Earnings Season Kicks Off: What Needs To Go Right

Earnings kick off again

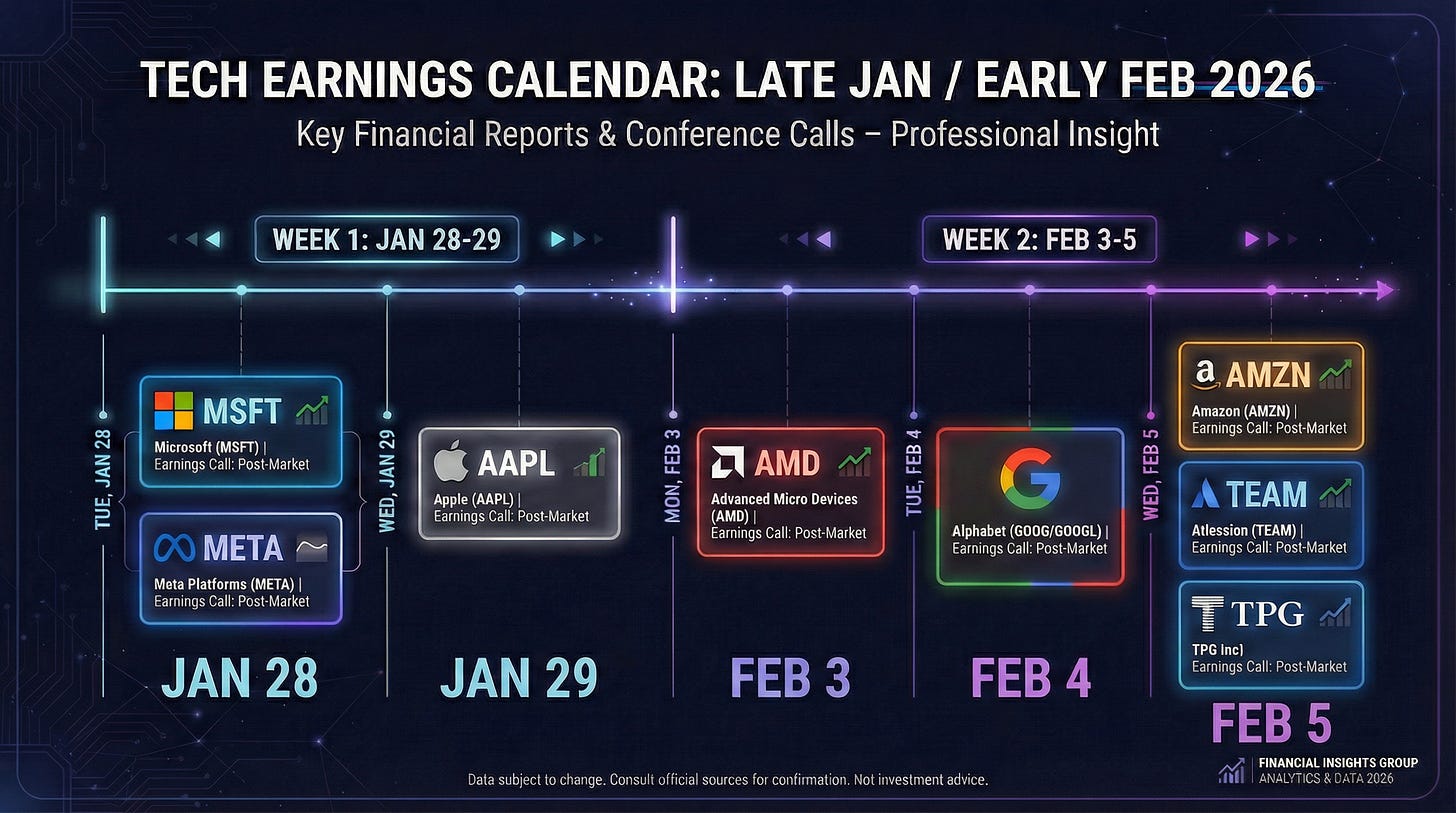

The next two weeks are loaded. MSFT and META report Tuesday, AAPL Wednesday, GOOG and AMZN the week after. This is the quarter where the AI trade either proves it can monetize or starts looking like an expensive science project.

