The AI Trade Is Moving Forward, Are You Keeping Up?

You need to read this now...

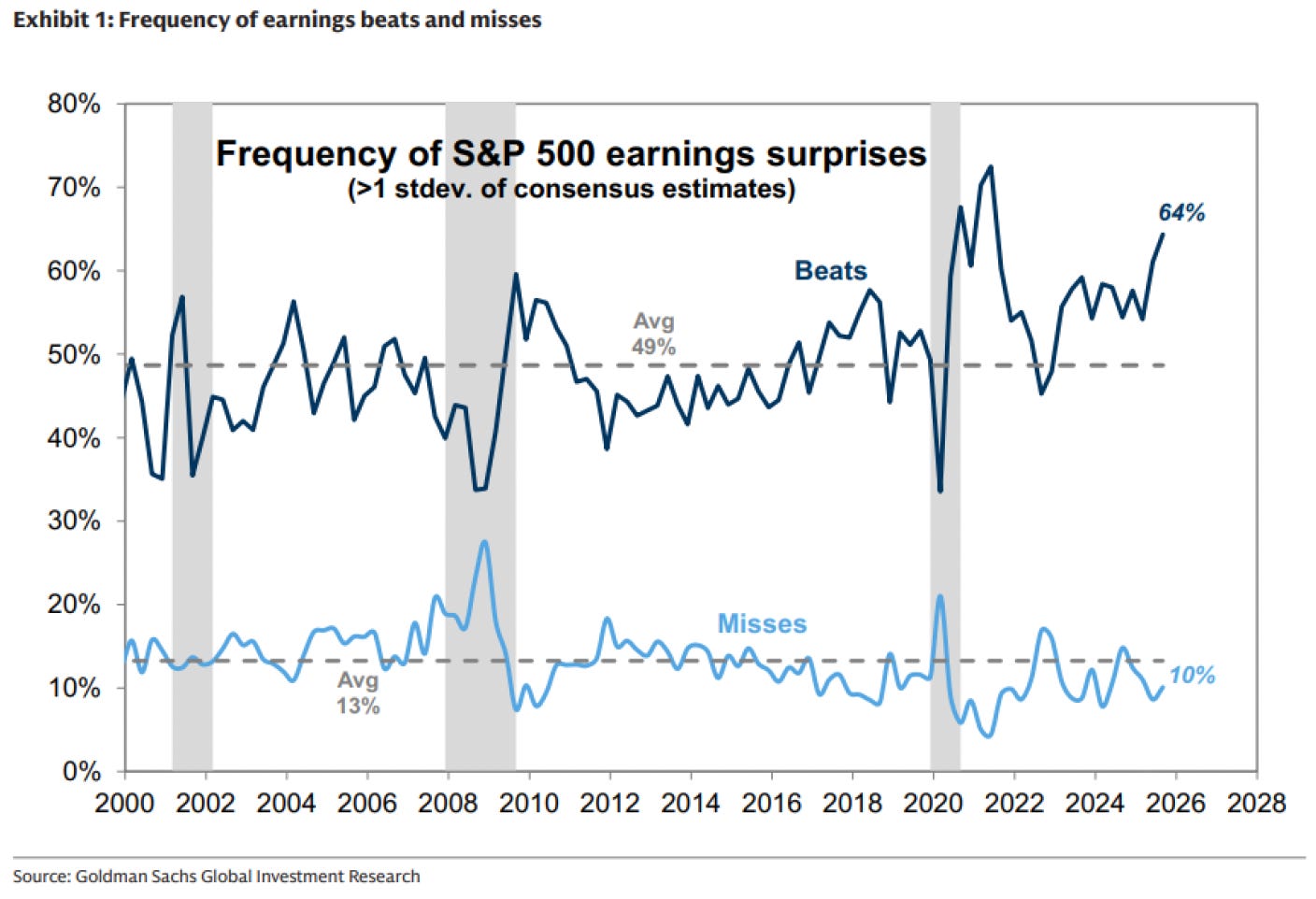

More than 65% of the S&P500 have reported earnings, and their results have deviated meaningfully from recent history.

