Xi Takes His Shirt Off

My take on China, the markets, and the economy...

Author’s Note: I plan to continue releasing free content where I can provide value to everyone. Posts will include premium content for paid subscribers at the end of emails or as separate write-ups.

This week, all eyes have been on China, which seeks ways to stimulate itself out of an economic malaise.

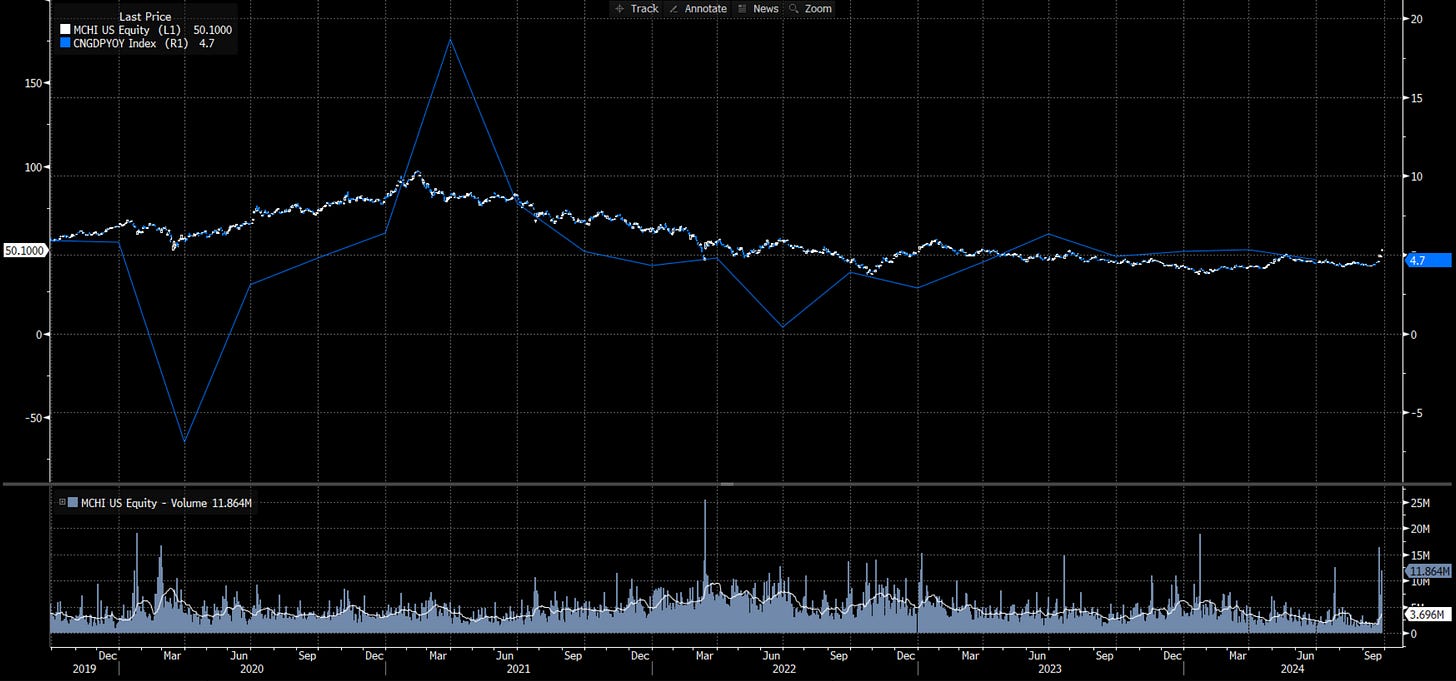

China has struggled over the last few years as GDP growth has stagnated and slowed.

