What the F*** Is Going On In Markets

What's actually breaking under the hood

The absolute worst genre of finance post is the Omega Doomer post where the writer tells you some equivalent of “we’re all gonna die” that invariably never actually happens.

These posts proliferate though, not because they are valuable or make anyone money, but because they appeal to something in human nature that keeps us always looking over our shoulders.

Sometimes that instinct can save us a lot of money, and sometimes it just leads us into buying expensive puts that go to Put Heaven™️.

But it was that instinct that led me to dig into what’s going on in markets, and is leading me to write what is essentially a full-blown doomer crash post. The same post you’re reading right now.

And I think this one might be different from its peers in that it actually holds some alpha.

Vol is creeping, credit is wobbling, and record October Opex creates gap risk into Monday. So strap in and get ready for a good old fashioned Halloween-themed DOOM post.

Heightened Crash Risk

Last Friday Trump threatened a 100% tariff on China that sent markets into a tailspin. SPX promptly sold off 300bps intraday, bitcoin crashed 12% and long bonds rallied 70bps.

Markets initially rallied on Monday after Trump TACO-d in a Truth Social post telling us “not to worry” about China.

But since that “truth” markets have remained choppy, and more interestingly, VIX has been progressively bid up throughout the week.

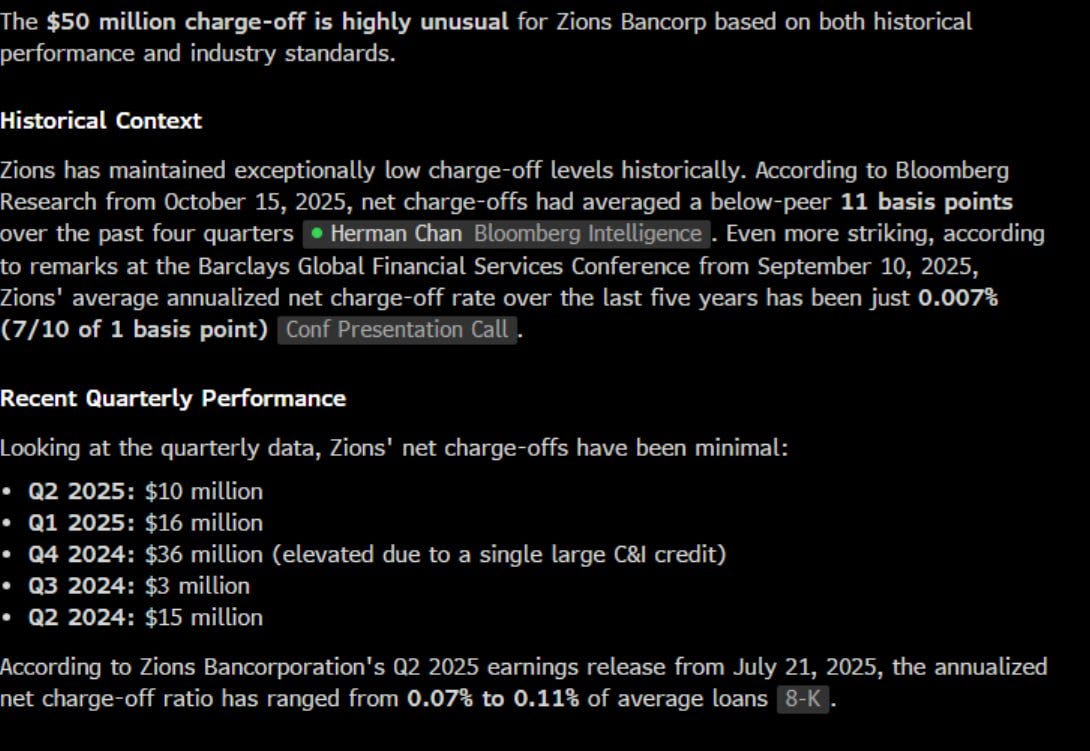

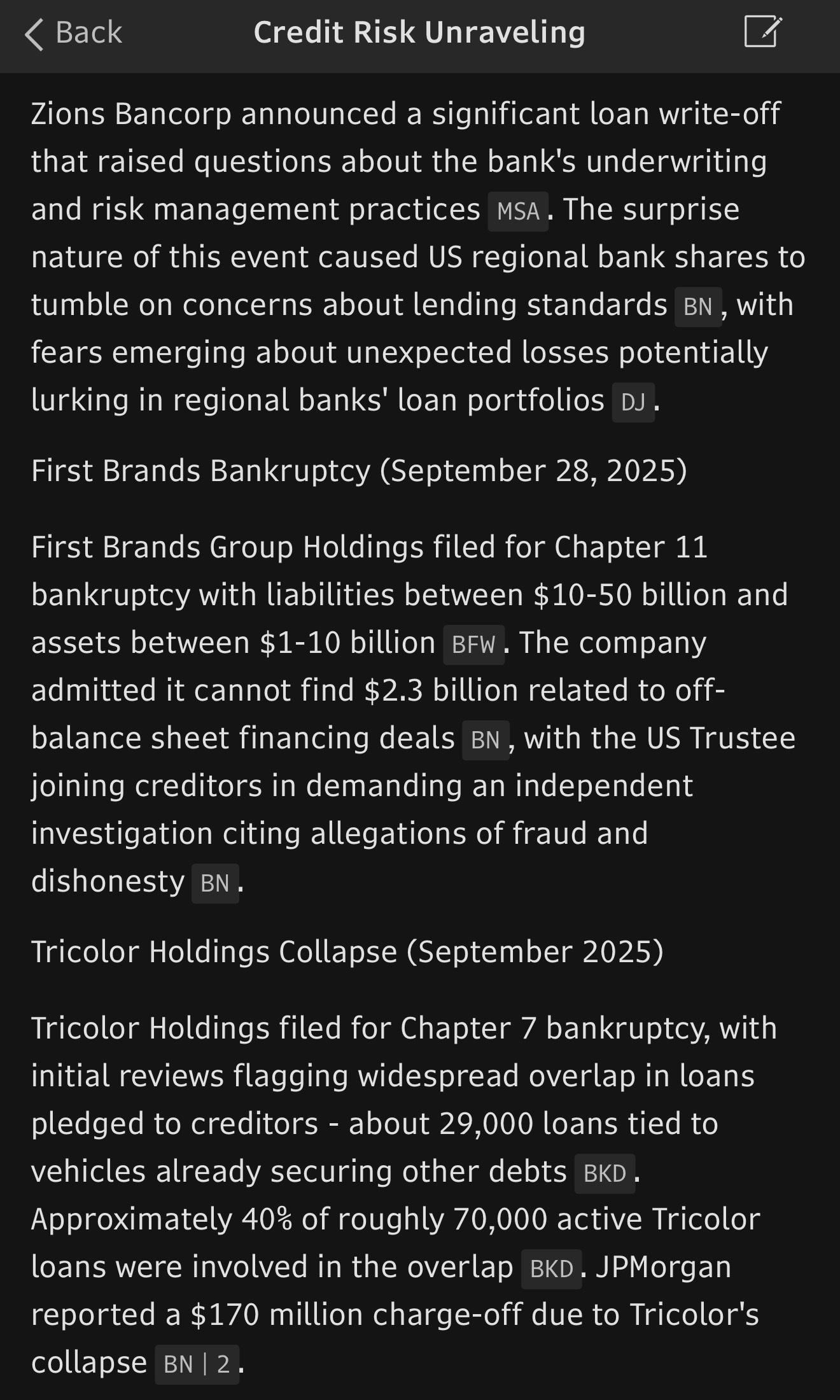

On Thursday we got word of some surprising credit charge-offs by Zions Bancorp that sent regional banks into a tailspin, and the KRE 0.00%↑ ETF had it’s worst day since Liberation Day.

