Markets Abhor a Vacuum

Entering the doom loop

Author’s Note: I will continue releasing free content where I can provide value to everyone. Posts will include premium content for paid subscribers at the end of emails or as separate write-ups. Free content will focus on macro views, whereas the paid content will focus more on the tactical trades I’m making.

Serious traders or investors should join Premium to get the best, most timely information.

First of all, if you missed my post this week, I highly recommend you go back and check it out. In it, I outline the backdrop we are trading in, which is a slow deterioration of American exceptionalism.

In other words, we are on a path toward a brave new world in which owning US equities is not a good idea. As American equity holders, we must hope something changes in the next few weeks.

Unfortunately, the chaos of the Trump administration continues to be a headwind for markets.

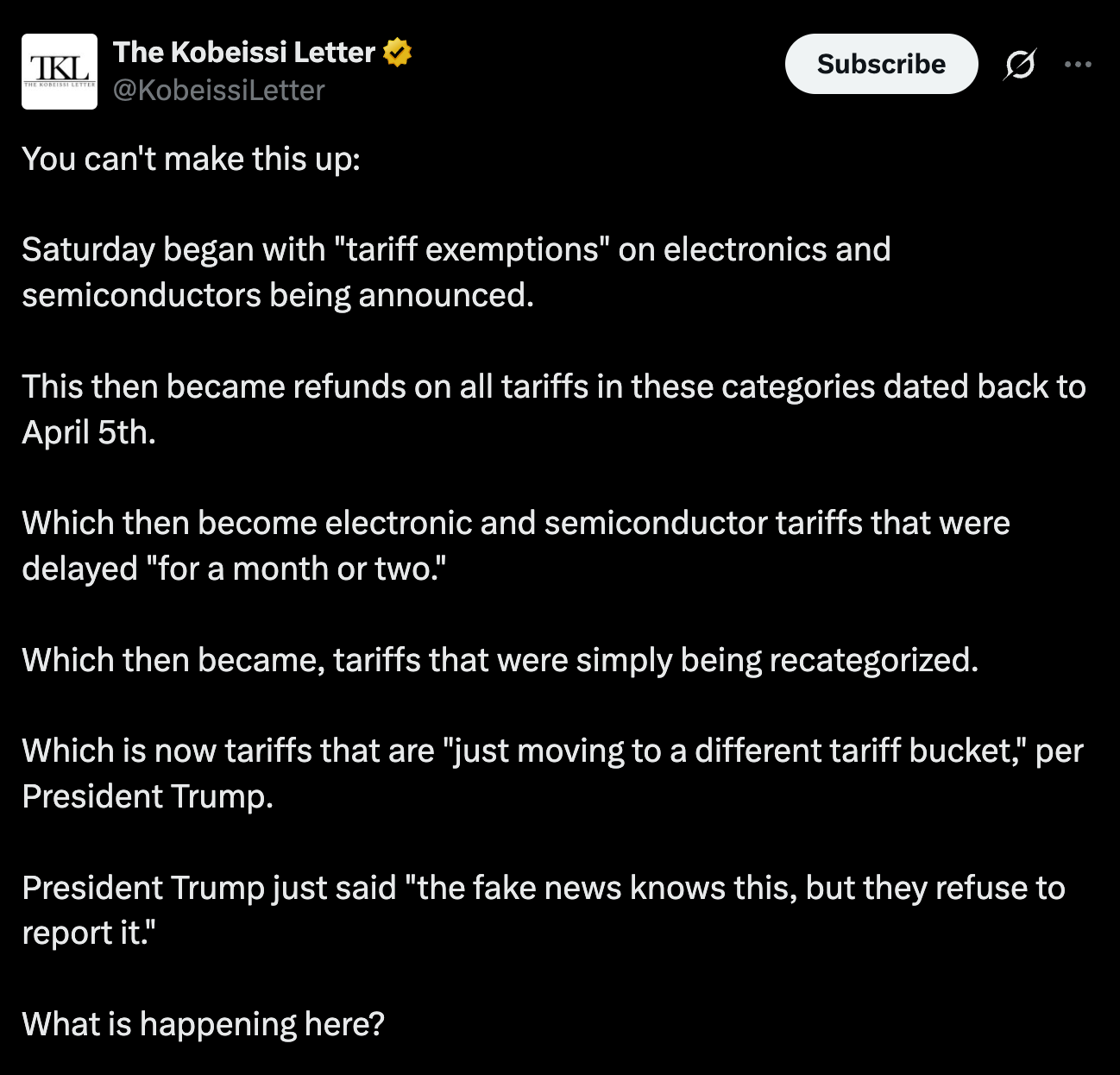

Just this weekend, we have had multiple conflicting headlines/messages out of the administration. A good summary here:

This is anathema to markets. They say nature abhors a vacuum, and markets certainly abhor a vacuum of clarity.

