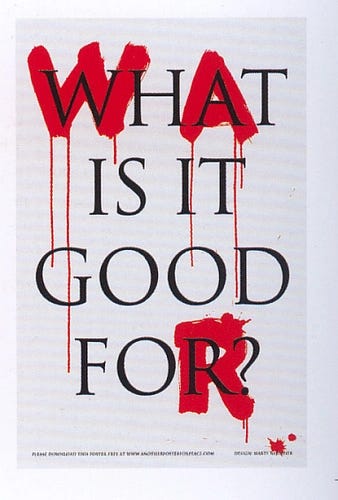

What is it good for?

Gold only, apparently

Bonds down. Stocks down. Oil down (flat). Crypto down.

Gold up big.

It looked for a minute there like the Iran v. Israel stuff had concluded on Saturday. Sunday was a relaxed day with little bad news, and futures opened up.

The follow through is worrisome, especially because it’s unclear how much of it is just off the Israeli rhetoric today and how much o…