A $50m write-off for some bank in Utah is hardly immediately relevant to global financial markets in itself, but it is worrying because it comes on the tails of some other recent credit events, and it represents a big loss for Zions.

But there have been signs of stress in the debt markets for a while now, they’ve just gone largely unnoticed because credit spreads have been stable.

Other Signs of Stress

Over the last few years credit has moved more and more into opaque “private credit” markets. In 2024 private credit assets under management reached $1.7 trillion, and it’s only grown since then.

That has made it difficult for investors like us to get a window into how corporate credit is actually performing. Private credit funds are under no obligation to mark their securities to market in real time, and even when they do mark to market they have no mechanism for finding a “true” price.

But we can look at a relatively obscure corner of the market for clues.

Business Development Companies are publicly traded funds that make loans to small and mid-sized U.S. companies, and then pass most of the interest they collect back to shareholders as dividends. Think “publicly listed private-credit funds.”

And they’ve been getting clobbered for months now.

Alternative asset managers like PE funds, which are also a proxy for the opaque world of corporate debt and the “real economy” have started to get beaten down as well.

And the two year yield (a bellwether for the economy) has been down only for months now.

On top of all of this, Gold has been going absolutely parabolic. Gold may not be saying anything that’s relevant to equities, but it sometimes has in the past.

Enter…

Black Monday Redux (The Spooktacular)

If you enjoyed this post please hit it with a like. If it gets 10 or more likes, I’ll give away two months of paid subs to people who like this post.