The Three Pillars of the AI Trade

Is the "New Math" that underpins the entirety of the AI trade a fraud?

Author’s Note: I will continue releasing free content where I can provide value to everyone. Posts will include premium content for paid subscribers at the end of emails or as separate write-ups. Free content will focus on macro views, whereas the paid content will focus more on the tactical trades I’m making.

Serious traders or investors should join Premium to get the best, most timely information.

Since last week’s note where I said we were heading for “another leg higher” we have seen… another (small) leg higher.

A 2% week is nothing to sneeze at.

I don’t have a lot more to say on positioning or near-term direction at this time, but I wanted to write you guys a note to discuss whether the AI trade is likely to run out of steam.

The Math Behind The AI Trade

Kuppy (of all people) wrote an interesting note this week on the AI trade. In it, he made a few interesting claims which I’ve clipped for you.

Basically, Kuppy is flagging what many people have been flagging recently: the math behind the “AI trade” stretches belief.

I’ve been a huge AI bull throughout this newsletter, and while I think the market has possibly more than caught up to my beliefs, I wanted to check in on the math myself. So I did some research.

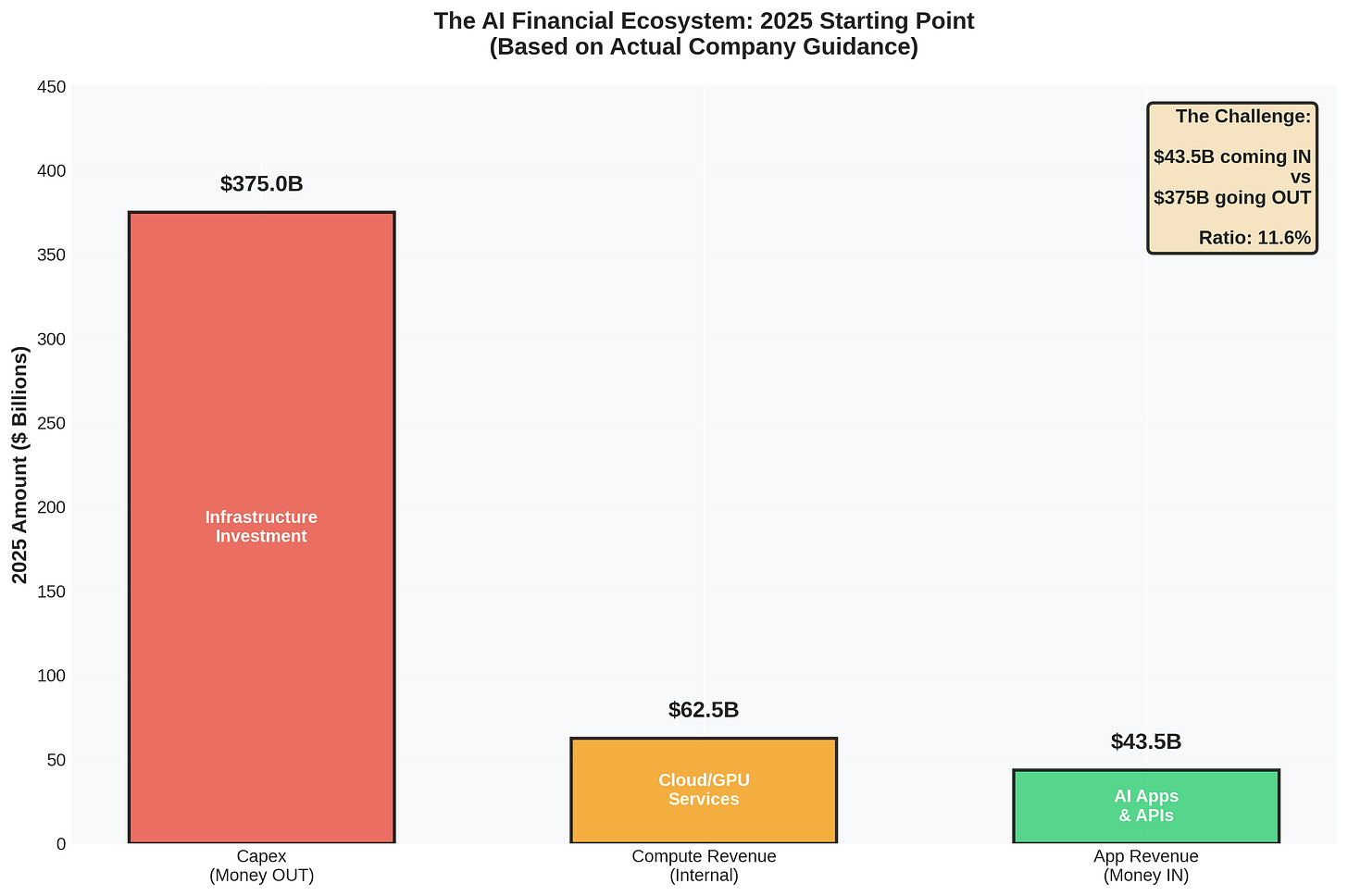

You can think of the AI “economy” as having three broad pillars.

Pillar #1 is the big one everybody thinks of: Capex. It’s what the hyperscalers and others are spending to build those massive data centers like this one Citrini was kind enough to make a video of:

