We had a bullish final 90 minutes of trading on Friday after a choppy and erratic week. Friday was always destined to be volatile as it was the Friday before a long weekend and the last trading day of the month.

Not to mention, the added options volume from the NVDA 0.00%↑ speculation.

As we head into the first trading day of September I want to look at a few things that caught my eye this week.

Warren Buffett is Selling!??!?!

Lately, I have seen a lot being made about Warren Buffett reducing Berkshire’s Apple position and stocking up on cash.

Dividendology, one of the biggest finance substacks around, wrote this post with a scary-sounding headline:

Most of what I’ve seen has been of a similar flavor. Some version of “Buffett, the Oracle of Omaha” is selling because he knows something big is happening.

I’ve even had a few people mention it to me in person, including my Mom (!!) who doesn’t follow markets at all.

So to quiet everyone’s fears let’s look at a few things.

First things first, Warren is up a ton on Apple. After trimming it, it’s still his biggest position. The amount of cash he has raised, while objectively a huge number, only represents ~25% of his NAV.

25% cash is definitely defensive, but it’s hardly “rushing for the exits.” You’ll recall that we went much higher than that during the sell-off throughout July and into August 5th, when we switched back into deployment mode.

If Warren was truly expecting a recession, why would he slowly go to 25% cash instead of raising much more?

