It's All A Liquidity Trade

Quick Market Thoughts and Portfolio Update

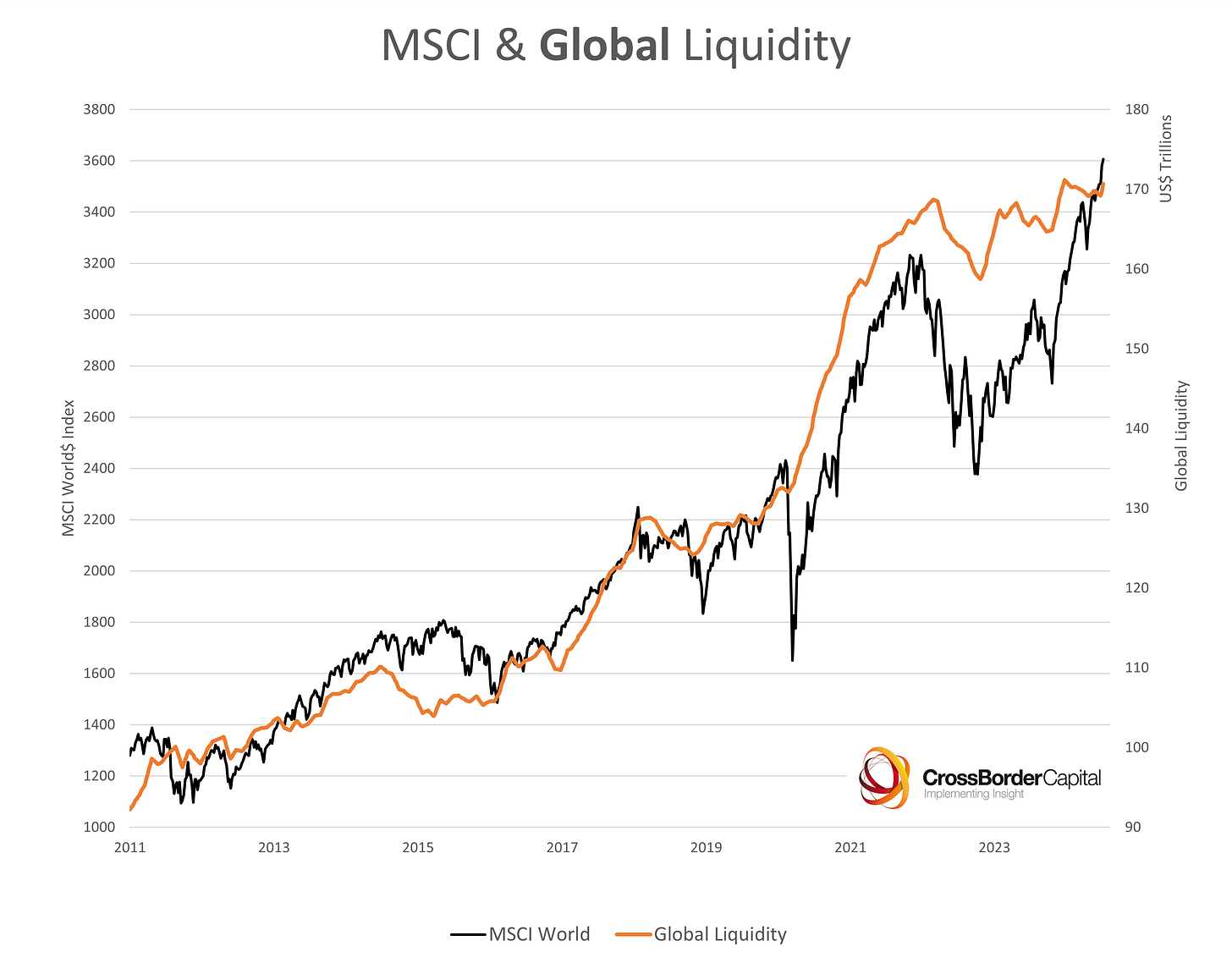

Thanks to Capital Wars for this chart.

The price of equities depends on a few factors. One of the major ones is global liquidity. The Capital Wars is a great and unique source of liquidity related info, providing weekly updates on an aggregated “global liquidity” factor that he tracks.

Looking at the chart you can see how asset prices have outpaced liquidity growth r…