Pillar #2 is how the capex spend monetizes. Large providers sell data center compute largely to other massive AI companies like OpenAI, Anthropic, the hyperscalers themselves, etc.

Pillar #3 is what really matters, as it’s the revenue earned by the application layer. It’s the amount of money all these companies spending hundreds of billions to rent AI services from the infrastructure layer are actually able to earn in the software marketplace.

Let’s take a look at the numbers.

Pillars of the AI economy.

Pillar #1: 2025 AI Capex (The Input)

Total: $350–400B

Amazon: ~$100B

Microsoft: ~$80–89B (FY25)

Alphabet: ~$75–85B

Meta: ~$66–72B

Oracle: ~$21–25B

“Other” DC builders (neoclouds, telco, regional): ~$10–20B

Pillar #2: 2025 AI Compute Revenue (The Tollbooth)

Total: $55–70B

AWS (AI-attributed share): ~$25–30B

Azure (AI-attributed share): ~$12–18B

Google Cloud (AI-attributed share): ~$6–10B

Oracle Cloud (AI-attributed share): ~$3–5B

Independent GPU clouds: ~$5–6B

CoreWeave ~$4.9–5.1B, Lambda ~$0.5B, Together ~$0.1B

Pillar #3: 2025 AI Application Revenue (The Outside Money)

Total: $32–55B

Independents, illustrative split:

OpenAI: ~$13B

Anthropic: ~$3–6B run-rate (2H25 basis)

AI coding tools: ~$1.5–3B (Copilot + Cursor, etc.)

Creative/search/chat apps: ~$0.6–1.0B

Midjourney ~$0.3–0.5B, Perplexity ~$0.1–0.15B, Character.AI ~$0.03–0.05B

Enterprise “AI attach” (incremental to suites): ~$7–15B

M365 Copilot, Salesforce, ServiceNow, Adobe Firefly, etc.

