TGIF

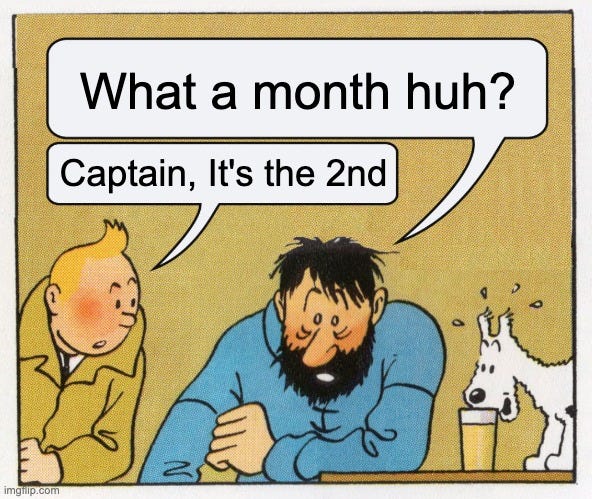

What a month, huh?

I’ve been writing more in the chat this week than long form pieces because things have been moving so fast. Still, I wanted to write something longer to try to digest everything that has happened.

Put simply, we went from 2 weeks of pricing a massive rotation to small caps to suddenly pricing a recession. This repricing was sparked by:

High unemployment n…