Big Tech, Big Cracks

Why is tech in free fall, and what's next?

Author’s Note: I will continue releasing free content where I can provide value to everyone. Posts will include premium content for paid subscribers at the end of emails or as separate write-ups. Free content will focus on macro views, whereas the paid content will focus more on the tactical trades I’m making.

Serious traders or investors should join Premium to get the best, most timely information.

Mag 7 earnings are behind us (NVDA reports at the end of November), and it was a bit of a mixed bag…

Or was it?

The reaction to earnings was mixed, but the earnings themselves were relatively strong.

Overall, MAG7 earnings surprised to the upside by 11.28%. Most of that came from margin expansion, as sales growth was more aligned with expectations.

Meta’s EPS surprise was one of the largest of the past two years, but the stock’s reaction was also one of the most negative. Likely, this is due to somewhat disappointing revenue that failed to exceed investor expectations.

Microsoft had impressive EPS and Revenue growth but was down the most of the MAG7 after its earnings.

So what gives? Why is the market souring on these MAG7 stocks even as they continue to post strong numbers?

Capex is only capex if it improves the company’s bottom line

The MAG7 names were at or near their all-time highs heading into earnings this week.

They were priced for perfection, or at least something close to it.

Surprisingly, the market has been patient with these names' ever-expanding AI capex. Still, they are beginning to get impatient with the promises that this will pay off “eventually.”

The notable difference between MSFT + Meta and the other MAG7 names (who had better earning reactions) is that MSFT and Meta both heavily guided toward a long road ahead for AI spending to pay off.

Microsoft’s Azure cloud service grew slightly slower than in the previous quarter as they struggled to bring data center capacity online. At the same time, the business’ Capex spending increased notably.

Investors are concerned about what looks to be growing investment requirements without an associated increase in sales.

Meta’s CEO Mark Zuckerberg wasn’t ready to forecast 2025 capex yet but said he expects it to “expand meaningfully” over 2024.

Meta and MSFT are the two Mag7 names that spend the most heavily on AI.

When investors feel good, they are happy to bet on growth and overlook the risks.

When external factors start to rock the boat, however, the turn sour fast.

External factors like…

The Election

There is a lot of macro risk in the markets today.

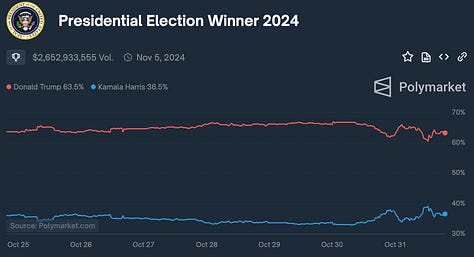

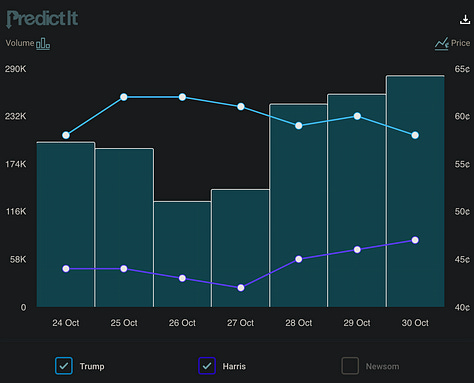

The election markets have tightened notably this week.

As I’ve written before, a Kamala win would be an unpleasant shock to markets, especially if it came as a surprise.

Tightening election spreads will result in additional hedging heading into election day. That could be painful for the markets in the short term, but might save us all a lot of volatility on election day.

The Gilt Crisis (?)

Gilts are the United Kingdom’s version of treasuries, and as the chart above shows, they are reacting quite poorly to the new PM’s proposed budget.

At the same time, US Treasuries have sold off nearly continuously for the last month as yields returned to July levels.

Falling bond prices (rising yields) contract global liquidity and put the onus on stocks to justify their P/Es. A relatively abrupt sell-off, as we have seen in both gilts and treasuries, also raises uncertainty about the future, causing hedging to increase across the board.

It remains to be seen how the situation in gilts and treasuries evolves. Next week, the US holds a pivotal election, followed by Friday’s Fed meeting. Both are likely to significantly impact bonds.

If you’re a reader of Mind The Tape, please consider taking this reader survey to let me know what you’re enjoying and what you’d like to see change. Help me tailor the content to what you want to see!

World War 3

The Middle East situation simply will not calm down and keeps resurfacing at the worst times.

Late in the day today, the New York Times published this article indicating that Iranian Officials planned to retaliate against Israel.

I’ve previously argued that I don’t think that’s likely. I’ve also previously (sometimes) been wrong.

There is an ongoing ceasefire negotiation taking place in the region. Also, Iran has previously engaged in rhetoric like this only to back down. Even in the last few months, that has sometimes happened, although more recently, they have followed through with such rhetoric.

With the ceasefire negotiations in progress but at an impasse, perhaps Iran is attempting to spur them along with this aggressive rhetoric.

Or maybe it’s sincere, and the regime must retaliate for its own stability.

It is exceedingly difficult for me to see what Iran gains from continued aggression towards Israel right now. The United States has stated:

Still, we must be humble in the face of the unknown, and oil certainly believed the headline.

I don’t know the truth of the situation in Iran. Wars have started in crazier circumstances, and these tit-for-tat cycles are hard to stop.

Suffice it to say that markets are not sleeping easy against this backdrop.

The rest of this article is for paid subscribers. In the next part, I detail where I think we are in the economic cycle, what it means for equities, and a brief plan for the week ahead. If you want to read it, redeem a trial to check it out. If you’re already subscribed, then thank you!