Looking At The Long Term Math

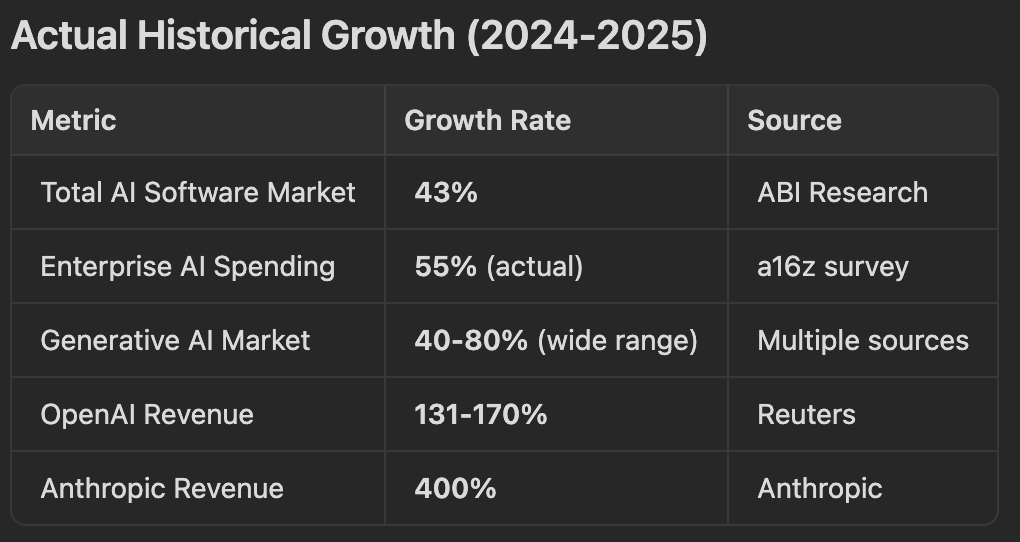

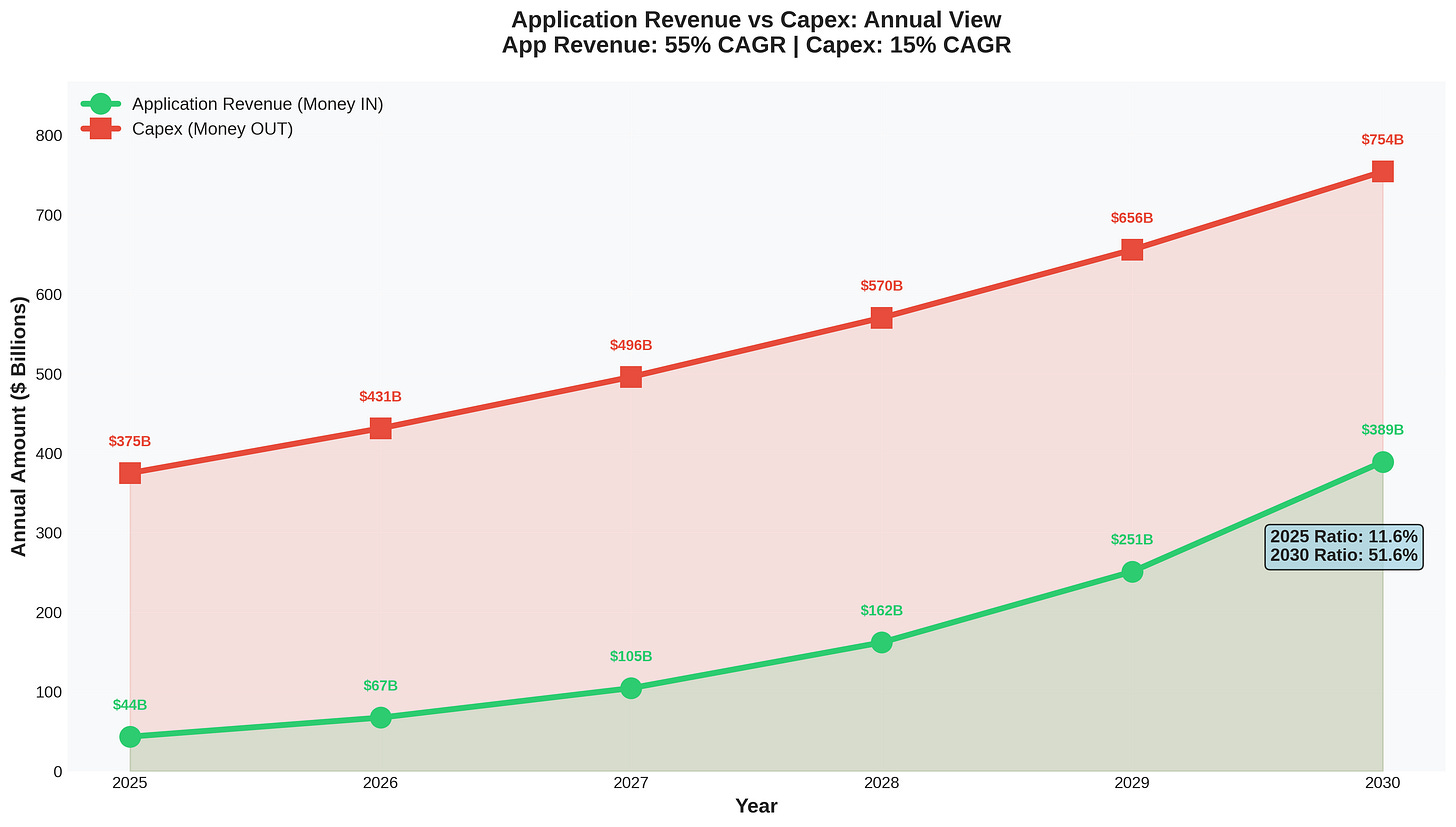

We need to see Pillar #3 grow substantially to justify this capex spend. Let’s look at the current CAGR for this segment.