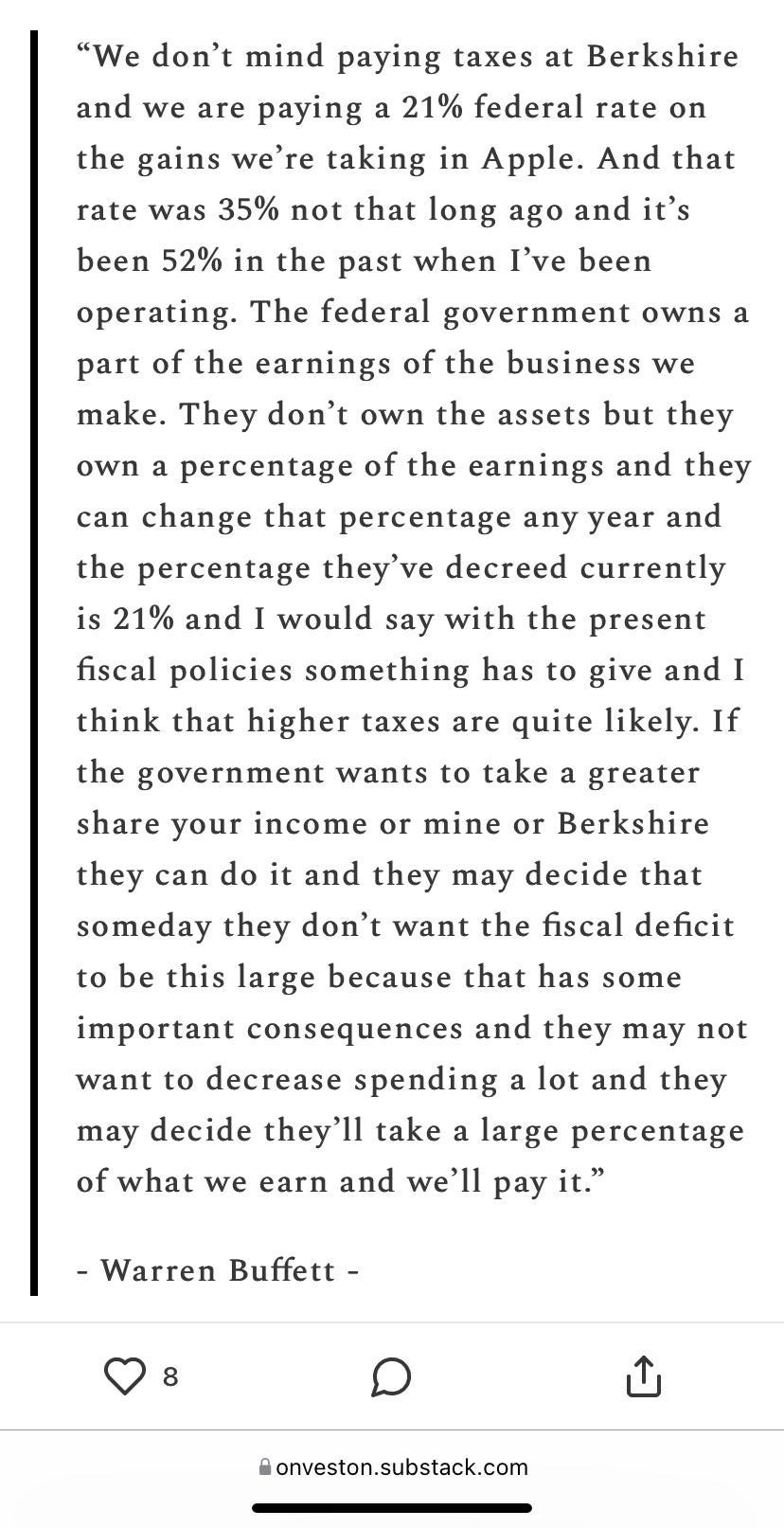

So why is he selling Apple? Let’s look at what he himself had to say on the subject:

That’s a pretty convincing answer to me.

The fact that Buffett is predicting higher capital gains taxes is hardly surprising. Higher capital gains taxes will be bad for markets, as you’ll see profit-taking before they go into effect, and people making different decisions about allocating their capital.

But it’s hardly a cause for alarm.

Don’t be scared of monsters in the closet here.

Credit Card Debts

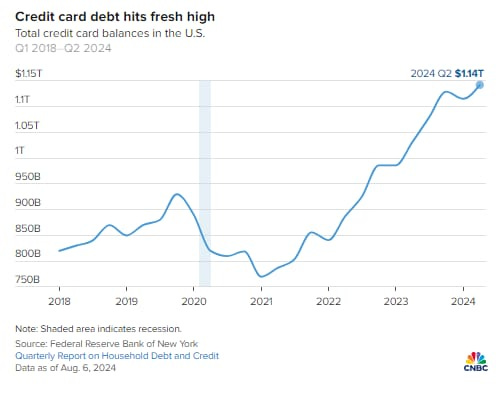

Speaking of recessions, I saw another chart going around a lot this week.

It’s a compelling headline. Credit card debt hitting all-time highs is what credit crises are made of, right?

Well, yes, but is this as bad as it looks?

There’s a lot of what we call “chart crime” here. The Y axis is truncated to exaggerate the differences. The time series is shortened to remove the ability to compare it to other recessions.

But worst of all, it’s charted in nominal terms. How much sense does it make to chart credit card debt in nominal terms when we are coming out of the biggest inflationary event since the 70s?

None.