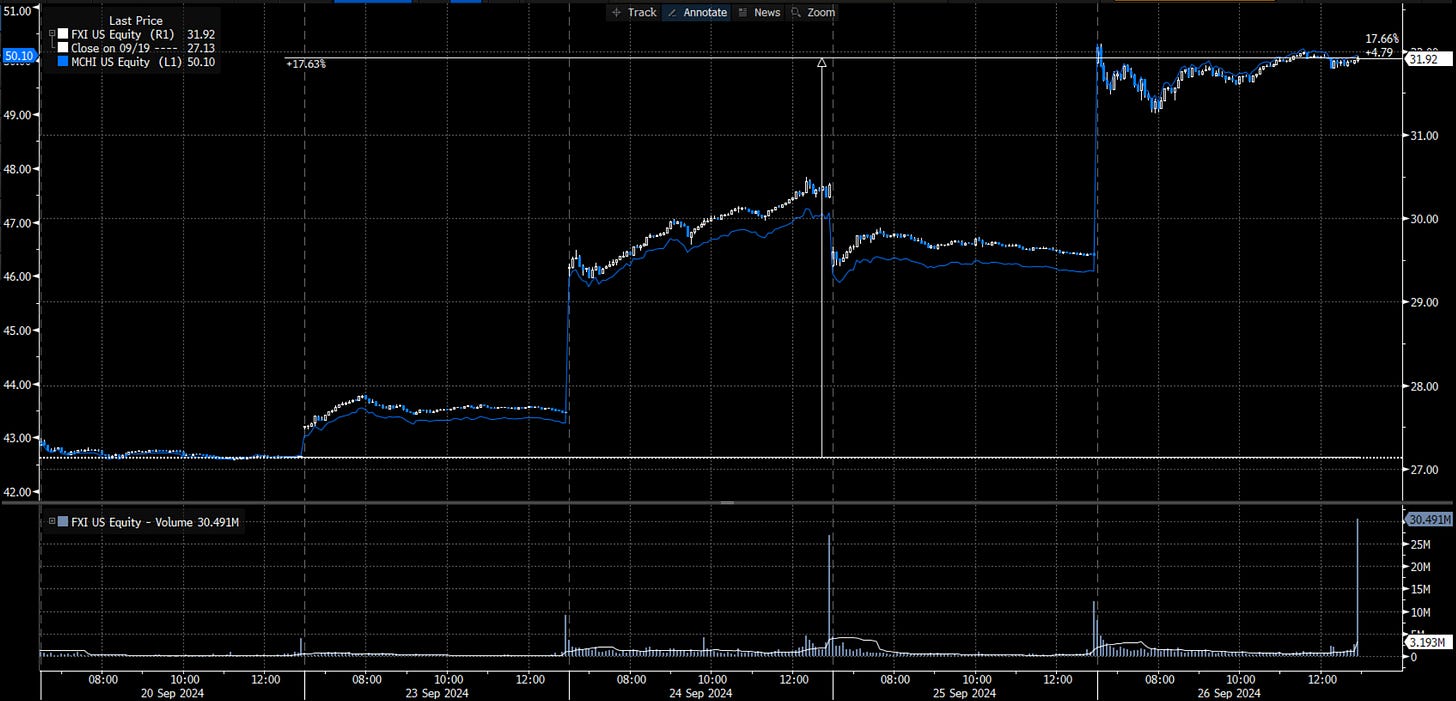

This week’s stimulus package was well received by markets, with China stocks up almost 20% over the last 5 trading days.