More companies are beating consensus estimates than anytime since immediately after COVID.

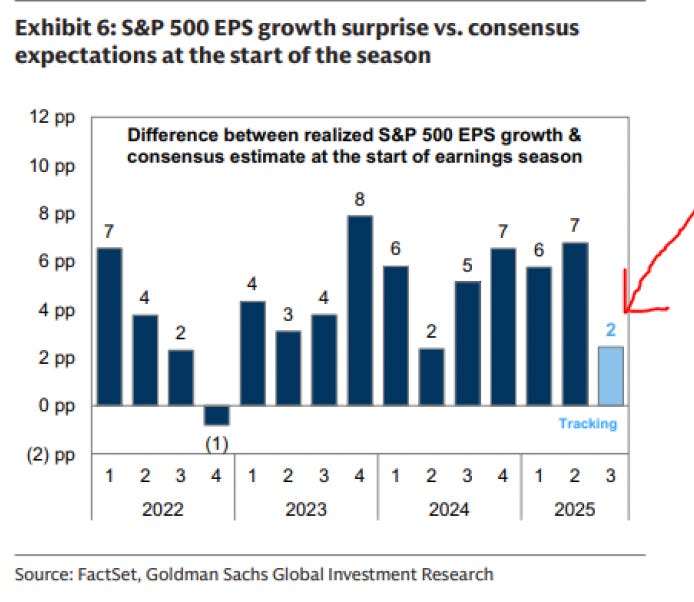

But they are beating by significantly smaller amounts than in recent history.