The Macro Backdrop

We’re heading into this earnings season with an interesting cross-current of signals.

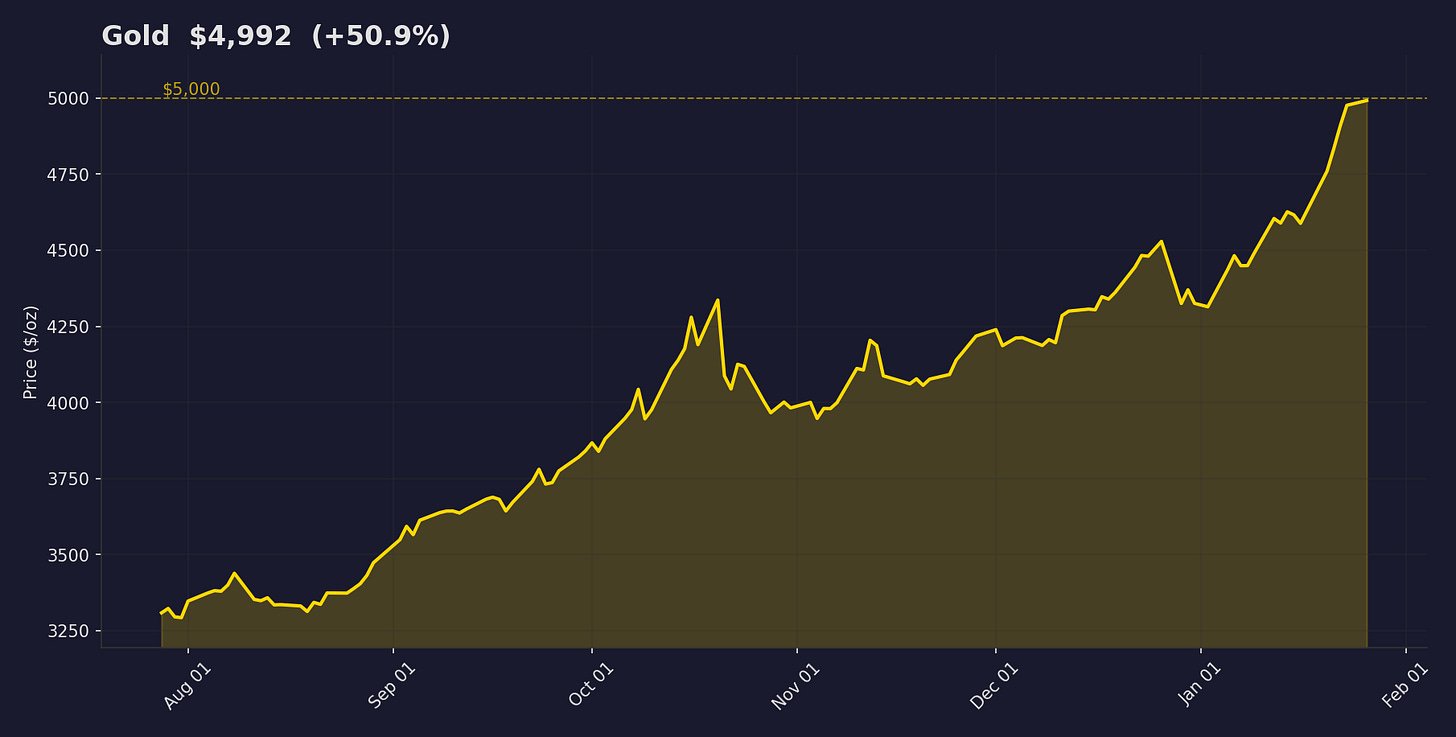

Gold just broke $5,000. The yellow metal is trading above $5,050 as of this writing, a level that seemed absurd just a year ago. The breakout reflects a cocktail of concerns: tariff uncertainty, geopolitical tensions, and a growing sense that central banks aren’t done accumulating. When gold runs like this, it’s usually telling you something about risk appetite. Smart money is hedging.