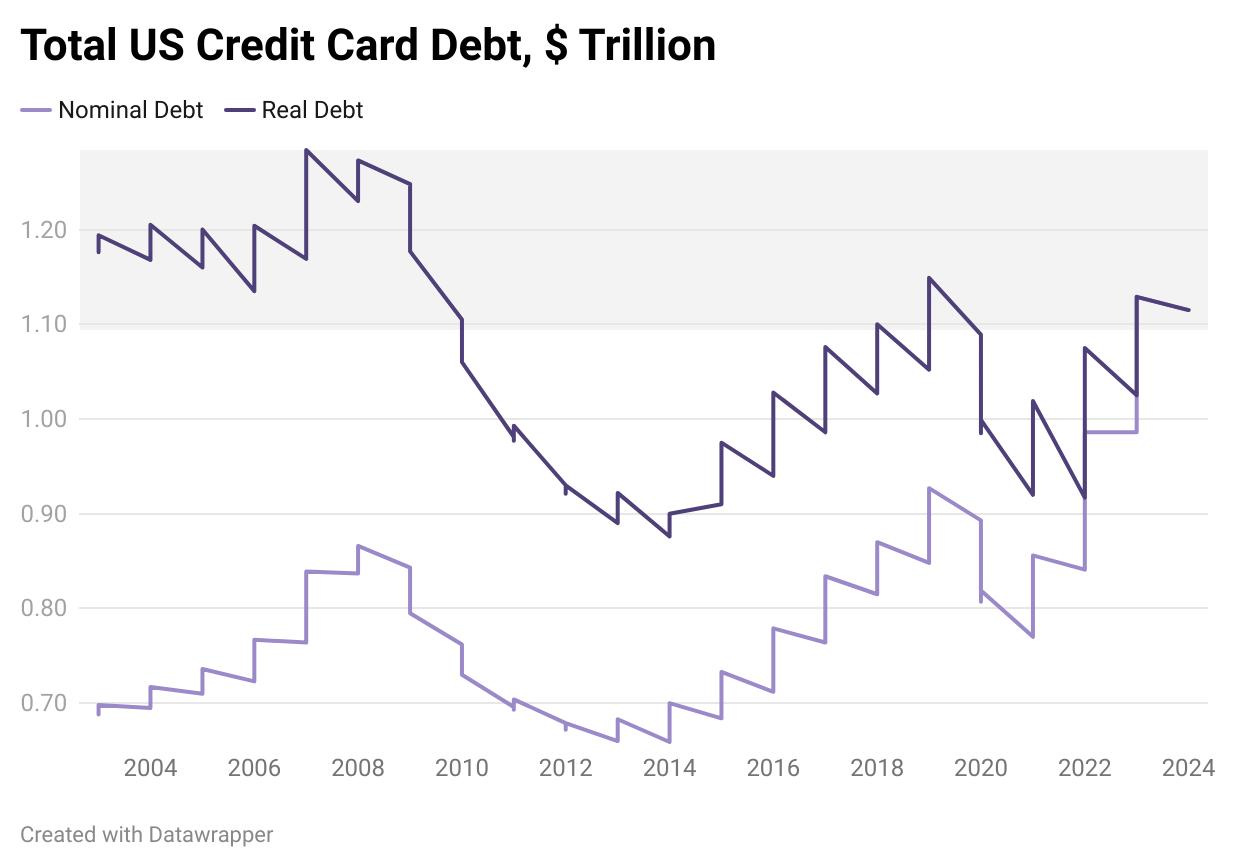

When I Googled around, I couldn’t find anyone who looked at this in a reasonable way, so I made my own chart.

This chart shows credit card debt in nominal and real terms, returning to just after the dot-com bubble.

You’ll notice that we are returning to the real levels we had before Covid.

The real debt levels are high, which is a worrying trend, but the debt is still far from unusual levels. It’s one to watch but not worry about for a while.

Health of the Consumer

Since we’re looking at credit card debt, why don’t we check the consumer's health more broadly.

Jobs are the single biggest factor, and we have some very important job data coming out on Friday. Non-farm payrolls is coming Friday.