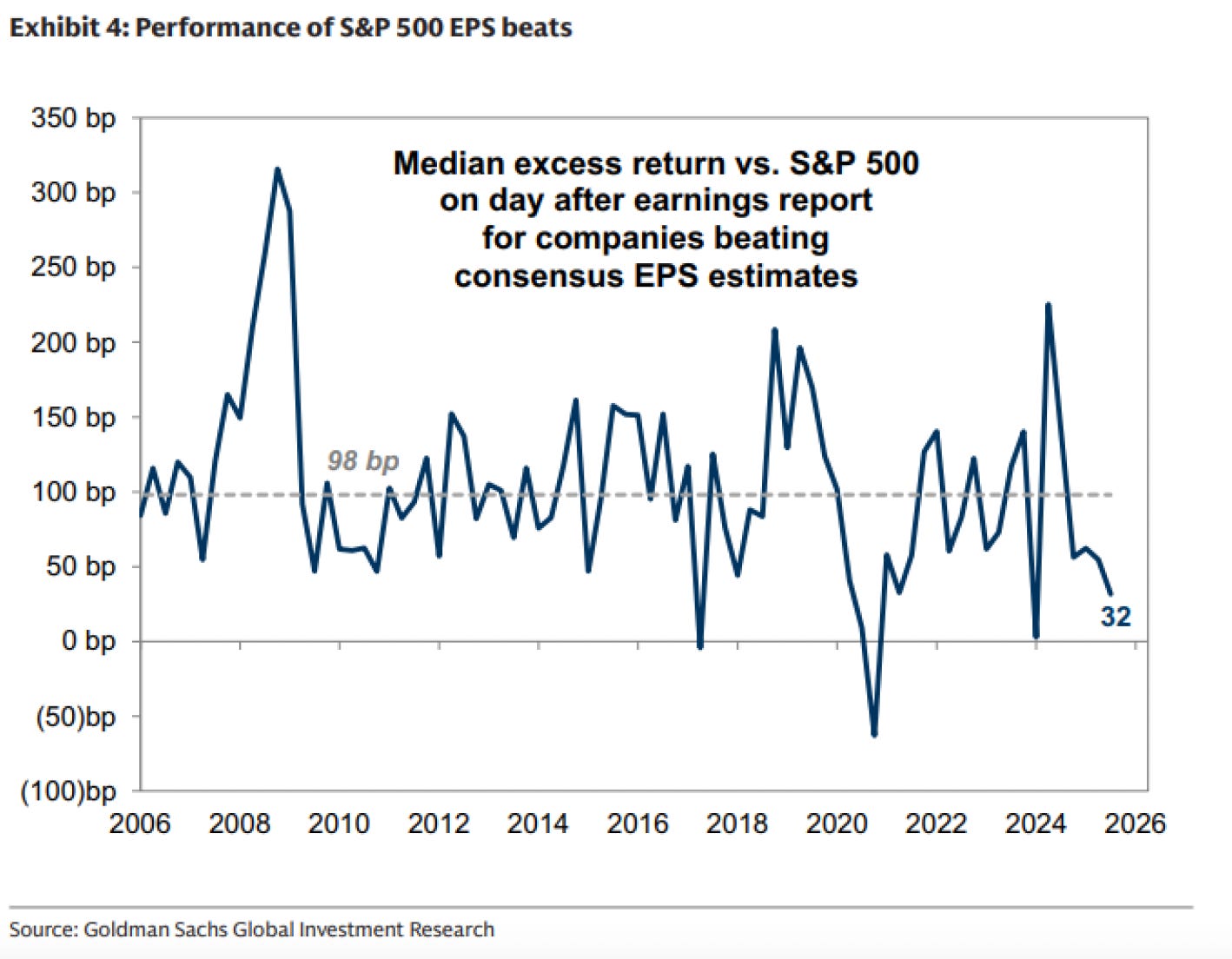

Look at Q2 2024 on the chart above. Then compare it to NDX’s performance in that same period on the chart below.

Not great.

It’s already manifesting a bit like Q2 2024 in other ways as well. Companies that are beating on earnings are not being rewarded for it compared to history.

When market expectations are high and results are good but not great you end up with some disappointed investors.

I don’t necessarily think we will see the same drawdown we saw in Q2 24’ off of this, because whereas in 2024 there was still deep lingering fear of a recession after the 2022 rate hiking cycle, we have a much more structurally optimistic investing environment this time around.

Still, these little cracks showing add up and are worth watching. The market is often willing to shrug them off until they either go away or you reach a critical mass.