Japan’s bond market is flashing warning signs. JGB 10-year yields have blown out above 2.2%, levels not seen in over a decade. But this isn’t just the BOJ normalizing policy. The move reflects deeper concerns: Japan’s fiscal situation is deteriorating, debt-to-GDP remains the highest in the developed world, and inflation is proving stickier than expected. The market is starting to price in the possibility that Japan can’t keep a lid on yields forever. The Nikkei sold off nearly 2% on Friday as investors reassess.

US 10-year yields are rising in sympathy. We’ve come down from the 4.7% panic levels of early January, but we’re creeping back up toward 4.2%. Part of this is the JGB spillover effect. When the world’s largest creditor nation sees bond yields surge, it ripples everywhere. Japanese investors have been massive buyers of US Treasuries for years. If they start demanding higher yields at home, or worse, start selling foreign bonds to repatriate capital, that’s a headwind for global risk assets. For growth stocks, every 25bps matters for DCF models. The bond market isn’t giving us an all-clear.

What does this mean for earnings? The macro isn’t hostile, but it’s not a tailwind either. Companies need to deliver on their own merits. There’s no multiple expansion coming from rate cuts or a liquidity surge. It’s a “show me” environment.

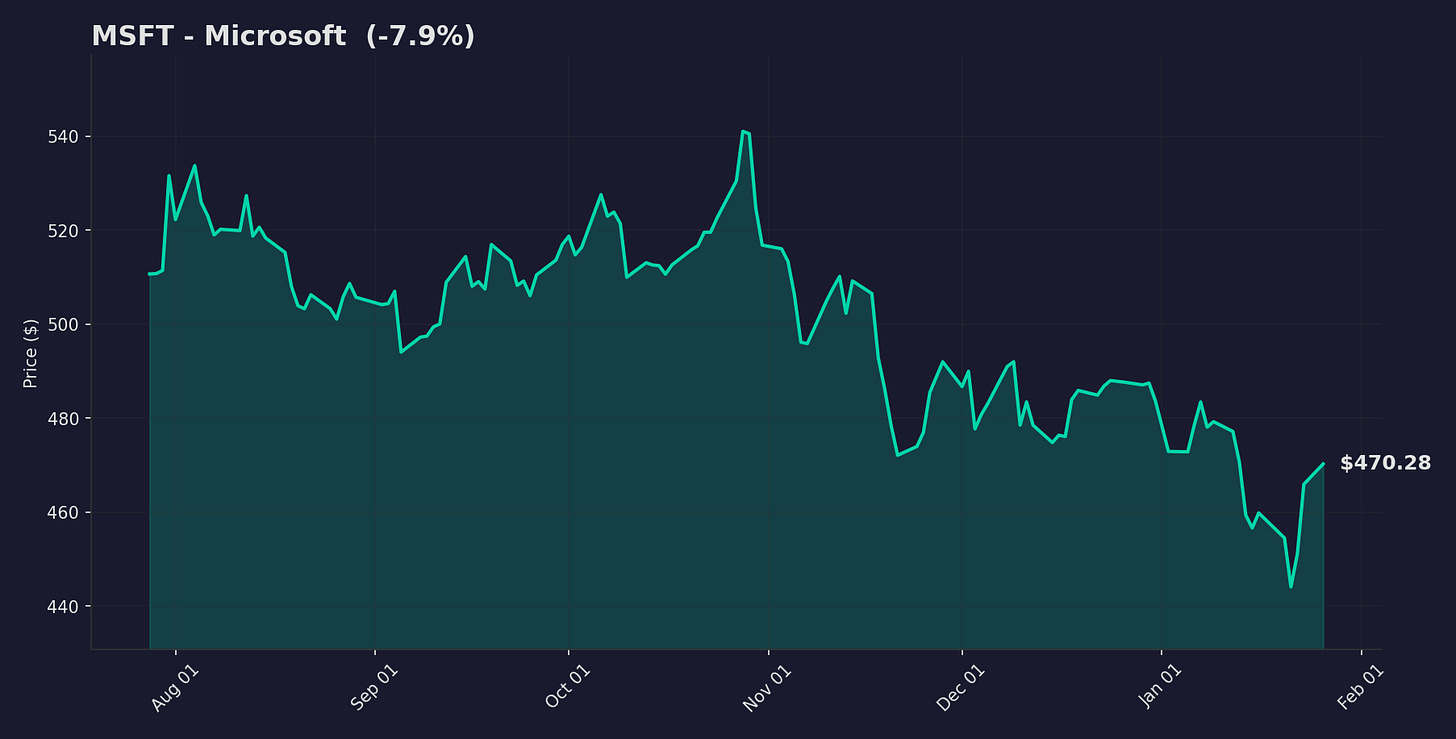

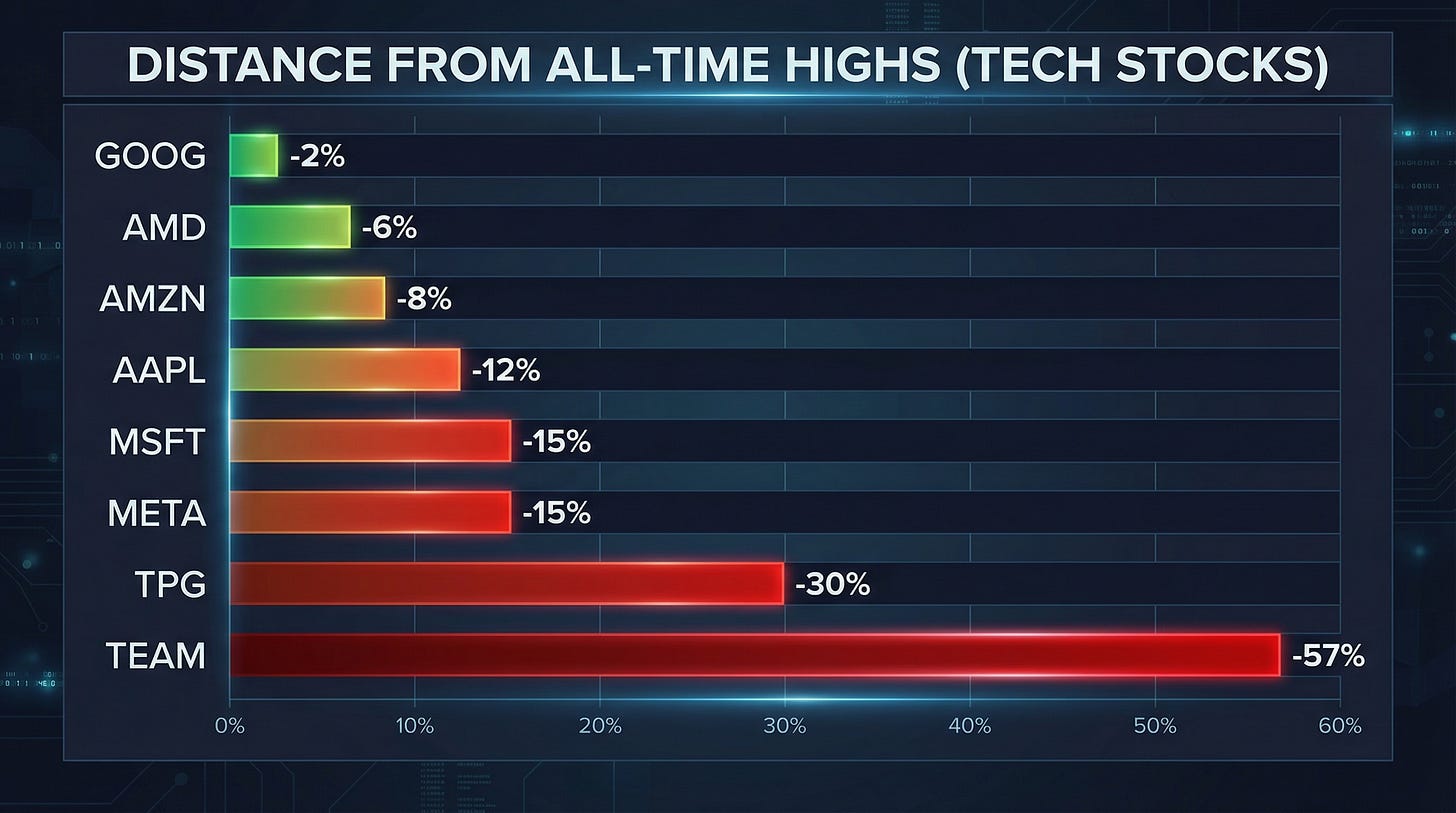

