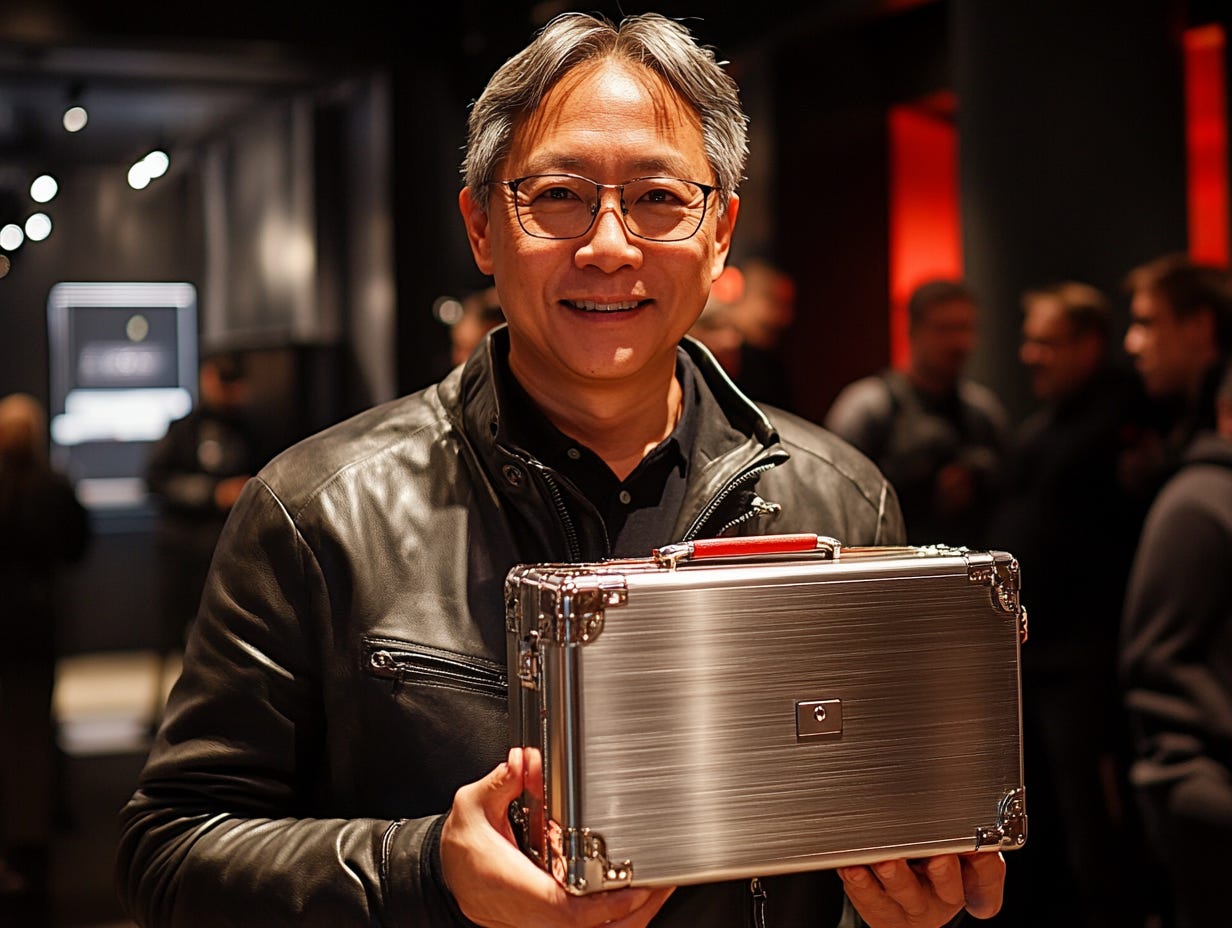

Deal Or No Deal: NVDA Edition

What's in the box Jensen?

I’ve gotten in a few disagreements with Citrini this week over whether or not Powell took his shirt off on Friday.

This week's price action has somewhat supported Citrini’s view that he didn’t. The market reacted and has since promptly reprice…