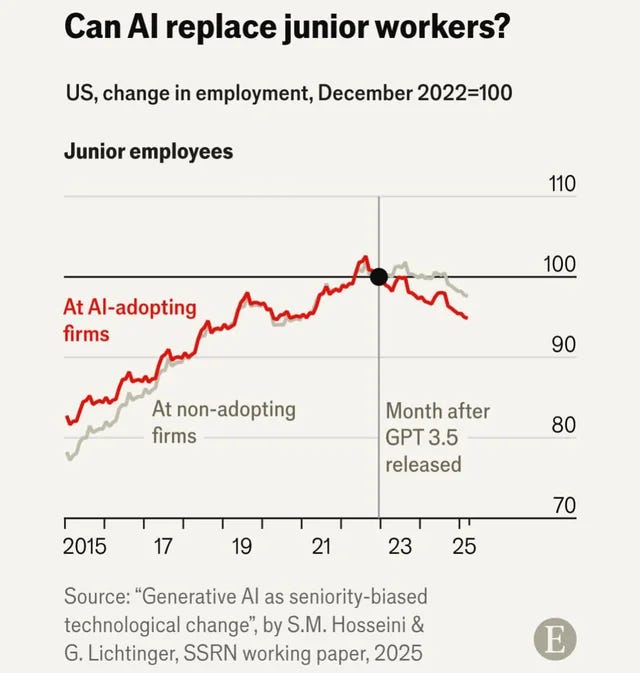

Employment

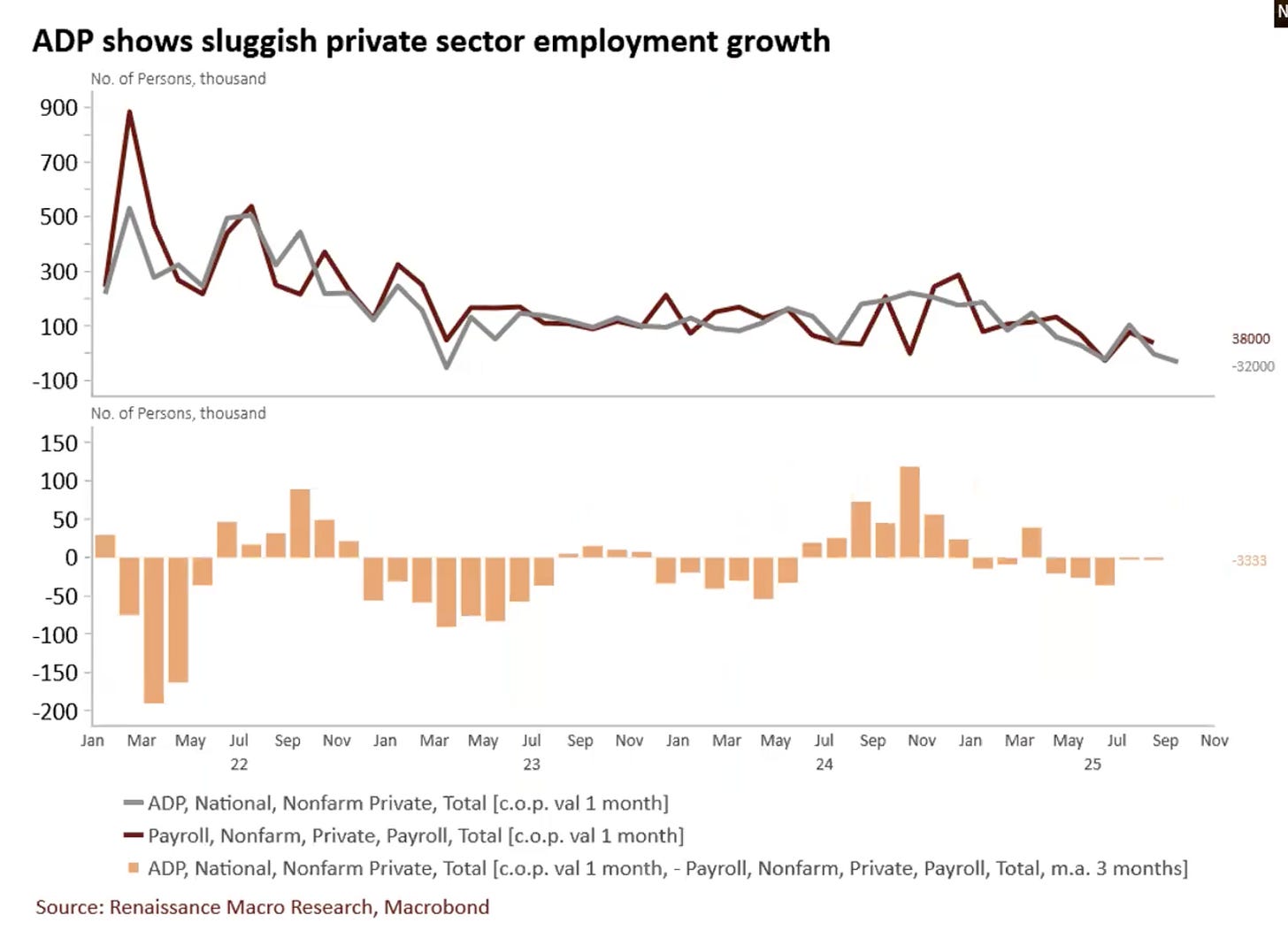

We continue to only see limited employment data due to the government shutdown, but the private ADP data we see shows continued slowdown.

You know what would be ironic is if ChatGPT release caused companies to realize that AI was coming for the jobs and slow hiring, thereby causing a recession that sets AI back 5+ years!

There is a confounding variable surrounding all this employment data in the immigration policy changes, but we need to see the job market hold steady or even the so-far-untouchable AI sector could start to wobble.

AI Themes

Last week was a big week for the AI story. With AMZN 0.00%↑ META 0.00%↑ MSFT 0.00%↑ GOOG 0.00%↑ AAPL 0.00%↑ all reporting earnings and commenting heavily on AI infrastructure and technology on their earnings calls we got a good look at the state of the theme.

If you missed my Meta update, you should check it out here:

Is It Time To Buy $META?

