A Make Or Break Week For AI

Find out what's happening this week that you NEED to know.

Last week was an interesting and chaotic one, with the final S&P 500 result of +.07% doing little justice to the swings.

The Nasdaq had a slightly worse week, finished down ~22bps.

Part of the reason for the mismatch between how traders felt last week and how the indices did is because we ripped Monday with SPX closing up ~150bps and NDX closing up ~200bps.

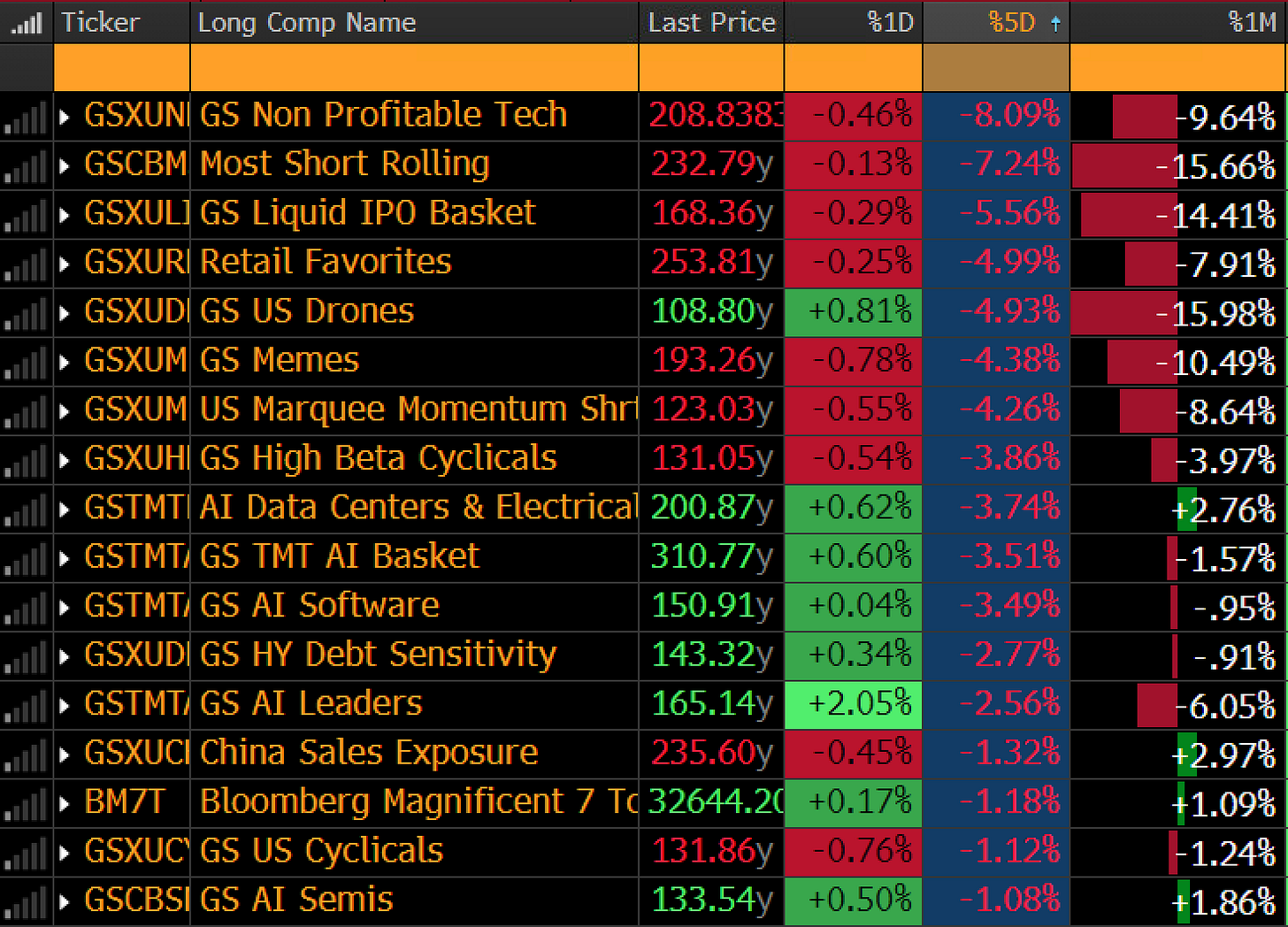

On top of that, retail-heavy names took a serious beating from those Monday highs.