The setup going in is interesting. Many of these names are 10-20% off their highs despite the broader market holding up. Expectations are elevated but not euphoric. The bar for “beat and raise” is high, but the stocks have already pulled back enough that truly good numbers could rip.

Signs of a Quality Rotation

Here’s something interesting: after months of struggling, the Magnificent Seven are showing early signs of life. The MAGS ETF, which tracks the seven mega-cap tech names, has been chopping sideways since November. But in the last few sessions, we’re seeing buyers step back in.

This matters because the market has been ignoring these stocks for months. The equal-weight S&P outperformed the cap-weighted index for most of Q4. Money rotated into small caps, value, and international. The “Mag7 are too crowded” narrative dominated.

Now the setup is flipping. With yields inching higher and growth coming off a major rotation, investors are remembering why they owned quality in the first place. These companies print cash, have pricing power, and are the primary beneficiaries of AI.

Earnings could accelerate this rotation. If MSFT, META, and the rest deliver strong numbers, the “quality bid” could turn into a full rotation back into mega-cap tech. The stocks have de-risked through time and price. They’re not as stretched as they were six months ago. Good earnings plus a quality rotation could be a powerful combination.

The Big Three Questions

Is AI capex still accelerating or are we seeing the first cracks?

Last quarter, every hyperscaler guided capex higher. That’s what funded the whole AI infrastructure trade. We need to keep hearing some version of “we can’t build fast enough.”

MSFT is the one to watch here. Satya said last quarter that he’s not chip-constrained anymore, he’s “warm shell” constrained. Translation: they can get the GPUs, but they can’t build datacenters fast enough to house them. If that’s still true, power and datacenter names keep working. If capex guidance disappoints, the whole stack gets hit.

Are companies actually attributing revenue to AI?

We’ve been waiting for “Phase 3” of the AI trade: software monetization. Last quarter we saw early signs. META said AI was improving ad targeting. CRM started breaking out Agentforce numbers. GOOG’s cloud reaccelerated.

This quarter needs to show that trend continuing. I want to hear specific AI revenue numbers, not just “AI is embedded in everything we do.” That line worked in 2024. It doesn’t work anymore.

What’s the guidance tone?

The Mag 7 has stayed magnificent through one formula. Beat and raise. That’s the name of the game for these companies. Any sign that things are slowing around the margins will be bearish. Any sign that time horizons are being pushed back will be bearish.

This Week: The Main Event

Wednesday is a big one. MSFT and META reporting on the same day means we’ll get a read on both enterprise AI adoption and consumer AI monetization in one shot.