Subscribe for free to get real-time market insights directly in your inbox. Serious investors should subscribe to premium for alpha you can’t get anywhere else.

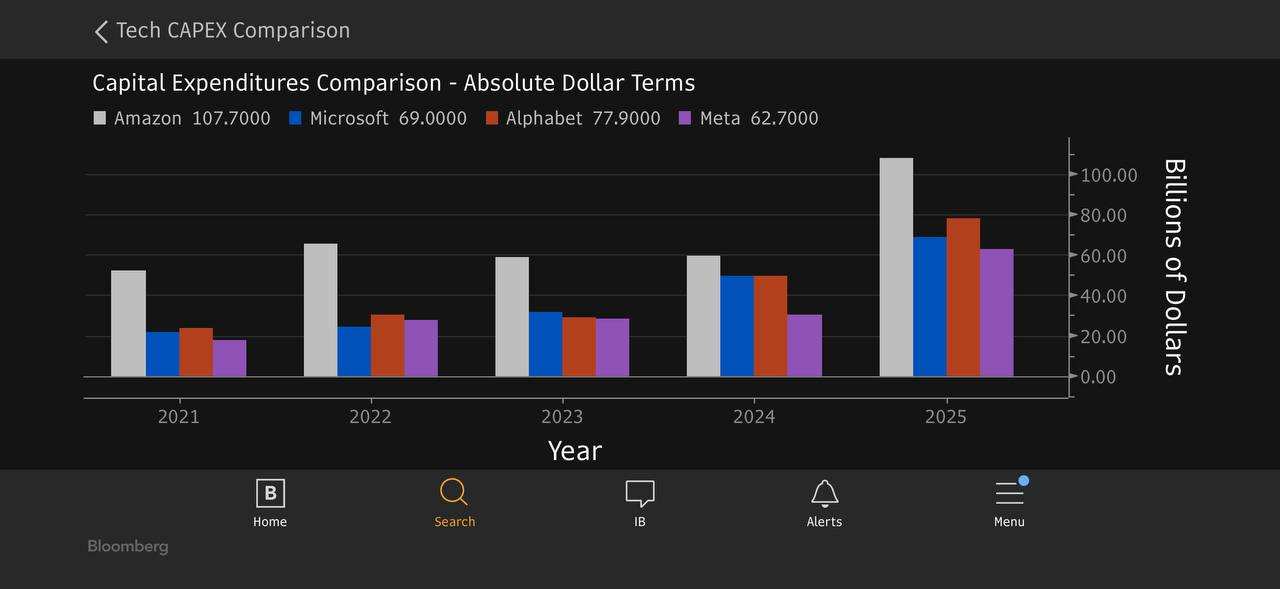

AMZN and GOOG were the big winners of the week each up ~7%.

What’s notable is that they are also the two biggest spenders on capex.

