Economic Tea Leaves

This week is all about economic data

Author’s Note: I will continue releasing free content where I can provide value to everyone. Posts will include premium content for paid subscribers at the end of emails or as separate write-ups. Free content will focus on macro views, whereas the paid content will focus more on the tactical trades I’m making.

Serious traders or investors should join Premium to get the best, most timely information.

November was my best month ever by a wide margin.

Obviously, these returns are abnormal, and I don’t want any of you to expect them or even target them. November was a rare confluence of situations that worked out well for us.

We read the election well. When the market was risk-off heading into the election, we decided that the asymmetry was to the upside, and we prepared for the post-election VOL crush.

On election night, we were deep in the weeds of the county-by-county data, and when it became clear Trump was winning decisively, we got leveraged long.

We also de-risked near the top, removing the leverage and not overtrading. Last week, we continued to enjoy some good performance.

My Trading Style

I’ve always been primarily an events-driven trader. My biggest trades have all revolved around reading events better than the markets. Events like:

COVID (2020)

Inflation Isn’t Transitory (2022)

Ukraine Invasion (2022)

Trump Win (2024)

The nice thing about being an events-driven trader is that you get these moments of enormous success that look great in a newsletter and feel great in the moment.

The downside to being an events-driven trader is that you never really know when you will find an event to trade. You’ll notice on my list of events above that there aren’t any from 2021 or 2023.

That leaves you always asking…

What’s Next?

The first week of every month brings us a significant slate of economic data, and December is no different.

Monday

ISM Manufacturing

S&P Manufacturing

Wednesday

ADP Employment Change

S&P Services

ISM Services

Fed’s Beige Book

Friday

Nonfarm Payrolls

Unemployment Rate

U. Mich Sentiment

The first week of August and the first week of September both sparked significant corrections in risk assets. We have the same potentially inflammatory data this week.

Survey-based data has been improving recently, and I am optimistic about what the manufacturing, services, and sentiment data will say.

I tend to buy into the theory that, overall, the election fading into the past is bullish for all forms of survey-based data.

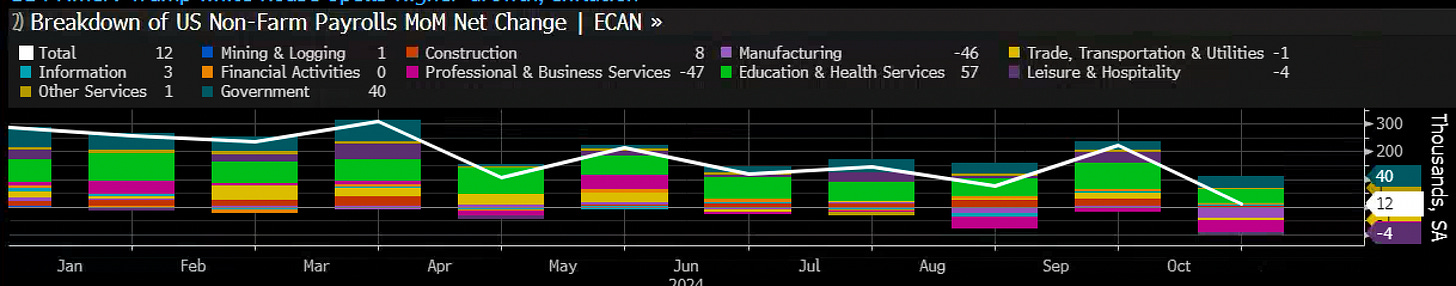

The employment data, particularly the nonfarm payroll data, is of much more concern. It came in astoundingly low last month, with the disappointing number primarily written off as being “due to the hurricanes.”

Anna Wong, the Bloomberg economist who was one of the few to accurately predict last month’s report, is expecting another disappointment. She expects NFP to come in at 155k vs 200k expected.

Nonfarm payrolls to increase 155k in November (vs. 12k prior). The October figure will likely be revised up to around 50k…

Of the expected 155k increase, the post-strike return of Boeing workers provided a one-time boost of about 40k…

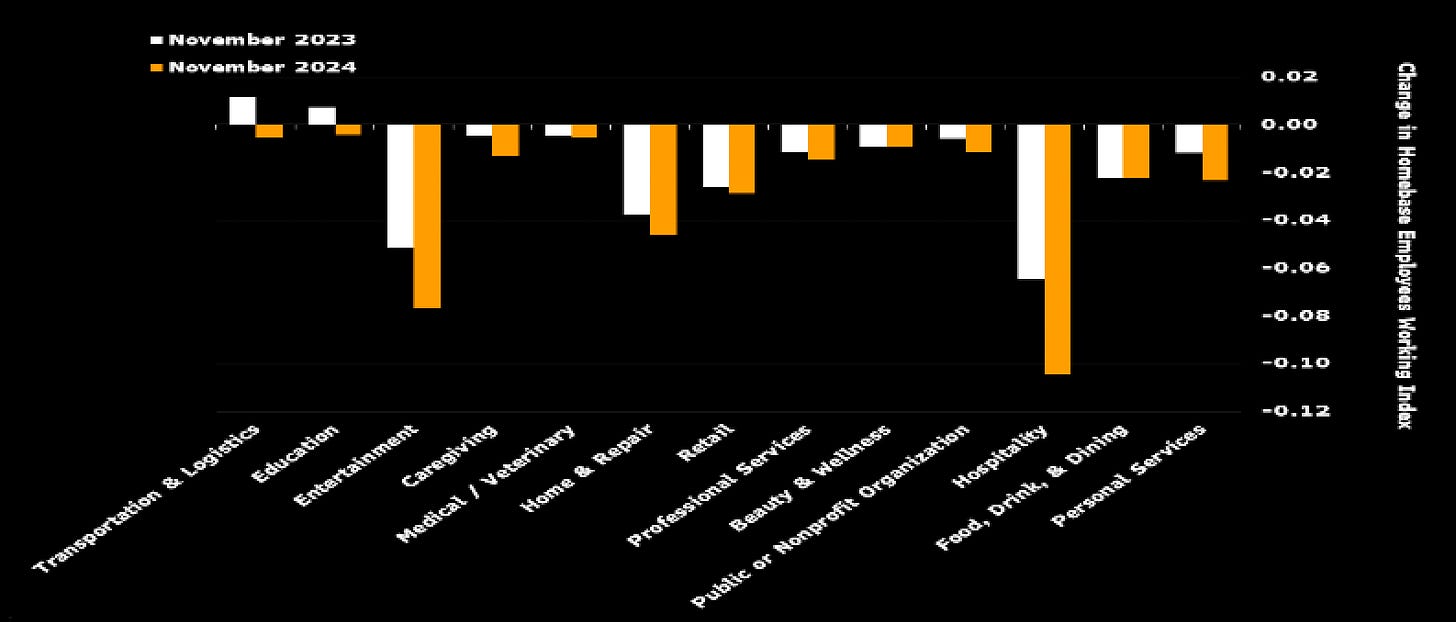

Particularly, we see unseasonably weak hiring in education, hospitality, and professional services (one of the key drivers of October’s weak reading too).

Meanwhile, demand for puts is back to pre-election levels.

Putting It All Together

The rest of this post is for paid subscribers only. If you’re already a paid subscriber, thank you! If not, please consider redeeming the free trial to continue reading.