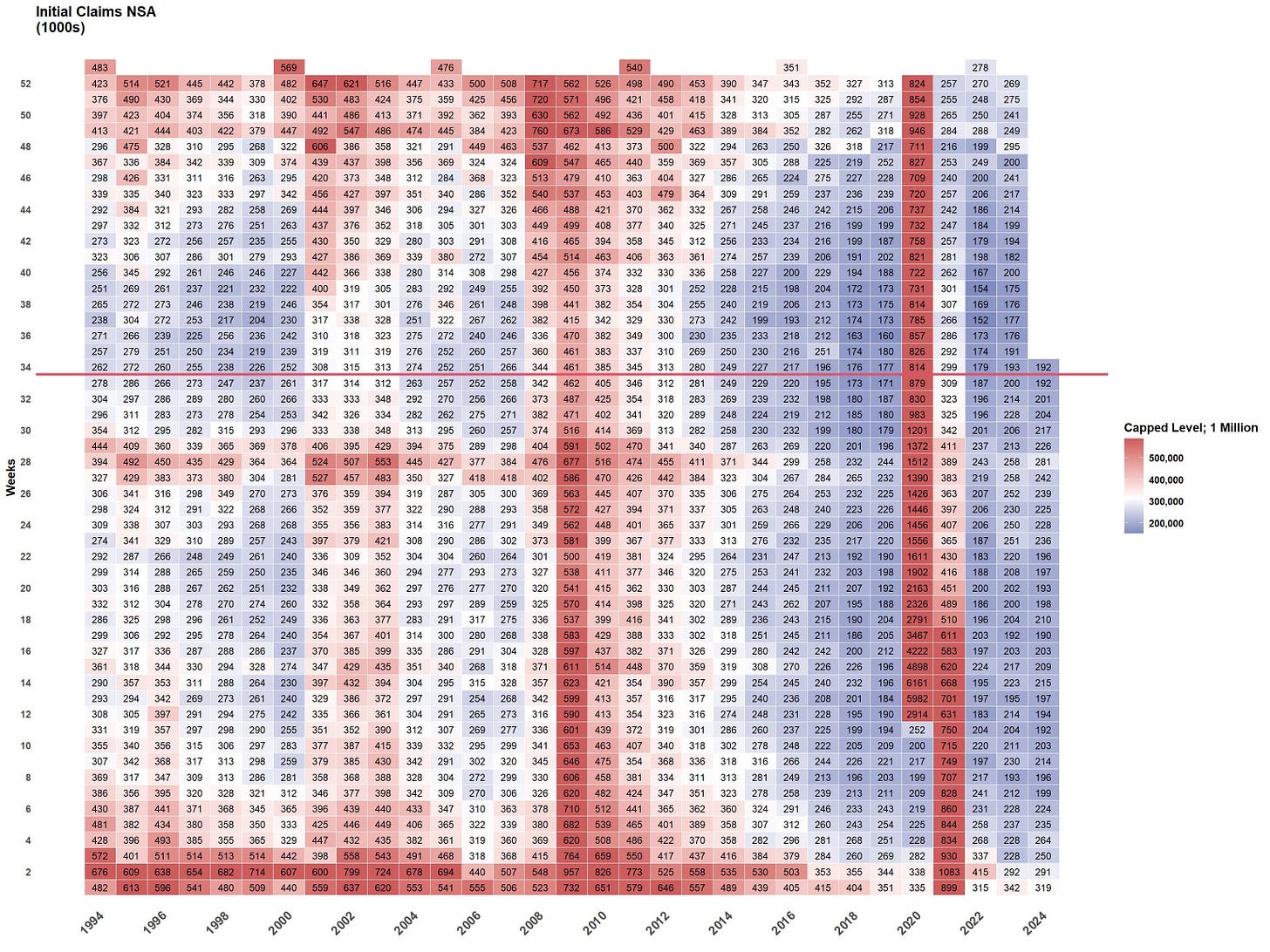

I’ve written a lot about jobs before. If you want a deeper look you can read my previous posts, but I’m going to put this chart here. This shows the weekly initial jobless claims by week for the past 30 years.

There is no sign of cooling in this chart. In fact, jobless claims are coming in near historic lows.

Until we get the next Non-Farm Payrolls report, this is the best data we are gonna get.

Key Note: The Non-Farm Payrolls next weeks is going to be very important. Look out for it.

Another reasonable proxy for jobs data is personal income data. This one is pretty noisy, which makes it hard to draw inferences from it, but in general, we want to see it bounce along above .20% MoM.

Right on the line.