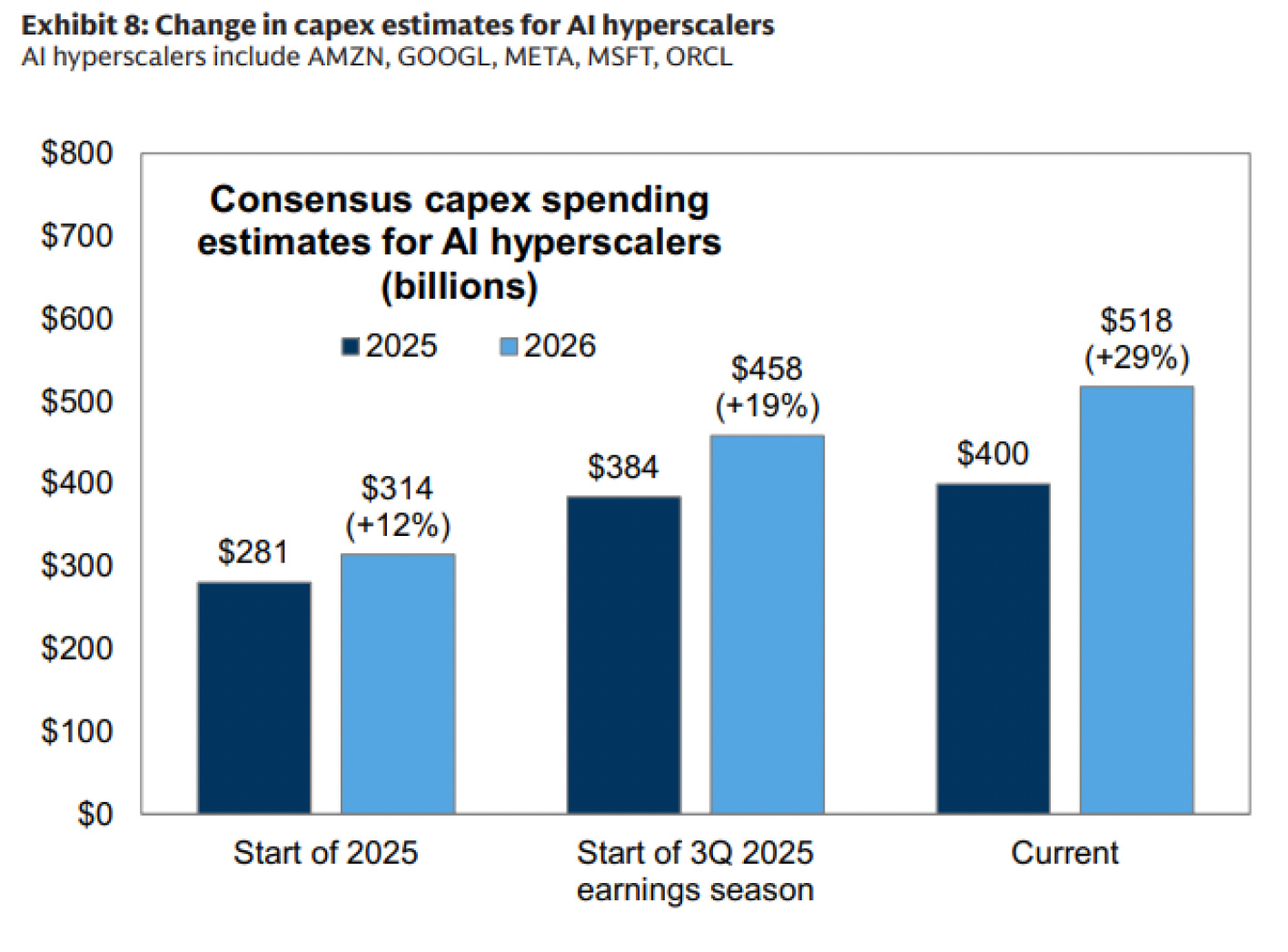

And generally across the whole hyperscaler complex the capex guides have substantially beaten expectations!

So the hyperscaler theme is certainly alive and well, despite what happened to Meta. There appears to be a growing preference for companies that are directly monetizing their massive capex, and GOOG and AMZN both fit the bill there with huge cloud revenue growth, and in Google’s case, the chance to have a leading-edge model as well.

An interesting tidbit also got thrown out by Microsoft CEO Satya Nadella. Satya, when asked by Brad Gerstner about a potential for a supply glut, responded:

I think the cycles of demand and supply in this particular case, you can’t really predict, right? The point is: what’s the secular trend? The secular trend is what Sam (OpenAI CEO) said, which is, at the end of the day, because quite frankly, the biggest issue we are now having is not a compute glut, but it’s power — it’s sort of the ability to get the builds done fast enough close to power,” Satya said in the podcast. “So, if you can’t do that, you may actually have a bunch of chips sitting in inventory that I can’t plug in. In fact, that is my problem today. It’s not a supply issue of chips; it’s actually the fact that I don’t have warm shells to plug into.”

In other words, Satya is no longer chip-constrained but “warm shell” (powered and ready datacenter) constrained. The market has begun to rapidly reprice some datacenter/power related companies higher this year, but Satya’s recent comment is likely to propel that forward in earnest.

I get into more on that in the Trade Ideas section below.

Trade Ideas

If you’re not already a paid sub, like this post. If it gets 7 likes I’ll give away one sub. If it gets 15+, I’ll give away two.