Non Profitable Tech off 8%, Retail Favorites off 5%, Memes 4.38%, etc. means there was a lot of pain among the High Beta Boys (HBBs).

In the factor world (link if you don’t have a good grasp on factors), Momentum and Liquidity (highly traded names) took a back seat to Low Vol and Quality, which means that any form of “hot money” got waxed.

In fact, “High Beta Momentum” had its worst day Thursday since “DeepSeek Monday.”

So while the indices may have closed mostly flat, chances are you felt the pain yourself.

Set Up For Vol

Momentum unwinds are simply a feature of the modern markets. Because there is research showing that momentum is one of the few factors that produces durable “alpha” there is a lot of money that follows the momentum factor. That contributes to these miniature “boom and bust” cycles, or as Citrini calls them “rolling bubbles” (or as Le Shrub calls the, “rolling ponzis”).

And it makes sense to have had one of these some time in Q4. For one, Q4 seasonality is not great for momentum on the whole.

Liquidity on the whole is also drying up a bit. It’s a complicated subject, but Michael Howell has been projecting it to fall through 2026 before rebounding.

And the Fed had a “secret meeting” with Wall Street last week over the repo spike and money markets, implying that there is some stress there.

All of this has predisposed markets to a wobbly period, and it likely all contributes to why the VIX is staying elevated.

More Vol Ahead?

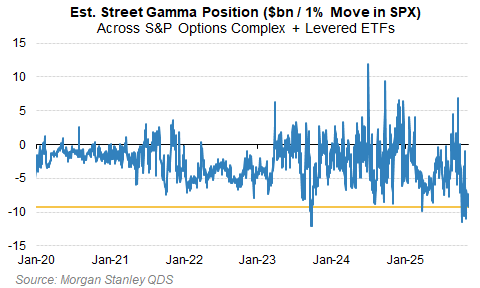

This week is monthly OpEx, and while I don’t believe it’s a particularly large one dealers are heavily short Gamma going into Monday.

When dealers are long Gamma they tend to hedge against moves, buying as the market sells, and selling as the market buys. When the are short Gamma they do the opposite, chasing moves and exacerbating them.

Also, the December Fed meeting has moved from almost a sure cut, to now a 55/45 “no-cut” projection. If the market continues to price out cuts, that could be a headwind for equities.