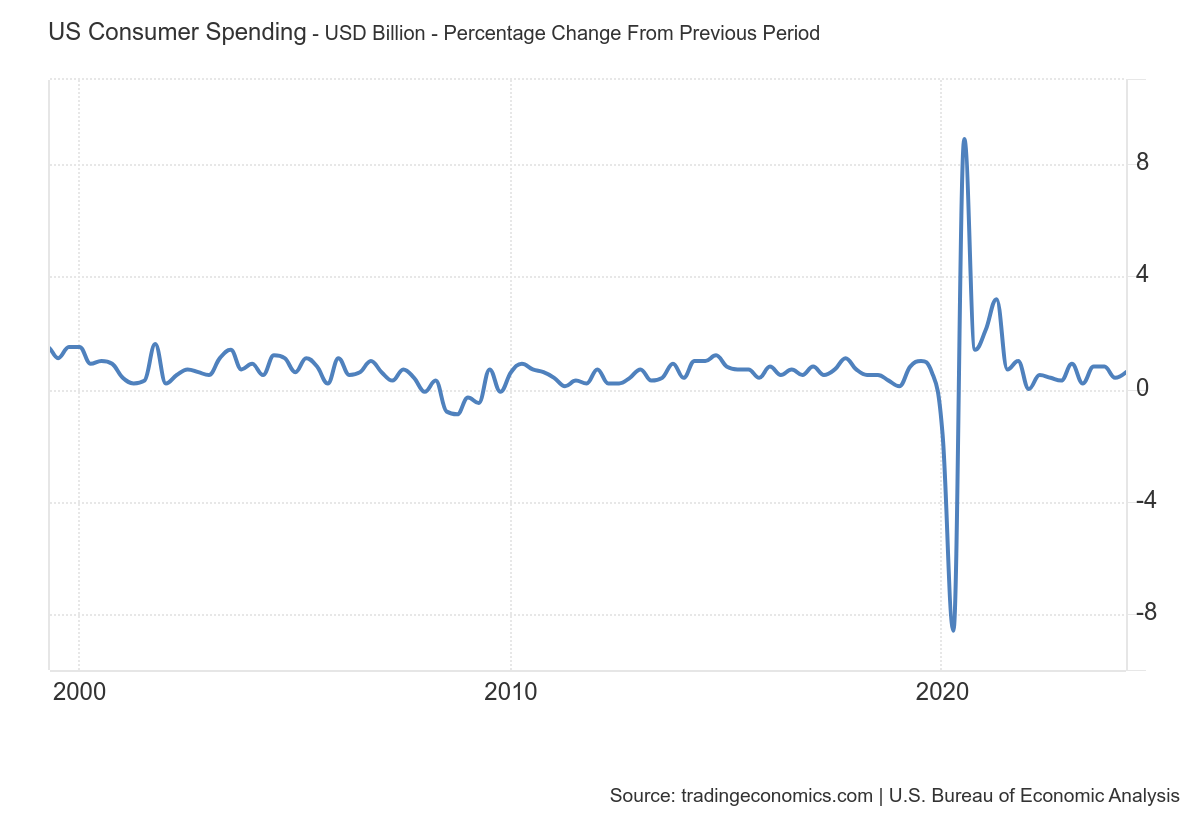

Consumer spending, in essence, is the economy, so that’s another good metric to check in on.

With this one, if we wait for a negative number we will already be in a recession by the time we see it. Looking at past recessions, you can notice a downward trend leading into them.

We will take a stance of watchful waiting here. But, by all measures, the consumer is healthy.

Don’t listen to people who tell you otherwise.