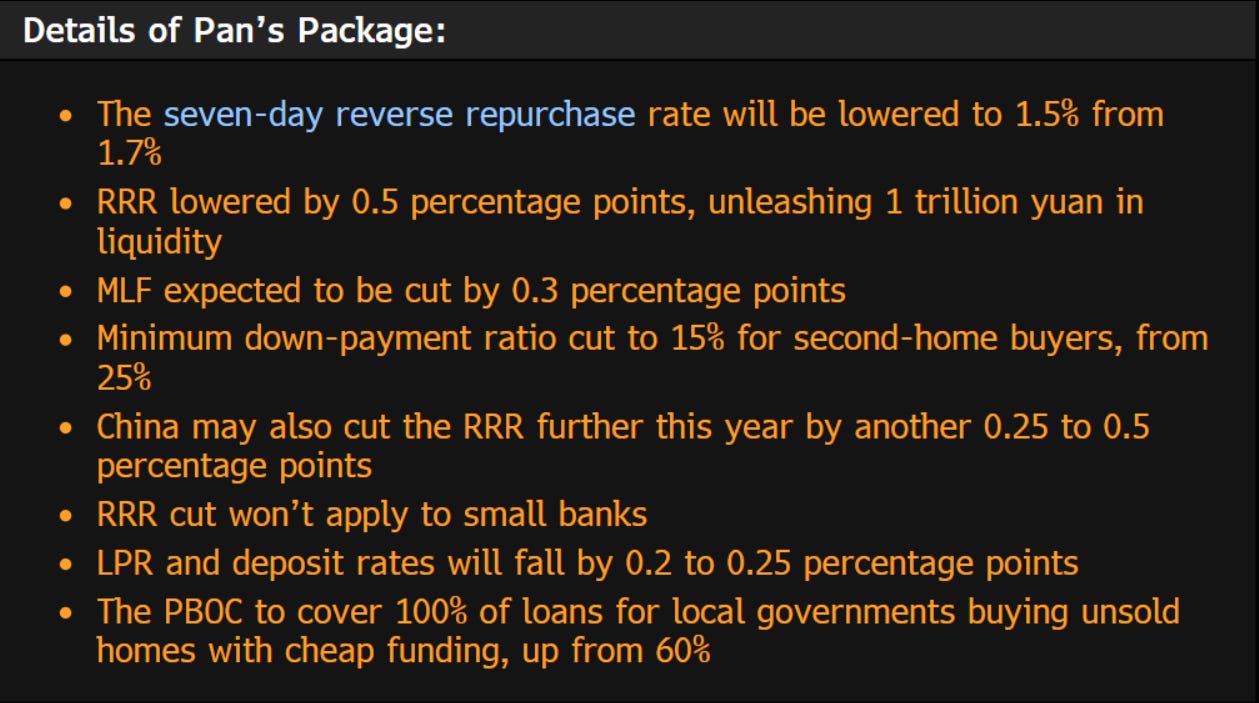

Monday’s stimulus was considered a “bazooka” by many market commentators.