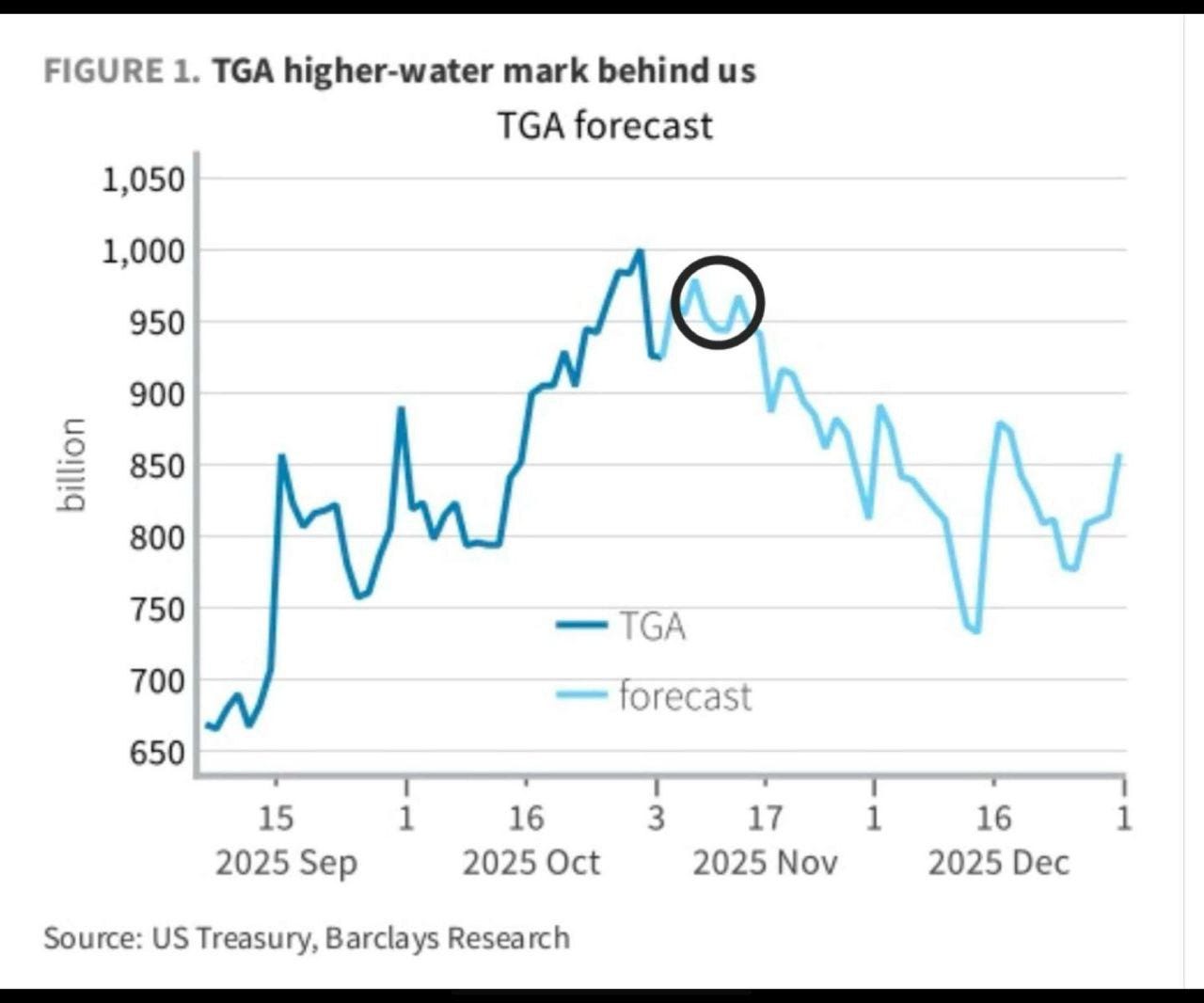

On the more protective front, it appears the TGA buildup is now behind us. Rather than the Treasury General Account pulling money “out” of the economy (a simplistic explanation but suitable for our needs) it should now begin pushing money IN to the economy.