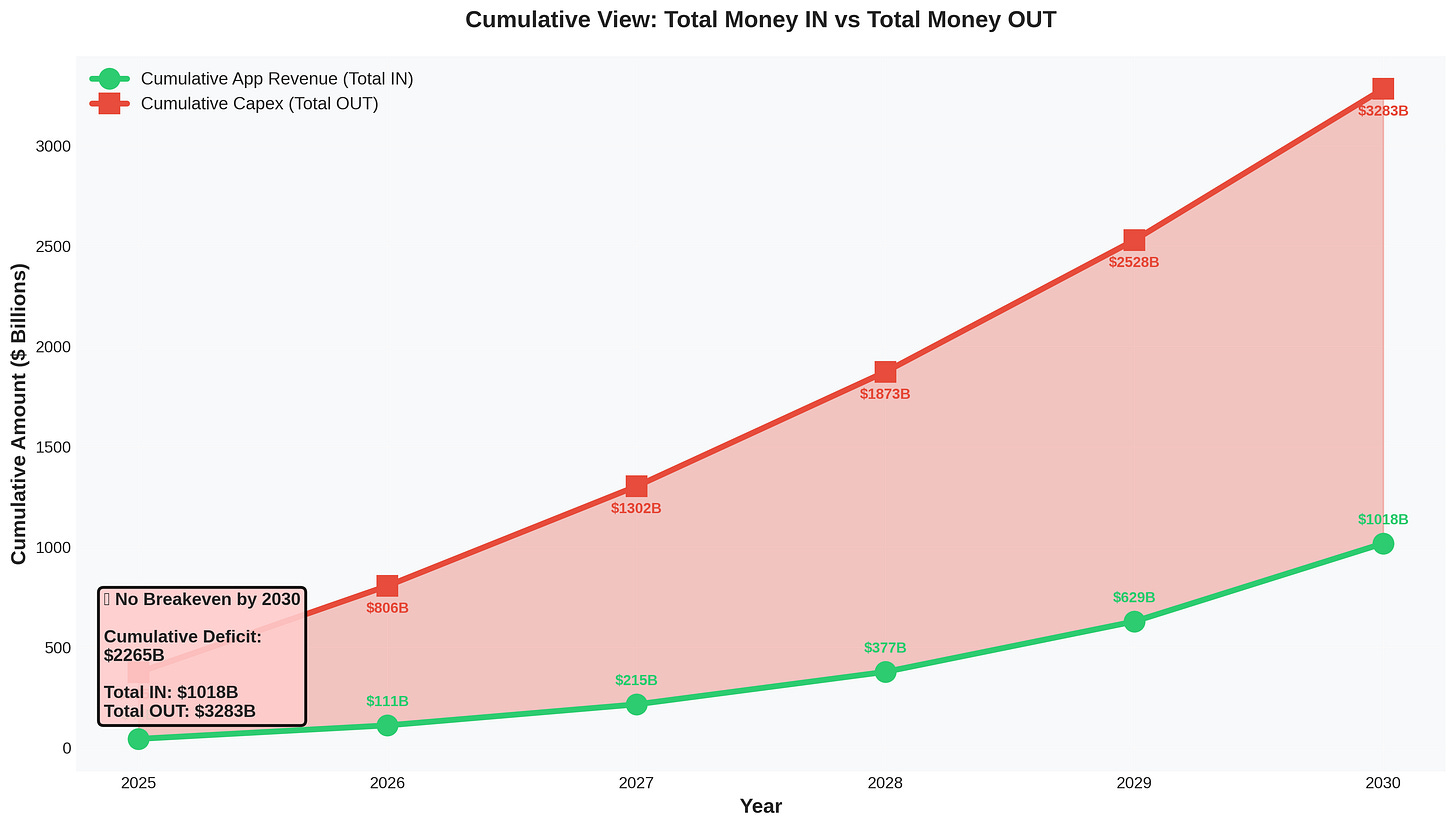

If we take a 55% growth rate on the software side, and a 15% growth rate on the capex side (which is actually a slowdown, considering replacement costs at a 5 year useful life), we see that the complex remains firmly money negative through 2030.

If you look at the cumulative numbers, you see that a $2T gap means trillions are incinerated to produce ~$1T in value.

What Does It Take To Make The Math Work Out?