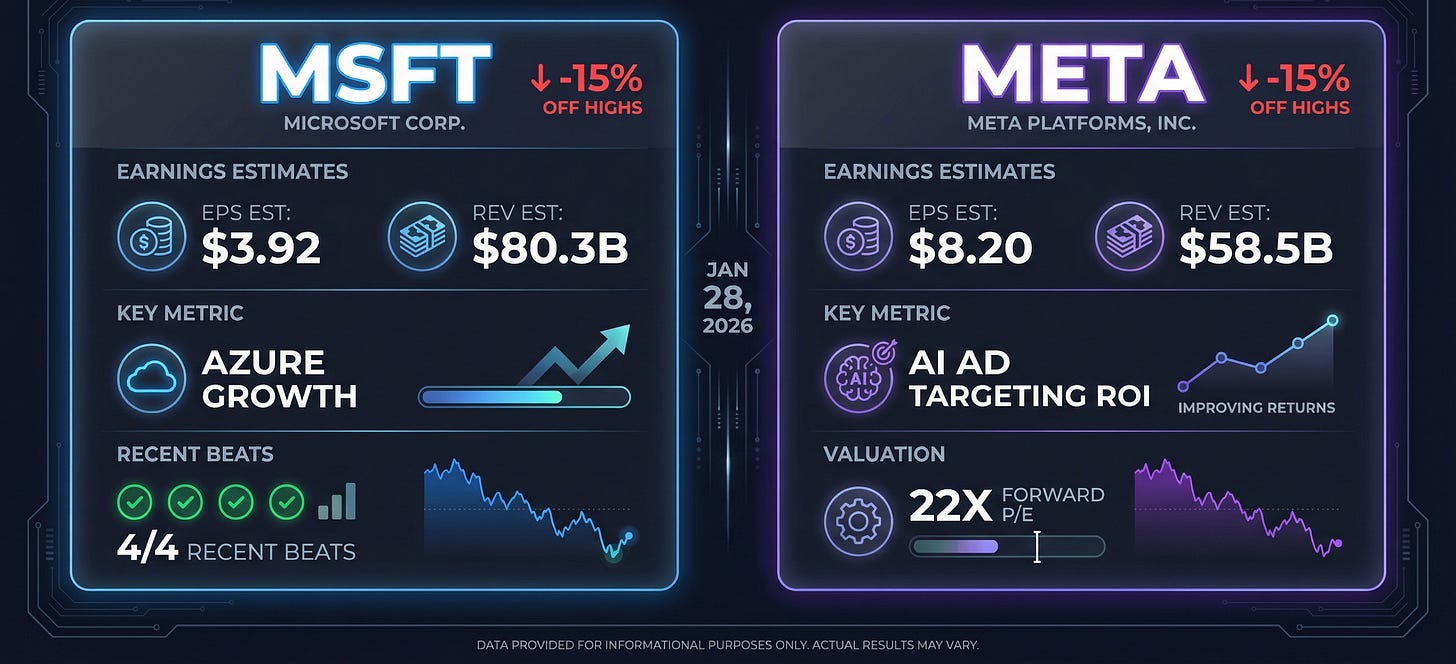

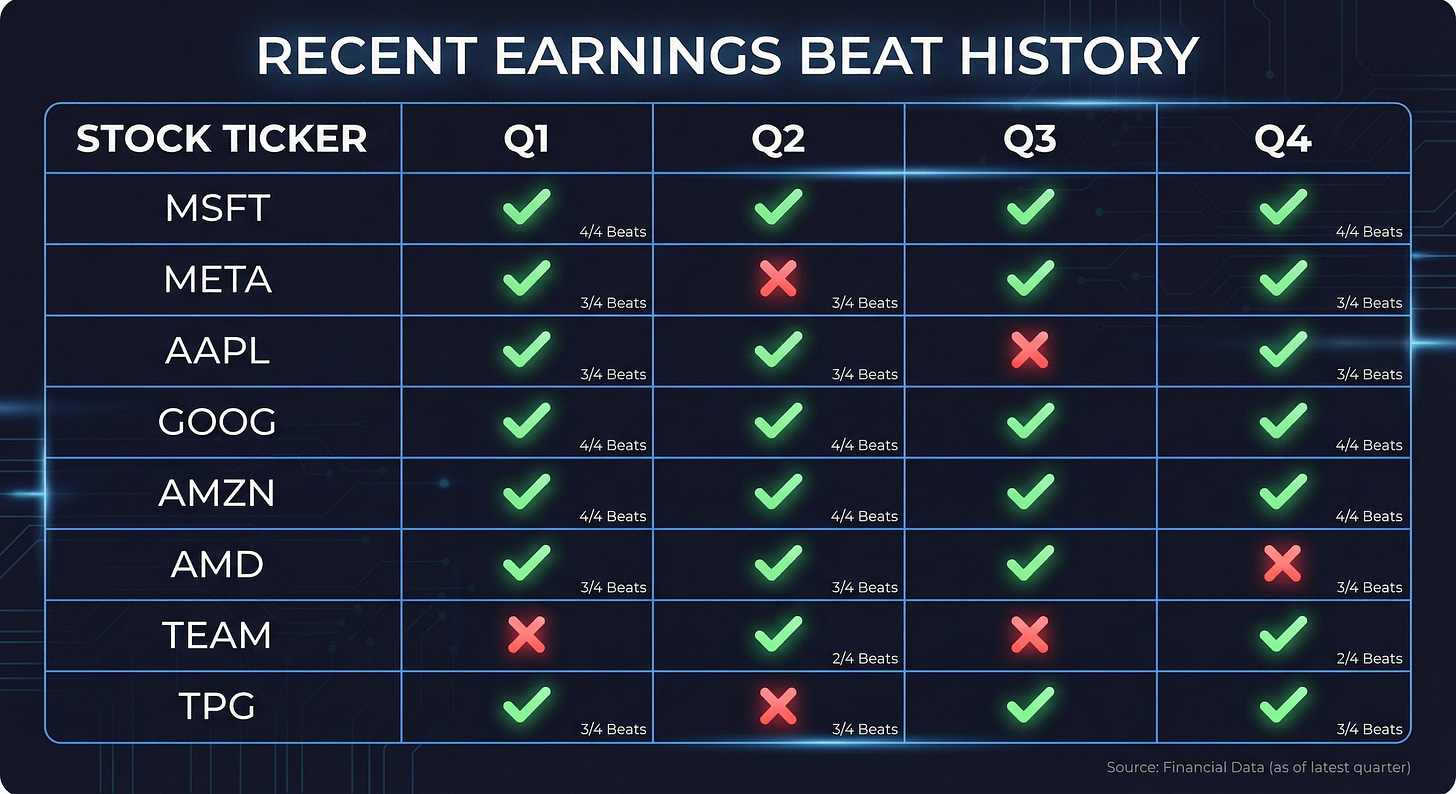

Microsoft reports after the bell Wednesday with street estimates at $3.92 EPS on $80.3B revenue. Azure growth rate is the number everyone’s watching. It needs to hold above 30%. The stock is 15% off highs with a perfect 4/4 beat streak over the last year. The real tell will be capex guidance for FY26. If they guide higher, it’s bullish for the entire AI infrastructure stack. If they guide flat or lower the hardware names will get hit.

Meta follows with estimates of $8.20 EPS on $58.5B revenue. They got punished last quarter for guiding capex higher without showing enough ROI. On last quarter’s earnings call Zuck nodded to the idea that they are seeing ROI in their core business. This quarter they need to prove the spend is paying off. The thesis is that AI is improving ad targeting and driving better ROAS for advertisers. If they can show that in the numbers, the stock looks cheap at 22x forward. If it’s still “trust us, AI is helping,” expect more selling.

Apple on Thursday is the AI laggard. The street expects $2.67 EPS on $138.5B revenue. Apple Intelligence adoption is the wildcard here. They were late to the AI party but have massive distribution. Services growth needs to stay strong. iPhone units matter less than ASPs. The stock is 12% off highs and trading like a bond with upside optionality on AI.

