The Most Hated Rally

Is this 2023 or 2008?

Author’s Note: I will continue releasing free content where I can provide value to everyone. Posts will include premium content for paid subscribers at the end of emails or as separate write-ups. Free content will focus on macro views, whereas the paid content will focus more on the tactical trades I’m making.

Serious traders or investors should join Premium to get the best, most timely information.

These have been weird markets to trade, and I haven’t really been sure how to write about them.

Jerome Powell’s moment to shine came and went this week. Reporters asked a lot of questions and Powell stretched the English language’s ability to say “I don’t know.”

From there, focus shifted to the first trade deal (the first of many, if you believe Trump) which was announced this morning. The 10% baseline tariffs remained with carveouts for various industries and companies (Rolls Royce enjoyed a nice carveout and a health round of glazing by Trump and the UK ambassador).

One might have thought that if our “oldest ally” (Trump’s words) couldn’t get the baseline tariffs below 10% then that would be an unpleasant surprise for markets. But that wasn’t the case, as the event included plenty of bullish rhetoric from Trump including:

You better go out and buy stock now.

Trump, today

Markets ate it up for a while but couldn’t sustain the big into the close. They finished the day little change after gapping up.

I’m taking Trump at his word for now.

Technically Interesting

The DXY broke out of it’s downward grind. Is this the end of the end of American Exceptionalism? Possibly. I think the world is ready to be surprised by just how resilient the United States’ economy, people, and oh yea, 7% fiscal deficits are.

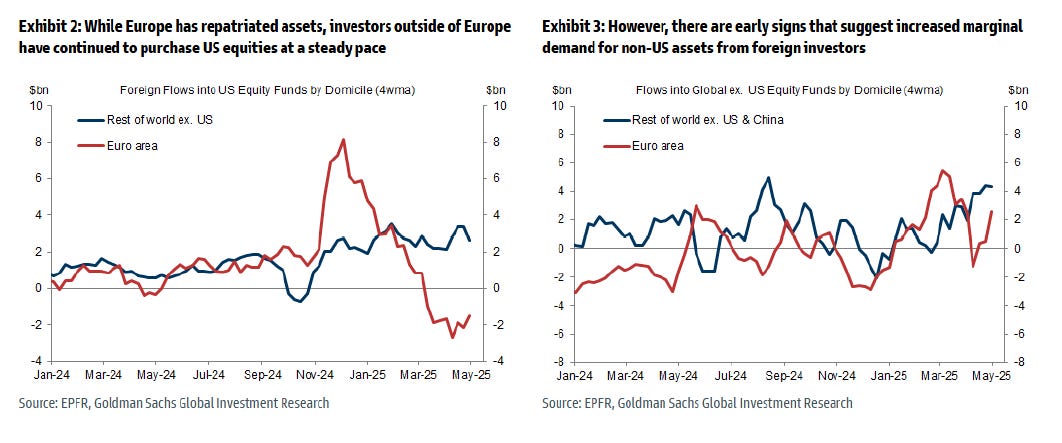

The big green candle today in the DXY does imply that there may be a line forming of foreigners looking to do business with the US’ markets. Surprise, surprise.

Is old Klaus taking an interest in the US again?

Meanwhile, somehow, sentiment is still quite stretched to the downside. The AAII bulls - bears index remains only modestly off the lows.

McElligot said it best this morning:

There have been a lot of mechanical factors driving a bid beneath the surface this week. Vol Control funds, and CTAs have bought as corporate buybacks have begun as a continued influx of retail buying has push a lot of capital into relatively illiquid markets.

The most recent charts I’ve seen have shown hedge funds to still be under-exposed. There is a ton of capital that is now staring at this rally wondering if it’s time to jump aboard but too scared of the state of the economy to do so just yet, because…