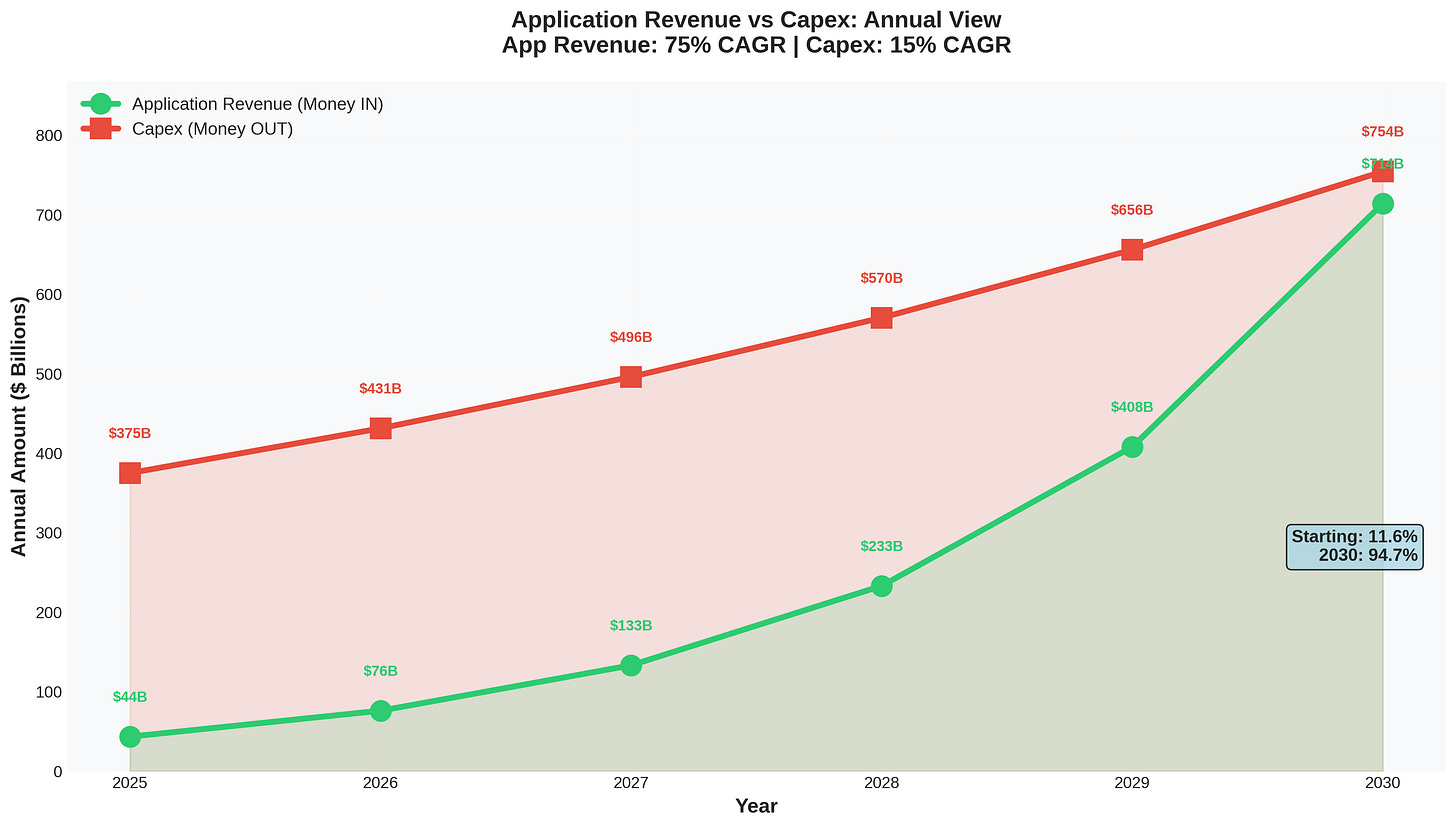

Put simply we need to see higher growth in Pillar #3 businesses. Using a 75% CAGR gets us to nearly breakeven by 2030.