Left Tail of the Dragon

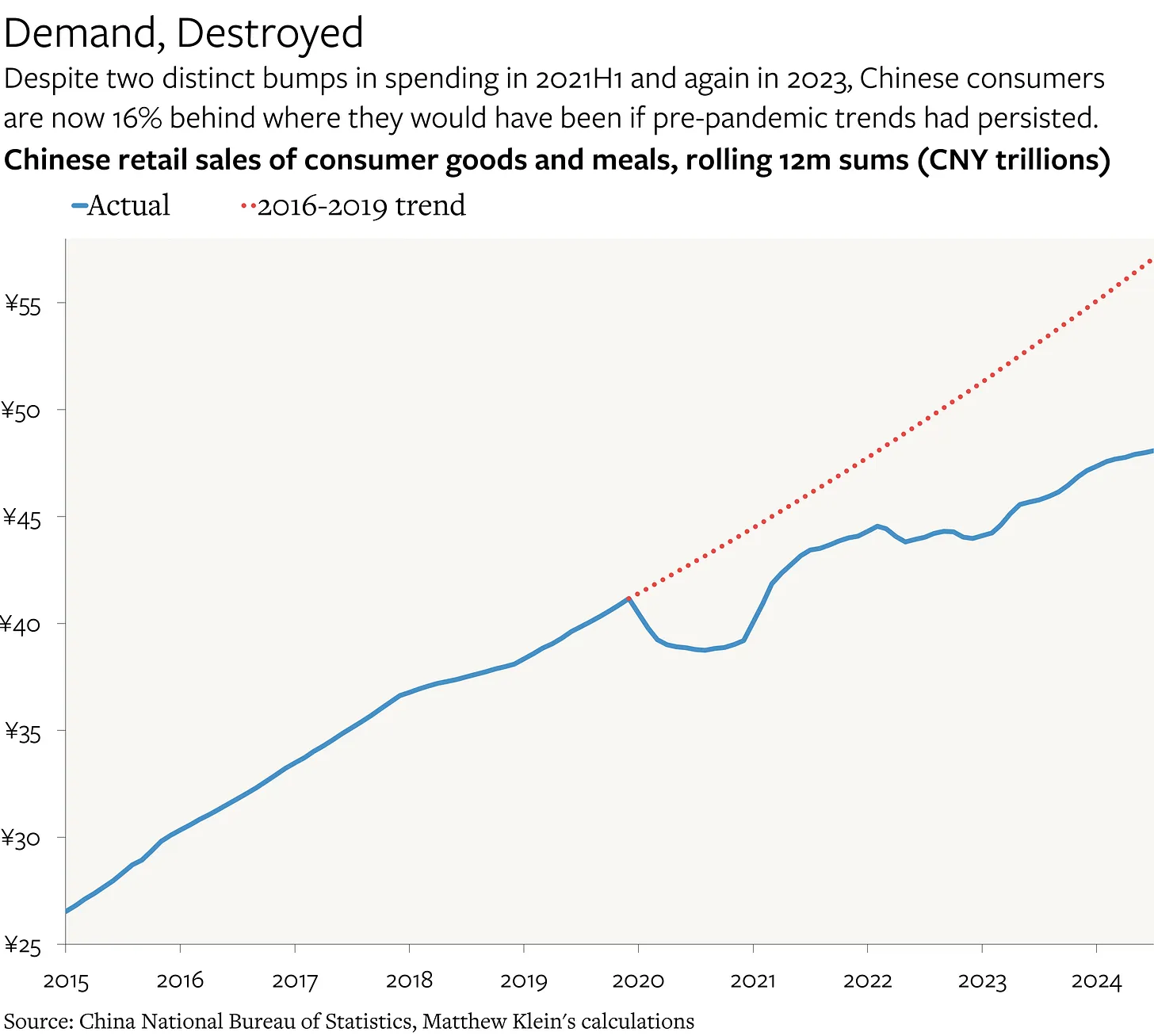

China has never really recovered from its mishandling of the Covid pandemic, and have struggled for years.

Lately I have not heard much about China other than vague mentions that they are “flailing” a bit.

Over the weekend I found this excellent post from Matthew C. Klein. I recommend you check it out here.

I’ve pulled a couple charts to show you the situation.

China is way off-trend and drifting in a listless direction. The Chinese consumer is struggling, and because of that, so is their industrial center.

In spite of all this, Beijing is refusing to stimulate. Or, more accurately, they have been stimulating but not enough.

An extended and deep slowdown in China could have ripple effects throughout the rest of the world. Undoubtedly it already is. I’m not smart enough to tell you what’s going to happen, but it’s something to watch.

Parting Thoughts

We have a short week with probably the most critical piece of economic data coming out Friday. The Fed doesn’t meet until the 18th.

That sounds like a recipe for chop to me.

I remain bullish in the longterm. Let’s ensure we hang onto our capital to get to the bull market.

Good luck out there.

Disclaimer: The information provided here is for general informational purposes only. It is not intended as financial advice. I am not a financial advisor, nor am I qualified to provide financial guidance. Please consult with a professional financial advisor before making any investment decisions. This content is shared from my personal perspective and experience only, and should not be considered professional financial investment advice. Make your own informed decisions and do not rely solely on the information presented here.