In particular pay attention to any talk of Siri, Apple’s voice assistant. It’s getting a makeover this year using Google’s Gemini models. A blowout Siri release could be big for turning around AAPL’s “AI Laggard” narrative.

Next Week: The Second Wave

The action continues into February with AMD on Tuesday, GOOG on Wednesday, and then AMZN, TEAM, and TPG on Thursday.

AMD ($1.32 EPS, $9.7B rev) is positioning itself as the Nvidia challenger. The MI300 ramp is the whole story. Data center revenue needs to accelerate to justify the 38x forward multiple. They’re only 6% off highs, so the market is already pricing in a decent quarter.

Google ($2.64 EPS, $111.4B rev) had cloud reacceleration last quarter and needs that trend to continue. Gemini monetization is starting to matter. The stock is basically at the highs, which tells you the market already likes the setup going in. GOOG 0.00%↑ has been one of my favorite names, but it has dramatically repriced. We need to see a positive beat to propel Google’s momentum higher.

Amazon ($1.94 EPS, $211.2B rev) is all about AWS growth. It needs to stay above 15%. Retail margins matter too, but AWS is the multiple driver. The stock is 8% off highs with strong buy ratings across the board.

Then there are the two names I find most interesting from a risk/reward standpoint.

Atlassian is 57% off its highs. That’s not a typo. The “AI kills SaaS” narrative has absolutely crushed this stock. Either that thesis is right and this is a melting ice cube, or the market has massively overcorrected.

What’s the dirty secret of the “AI kills SaaS” story? Even the big AI labs use SaaS. OpenAI uses Slack, Anthropic uses Workday. Their earnings could be a turning point. I’ve been nibbling on the thesis that enterprise software isn’t going away just because AI exists.

TPG is 15% off highs with rates coming down. They’re the most tech-forward of the big PE shops, with heavy exposure to software and growth companies through their Rise fund and tech-focused strategies. Private equity is quietly one of my contrarian AI plays because they can apply efficiency gains across entire portfolios. TPG in particular has the expertise to actually implement AI at their portfolio companies rather than just talking about it.

The Setup In Pictures

Look at that dispersion. GOOG is basically at highs while TEAM is down 57%. The hyperscalers are in decent shape at 10-15% off peaks, which means good numbers should move stocks but great numbers are needed for big moves. The beaten-down names like TEAM and TPG have more torque if they deliver

The beat history is solid across the board. These companies know how to manage expectations. But that’s almost the problem. The question isn’t whether they beat, it’s whether the beat is big enough and the guidance is strong enough to actually move the stocks. Beating by a penny and guiding in-line isn’t going to cut it this quarter.

The Bottom Line

This earnings season is a checkpoint for the AI trade. The infrastructure buildout thesis has been working, but the market wants to see revenue follow capex. We’ve been patient. We’ve funded the buildout. Now show us the returns.

To that end, pay attention to where and if the actual revenue gains show up in places that BENEFIT from AI, not just sell it.

What would make me more cautious: capex guidance disappointments, Azure or AWS deceleration below 25%, or management teams suddenly talking about “efficiency” instead of growth. If the tone shifts from “we can’t build fast enough” to “we’re optimizing our spend,” that’s a problem for the whole trade.

The stocks have pulled back enough that good numbers should be rewarded. But “good” won’t cut it anymore. We need “great” on capex, specific AI revenue attribution, and confident 2026 guidance. Anything less and these stocks are probably range-bound until we get better data.

Good luck out there.

Disclaimer: The information provided here is for general informational purposes only. It is not intended as financial advice. I am not a financial advisor, nor am I qualified to provide financial guidance. Please consult with a professional financial advisor before making any investment decisions. This content is shared from my personal perspective and experience only, and should not be considered professional financial investment advice. Make your own informed decisions and do not rely solely on the information presented here. The information is presented for educational reasons only. Investment positions listed in the newsletter may be exited or adjusted without notice.