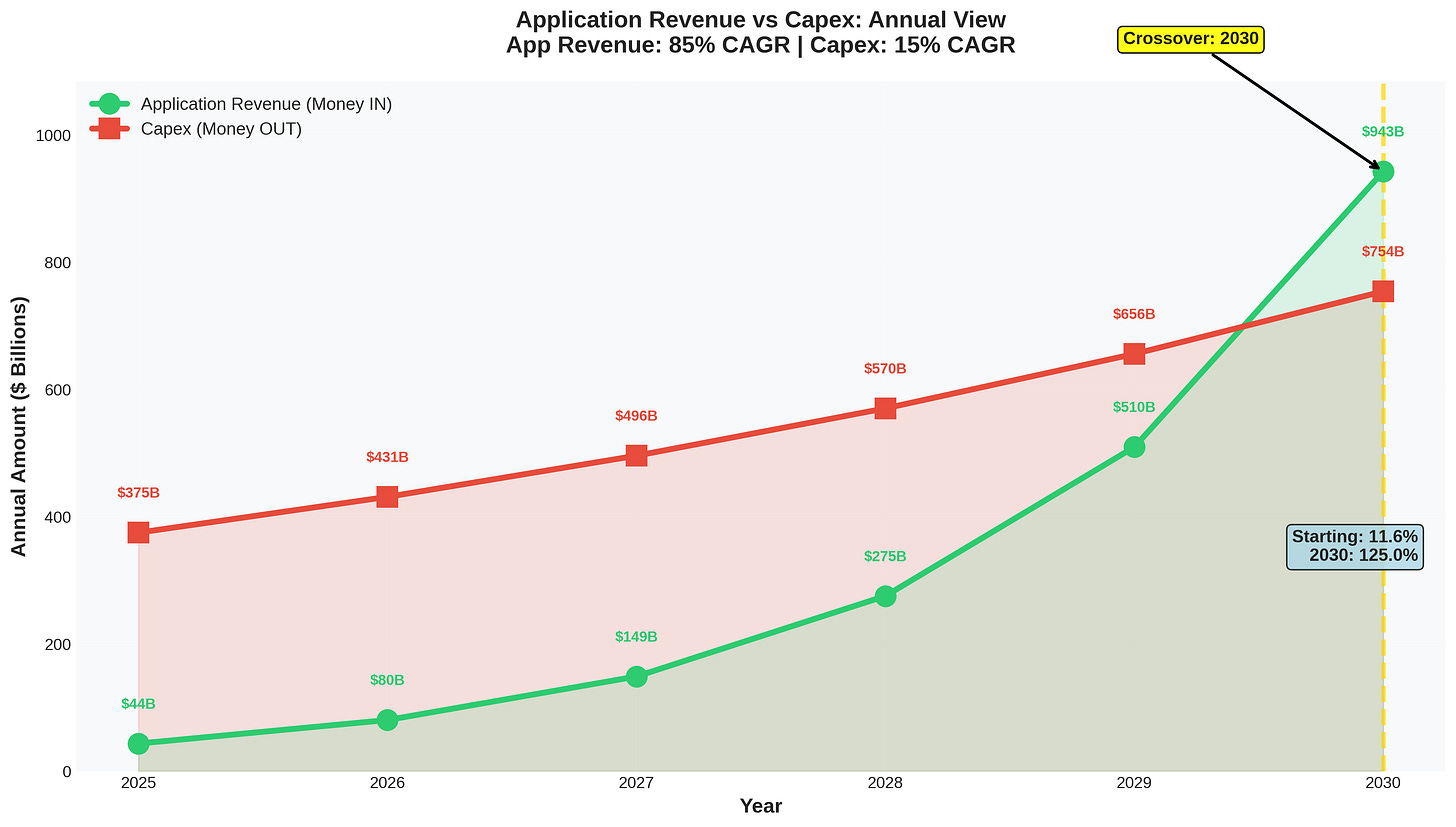

Using a 85% CAGR for software growth gets us even more firmly positive in 2030.

Achieving this level of growth is not impossible, but it means we need to see Pillar #3 revenue accelerating upwards from here. Furthermore, AI Software revenues will need to more than DOUBLE the entire cloud software industry of today by 2030.

Takeaways For The AI Trade

Put very simply, ~$400b is being spent to develop data centers that are expected to rent for ~$65b this year. The companies renting that data center space expect to earn between $40b from “outside” of the AI complex.

This requires explosive revenue growth from AI software providers to justify. Continuing to grow at the same pace is not enough. One of three things will happen:

AI software revenue growth increases dramatically enough to keep the party going.

AI software revenue growth increases, but not fast enough to justify the current capex. Hardware providers will be hit hardest, while cloud software providers will benefit form over-the-top capex spending driving their costs down.

AI software revenue growth stays flat at 55% or decreases, and the entire complex of “AI” companies has to be dramatically rerated downward.

The conclusion is simple: Even for an AI bull like myself, it seems impossible for the AI trade to play out as immaculately as the market expects.

The problem is that this fact is not immediately actionable. It’s not enough to think that the current AI projections are wrong. Contrary to pop culture, trading is not about being early to a thesis, putting the trade on, and waiting for the market to catch up. That’s a good way to go broke!

“AI” is likely to continue to run from here.

While everyone is watching the capex spend, I’ll be carefully watching AI associated revenues. If we don’t see continued acceleration it could mean trouble ahead.

Good luck out there.

This one took a lot of time and effort to write, so don’t be shy about liking and sharing. If this post gets 10 likes I’ll give away two months of premium subscription!

Disclaimer: The information provided here is for general informational purposes only. It is not intended as financial advice. I am not a financial advisor, nor am I qualified to provide financial guidance. Please consult with a professional financial advisor before making any investment decisions. This content is shared from my personal perspective and experience only, and should not be considered professional financial investment advice. Make your own informed decisions and do not rely solely on the information presented here. The information is presented for educational reasons only. Investment positions listed in the newsletter may be exited or adjusted without notice.

Great simple way to frame the current critical question. Thx for the write up!

Great overview! Any thoughts on how this would impact sectors supplying the hardware (shovels) or the hardware to build the hardware. Could be a bullwhip effect…