Is It Time To Buy $META?

A Deep Dive on Meta's Last Quarter and the Path Ahead

Both Google and Meta reported earnings yesterday after the bell, and to say that the stocks had different reactions would be an understatement.

Meta dropped sharply by about 10% and continues falling during the call and overnight.

I was a bit surprised by this reaction. After adjusting out a one-time tax payment due to the One Big Beautiful Bill Meta’s headline numbers weren’t bad.

The Numbers

*REV. $51.24B, EST. $49.59B

*EPS $1.05 VS. $6.03 Y/Y

*ADJ EPS $7.25 vs $6.03 Y/Y (Adjusting out the one time payment)

*SEES 4Q REV. $56B TO $59B, EST. $57.38B

*SEES FY CAPEX $70B TO $72b, SAW $66B TO $72B, EST. $69.3B

*EXPECTS CAPEX DOLLAR GROWTH NOTABLY LARGER IN 2026 VS 2025

Looking at these headlines two things stand out. Firstly, Meta’s 4Q projections were roughly in line, and secondly they are expecting capex to grow “notably larger” in 2026.

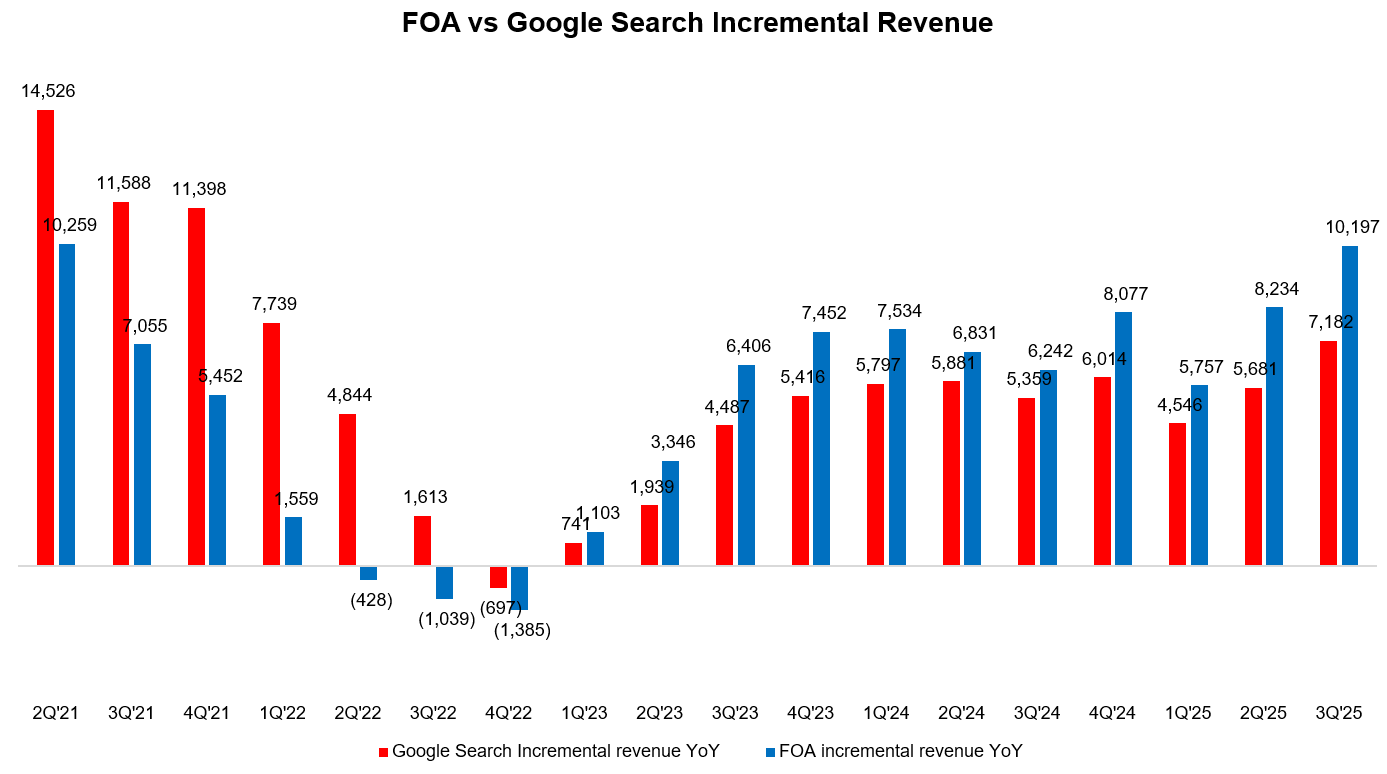

Digging deeper, Meta’s Family of Apps revenue is actually growing faster than Google Search revenue, and has been at an increasing rate since 2023.

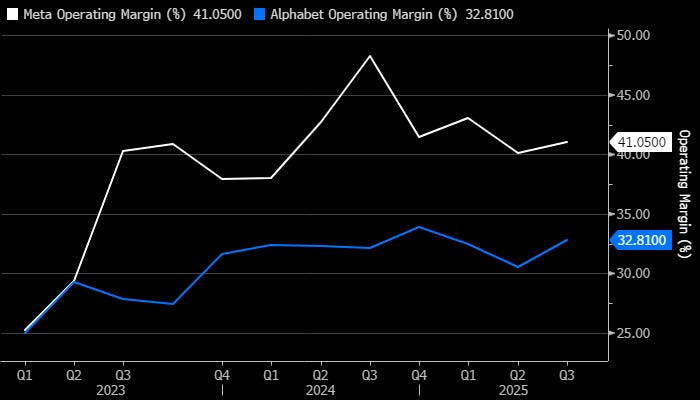

So while Google had an excellent quarter the Meta cash machine actually seems to be spinning up faster than Google’s core business, while operating margins are expanding at a similar pace.

The problem, then, is on the expense side. Meta warned that 2026 capex would be “notably larger” and that expenses would grow “at a significantly faster rate” compared to 2025.

To put that in context let’s take a look at how Meta is using their existing compute.

AI in the Core Business

To understand whether the capex plans are bullish, bearish, or something in between let’s take a look at some of Mark’s statements on the earnings call.

Meta Superintelligence Labs is off to a strong start. I think that we’ve already built the lab with the highest talent density in the industry. We’re heads down developing our next generation of models and products, and I’m looking forward to sharing more in that front over the coming months. We’re also building what we expect to be an industry-leading amount of compute.

Now, there’s a range of timelines for when people think that we’re going to get superintelligence. Some people think that we’ll get there in a few years. Others think it will be five, seven years or longer. I think that it’s the right strategy to aggressively front load building capacity so that way we’re prepared for the most optimistic cases. That way, if superintelligence arrives sooner, we will be ideally positioned for a generational paradigm shift and many large opportunities.

If it takes longer, then we’ll use the extra compute to accelerate our core business, which continues to be able to profitably use much more compute than we’ve been able to throw at it and we’re seeing very high demand for additional compute, both internally and externally. And in the worst case, we would just slow building new infrastructure for some period while we grow into what we build.

Pulling this next part out separately as I think it’s the key to understanding Meta’s capex plans.

And one way that I think about our company overall is that there are 3 giant transformers that run Facebook, Instagram and ads recommendations. We have a very strong pipeline of lots of ways to improve these models by incorporating new AI advances and capabilities.

Let’s break down what Mark is saying.