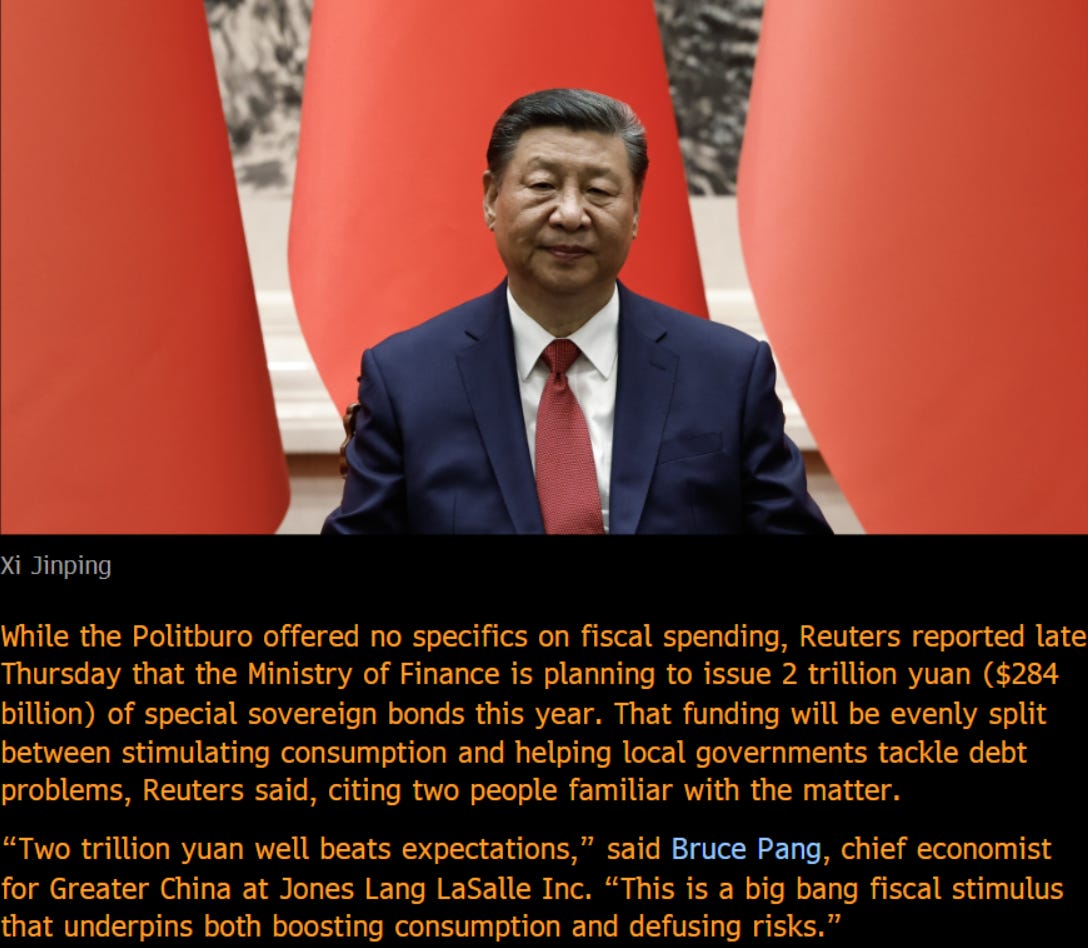

But today's follow-through caused the rally to continue, as China’s Politburo floated the idea of more direct demand stimulus.

Meanwhile the Q’s are up nicely on the week, but not without some serious choppiness.

In fact, it looked for a minute today like the Qs were headed red on news that the Justice Department was investigating SMCI following a Hindenburg Research report last month.

SPX has had an even more dramatic week than the Q’s, but is similarly looking fairly strong.

The laggard has been IWM, which tried to have a moment in the sun today but failed. It’s down 125bps on the week so far.

Bonds followed IWM lower, with TLT falling 120bps over the last 5 trading days.

Commodities failed to hold last week’s bid, even against the backdrop of Chinese stimulus.

Economic Data

While this week has not been packed with economic releases, unlike the last two weeks, which were nail-biters, there have been a few meaningful releases.

The S&P Global surveys came in with Manufacturing slightly colder than expected and services somewhat hotter than expected. This has been a recurring trend over the last few months, as manufacturing surveys deteriorate while services surveys remain relatively strong.

Housing was colder than expected, but most importantly, Q2 GDP Growth came in quite strong at a firm 3% annualized. That’s up from 1.6% in Q1.

Worryingly, in the GDP report, almost a full 1/3 of realized GDP growth was from increases in inventories. That’s not necessarily bad news, but it could indicate that the private sector is planning for more aggressive economic growth than we will eventually see in Q3.

I would categorize this week so far as another “cautiously optimistic” slate of economic data.

Tomorrow’s U. Mich. sentiment survey is one to monitor, and when combined with PCE, which also releases tomorrow, it will be even more significant.

Let’s watch.

Our Views

Make sure you’re in the chat to get calls and real-time market reads.

Mostly, things have played out as we have predicted. Large-cap tech has outperformed, with bonds lower and commodities marginally higher post-Fed-50. I must admit that the lack of a commodities bid, especially in energy, perplexes me.

While it’s true that you can’t create demand, that isn’t stopping the Fed or the Politburo from trying. Both seem very committed to doing what it takes to get their respective economies running.

I’m most confident in our long large-cap tech and short bonds calls. Commodities are a tough market, and trading them is a rigged game. When you trade oil, you are literally trading against the Saudis and their intermediaries.

It stands to reason that they have a bit of an information advantage over us.

That’s why you’ll never catch me putting on big commodities positions.

In fact, it’s my view that something funky is happening with the Saudis in oil. They have sought closer US-relations and have leveraged the Middle East situation to get us on their side.

In the same week China stimulated, the Saudis publicly abandoned their $100 price target to chase “market share.”

What does market share do for you in a commodity business? Unclear.

Probably, the Saudis are agreeing to keep oil prices low, to in turn keep inflation low, so that both China and the US can stimulate without fear of rebounding inflation.

On the US side, the Saudis get a closer relationship with the West and this:

In the East… I’m not sure what they’re getting.

This conspiracy talk just says one simple thing: Don’t lose your shirt trading oil. Don’t read too much into oil prices.

The rest of this post is for paid subscribers. Lock in your low-price subscription today!