Is the Market Near a Bottom?

Is it time to buy the F***ing dip?

Author’s Note: I will continue releasing free content where I can provide value to everyone. Posts will include premium content for paid subscribers at the end of emails or as separate write-ups. Free content will focus on macro views, whereas the paid content will focus more on the tactical trades I’m making.

Serious traders or investors should join Premium to get the best, most timely information.

The S&P 500 snapped its’ 4 week losing streak on Friday with a late-day rally to close at 5667.

It’s now close to 3% off the bottom, though it’s still chopping around in the range we previously identified of 5630 to 5700.

The Nasdaq 100 is in a similar situation, now 3% off the bottom and up slightly on the week.

It’s clear from these charts that we are out of the immediate downtrend, but everyone is wondering the same thing.

Should we buy the dip?

The End of American Exceptionalism

I argued last week that we had reached a local peak of bearish sentiment with everyone and their mother calling for the “end of American Exceptionalism.” As if on cue, Forbes put this on their “daily cover.”

When trading sentiment you basically want to fade (bet against) any narrative that gets a magazine cover. This is a promising development for US stocks.

Meanwhile European stocks have stalled out and are off their highs.

And Chinese stocks have done the same.

Neither market has seen any appreciation in 6 weeks.

Return of the Powell Put

On Wednesday Powell took the stage to assuage fears over an economic slowdown and resurging inflation.

A hawkish SEP gave way to a dovish press conference and we rallied.

Powell insisted that we should look through the survey data that is telling us the economy is slowing and focus on the hard numbers which look decidedly robust.

I’ve been arguing the same thing in this newsletter throughout the whole sell-off. As much as stocks and bonds are pricing in a slowdown the hard data doesn’t support it.

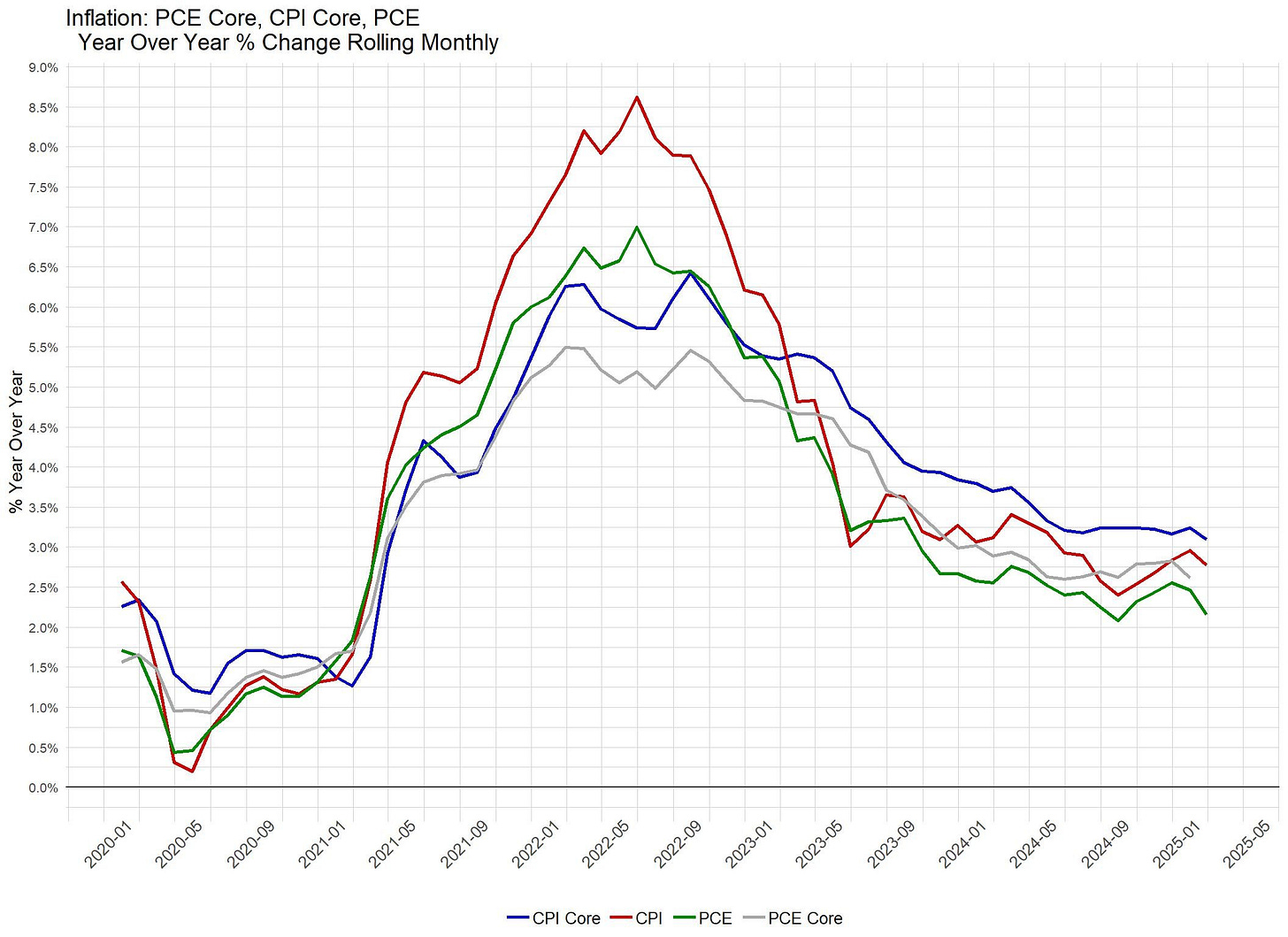

Inflation may or may not be rolling over. It’s not totally clear. But what is clear is that inflation isn’t rebounding, and the Fed is willing to “look through” one-time tariff-related increases.

All of this confirms what we already knew about the Fed: They are doves who want to cut when they can, not when they have to.

Tariff Uncertainty

Economic policy uncertainty has been at record non-COVID highs this month as Trump and his administration officials have flocked to television to make often competing statements about their plans, careful never to give the markets too much clarity.

This level of uncertainty has contributed to unusually elevated VIX. Elevated VIX mechanically sidelines vol-control funds who are programmatically unable to fully allocate to equities while volatility levels are elevated.

But my expectation has been that we will now be entering a “phase 2” of the Trump policy plan, which includes more deal-making and less “flooding the zone” with chaos and hawkish messaging.

We have already seen fewer “tape bombs” coming out of the Trump administration in the last week compared to the previous 3 weeks.

An article released by Bloomberg this weekend seems to confirm that assessment.