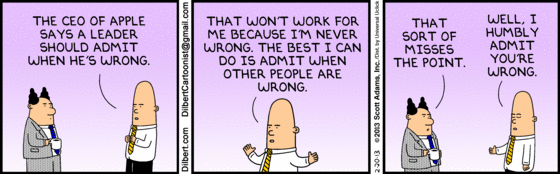

How Could We Be Wrong?

The most important question to ask.

Well, I read a note fromMichael Howelltoday that sparked a realization “oh this is how we could be wrong.”

It’s important to always be thinking about that when you are trading. You should always ask yourself “what would make me wrong?” so that you can spot it quickly when you are, in fact, wrong.

We are long stocks and short bonds which I still think is good positionin…