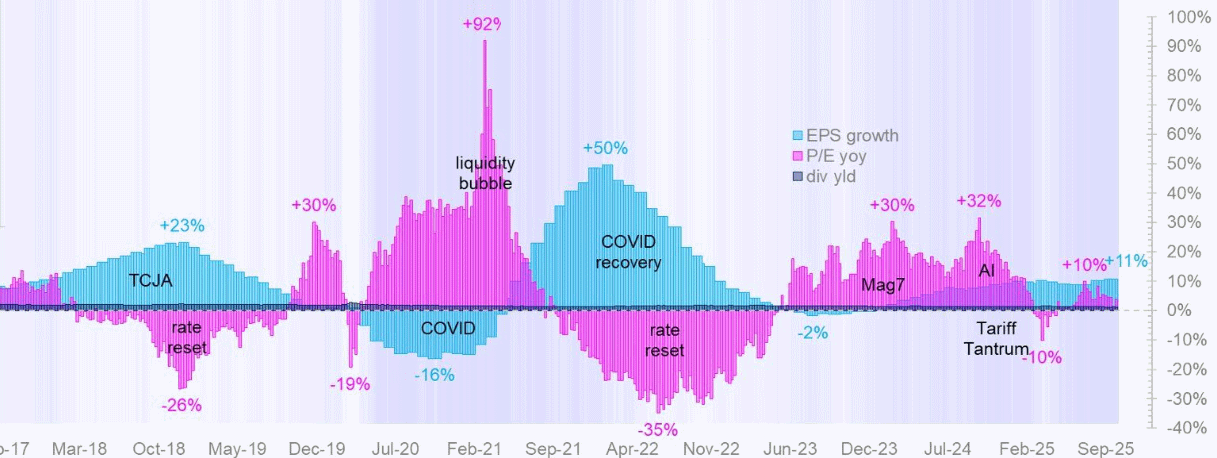

This is an interesting chart showing that we are in a somewhat unique moment where EPS growth is outpacing P/E growth without a rate hiking cycle.

We’re also in a period of dramatically expanding margins for the S&P500. Anyone who talks about P/E ratios being at “ATHs” without discussing this magin-growth story is larping.

My Vibe

ATHs aren’t magic, but seasonality and buybacks lean bullish, positioning still (somehow!) leaves plenty of dry powder, earnings breadth is decent, and margins are expanding.

Want to read the rest? Like this post and if it gets 10 likes I’ll give away 2 months of premium!