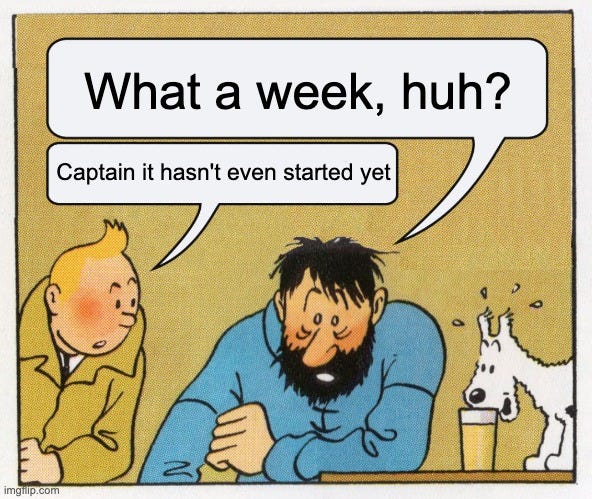

What a Week! Captain It's Sunday...

Trump x Rogan, WW3, Baseball World Series...

Author’s Note: I will continue releasing free content where I can provide value to everyone. Posts will include premium content for paid subscribers at the end of emails or as separate write-ups. Free content will focus on macro views, whereas the paid content will focus more on the tactical trades I’m making.

Serious traders or investors should join Premium to get the best, most timely information.

Well. It was a hell of a weekend leading into a chaotic couple of weeks.

Friday, we saw some bizarre and anxiety-inducing price action that flummoxed me. I watched my screen all day, wondering, “Is this about some geopolitical event? Is this about the Israel/Iran situation?”

Well, yes, it was.

Friday night Israel launched airstrikes against Iran, focusing on military targets in Tehran and two other locations in the west of the country.

Reportedly the strikes focused on air-defense installations and missile factories. Early indications are that they hit around 20 locations, 12 of which were so-called “planetary mixers” which are factories for producing solid fuel for ballistic missiles.

The upshot of the attacks is that they will be seen by the world as “proportional” and directly relevant to the previous strikes by Iran, which used some 200 ballistic missiles.

Washington came out strongly in support of Israel, indicating that the strike was proportional and now the matter should be concluded. Notably, they have specifically said they would “defend Israel” from further attacks.

I have not found the direct quote, which is a shame because this is one of those instances where the nuance of the language is essential. Nonetheless, I’ve seen multiple outlets reporting that US officials said they would “defend” Israel against another round of attacks.

The response from Iran has been muted. They downplayed the extent of the strikes, even as they admitted that the strikes had killed 4 soldiers.

Even more importantly, they have reiterated their desire for a ceasefire.

With this rhetoric out of Iran, the proportional nature of the strikes, Israel’s demonstrated and now improved ability to operate with impunity in Iran’s airspace, and the United States’ statements about “defending” Israel, it would be suicide for Iran to retaliate directly or immediately on Israel.

But I want to clarify: we have probably moved further away from regional war this weekend due to the restraint Israel showed, but we have not thoroughly put it in the rearview mirror. Israel is currently engaged in ground combat with Hezbollah, a direct proxy of Iran, who also regularly launches rocket strikes into Israeli territory.

Tensions will calm this week, but the situation will remain a powder keg unless a ceasefire can be reached. Wars often escalate out of relatively minor things, like the killing of a leader, and all it would take for things to go off the rails is a single errant rocket or drone strike inside Israel.

Still, as far as the market is concerned, we can put this stuff behind us for now and focus on…

The Week Ahead

We have a blockbuster slate of data and earnings this week.

First, let’s take a look at the key earnings this week.

Monday

On Semiconductor: Pre-market, small company but semiconductor bellwether

Tuesday

Alphabet: After-market

AMD: After-market

Wednesday

Doordash: After-market

Meta: After-market

Microsoft: After-market

Starbucks: After-market

Thursday

Comcast: Pre-market

Intel: After-market

Apple: After-market

Amazon:

Friday

Super Micro Computer Inc: 4pm EST

Lots of Mag7 and big tech stocks this week will set the tone for large-cap tech for the quarter to come.

I recently wrote that I am quite bullish on large-cap tech. This sector's earnings have been good this quarter, and I expect that to continue. The plan is to add longs in this sector heading into earnings.

Economic Data

It’s Nonfarm Payroll week again! These Nonfarm Payroll weeks have been chaotic the last few months, made all the worse for those of us on the West Coast because so many releases happen at 5:30 am PST.

The major events will be Consumer Confidence on Tuesday, GDP and ADP Employment on Wednesday, Jobless Claims on Thursday, and finally, the main events of Nonfarm Payrolls and ISM Manufacturing.

Economic data has been surprising to the upside since the lows in August, and looking at this week’s estimates, I would expect that trend to continue.

None of the estimates are pricing especially hot data. I would bet the markets are a little more optimistic than the experts here, but still, I suspect that it will be easier to beat the baselines than to disappoint.

The Volatility Complex

This next part of the post is for paid subscribers only. If you’ve been thinking about subbing, this might be a good time to use your free trial, as there’s a lot of good info here this week. If you’re already subscribed, thank you, and enjoy.