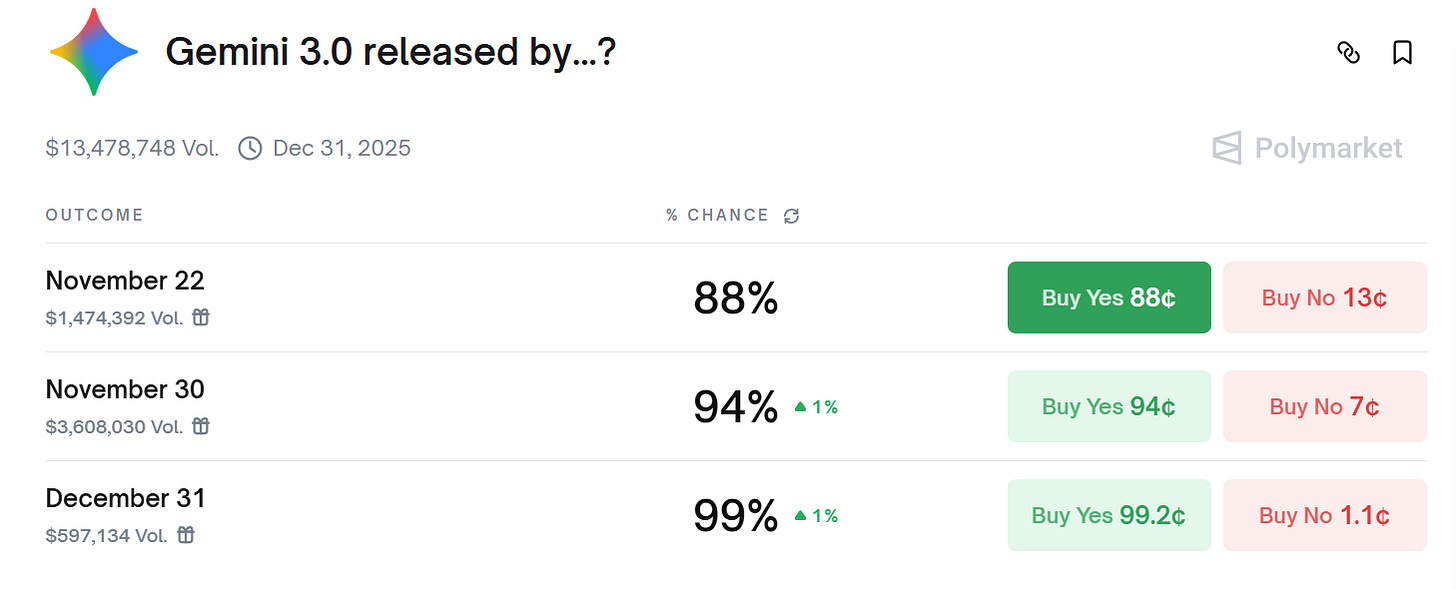

But we also have a heavy event schedule this week, with NVDA earnings Wednesday, September (you read that right) Non Farm Payrolls releasing Thursday, and Gemini 3.0 expected sometime this week…

Gemini 3.0 is expected to be the new best in class LLM model. After a relatively disappointing GPT-5 release, all eyes will be on Google to see if they can honor the scaling laws and keep the models moving forward.

The State of the AI Trade

AI has been the source of a lot of unease the last few weeks. Sama made a rare public misstep in his Brad Gerstner interview, the AI stocks drew down heavily, and the chatter about a “debt fueled capex bubble” reached a fever pitch.

There are growing risks in the AI trade, one of which I highlight above: Gemini 3.0 disappointing and “popping” the bubble of model improvement expectations.

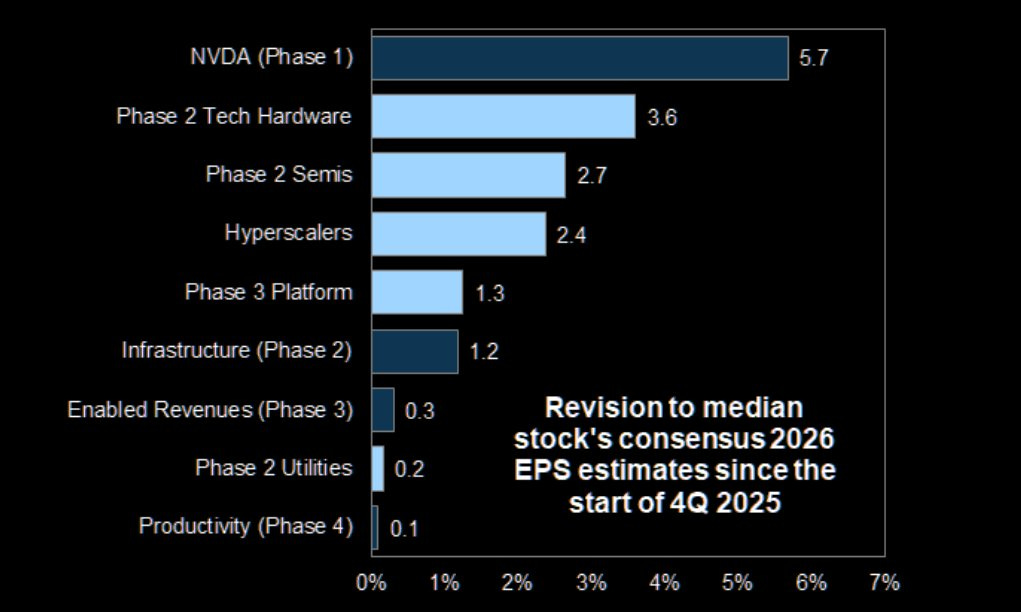

But the reality is that the earnings expectations for AI companies continue to get revised up.

The hyperscalers made it clear that they plan to spend more than ever in 2026.

And while the Big Tech firms’ free cash flow is decreasing to fund these capex expectations the idea would be that this capex is ROI positive. Plus, they’ve managed to avoid lowering buybacks by taking on debt.

My Vibe and My Trades

Like this post for a chance to win a FREE month subscription if it gets 10+ likes.