And the Trump administration has continued to ratchet up uncertainty.

What a shit show.

Uncertainty and Financial Conditions

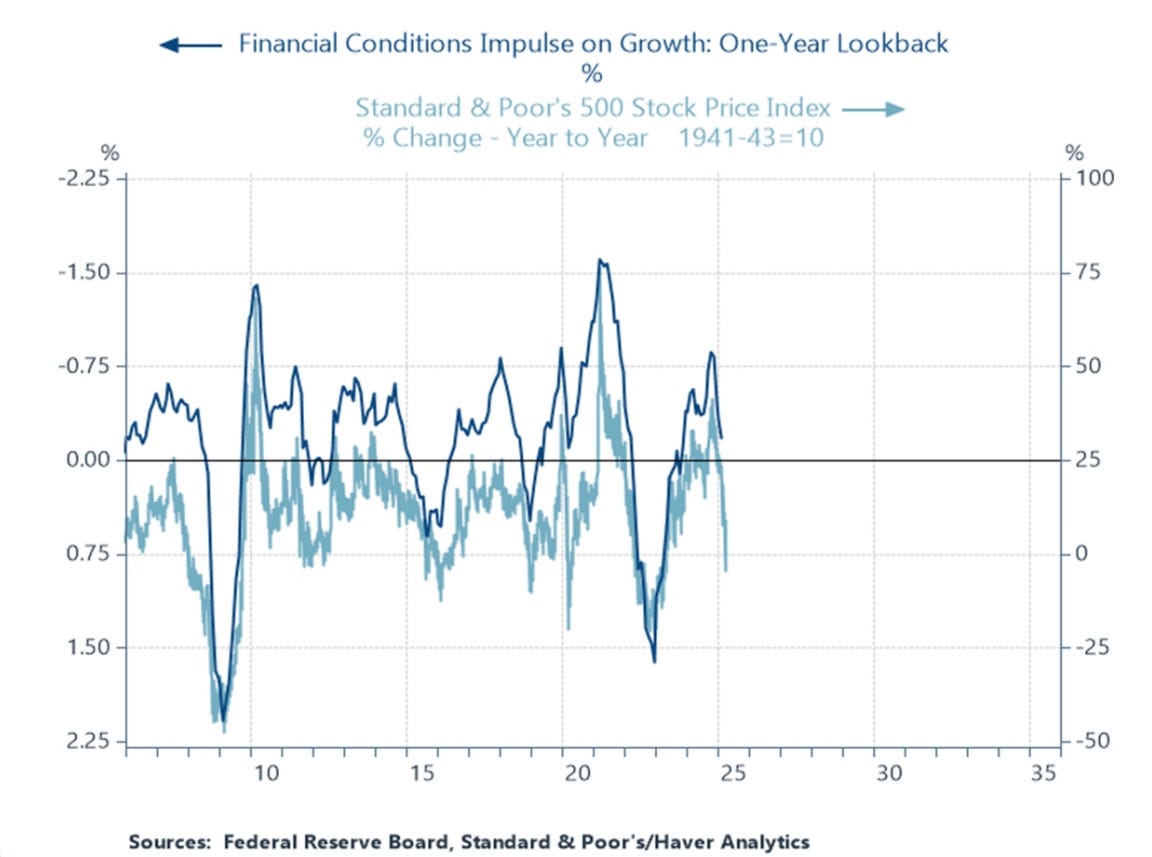

Financial conditions have started to tighten significantly due to both a crippling lack of certainty and increased market volatility (which go hand in hand).

These conditions will manifest a recession if they are allowed to continue.

We are now in an environment defined by a straightforward equation:

Will tariffs and uncertainty ease faster than financial conditions deteriorate?

If yes = bullish

If no = bearish

Capital Flight

To make matters worse, we have a growing problem that Danny Dayan describes accurately as a “doom loop.”

US equity markets, Treasuries, and the Dollar have all been falling in tandem. This is highly unusual price action. Typically, in market panics, there is a flight to the dollar, and historically, bonds and equities have had a negative correlation (a truth that’s been violated since 2022 but is the basis for the famous 60/40 portfolio that became portfolio construction gospel in 2000-2020).

You can barely see the DXY (dollar index) on this chart because its moves have tracked the S&P 500 closely this year.

For all three to fall together is very rare, and it strongly argues that capital is leaving the United States.

Here’s Danny Dayan on the doom loop:

As the dollar weakens, it raises inflation further via higher import costs. Higher inflation eventually hits bonds as it makes them less attractive, so bonds selloff. The issue is it is occurring as foreigners also sell equities due to growth concerns. Thus, this presents the ultimate dilemma for policymakers as their typical responses to growth and financial stability worries will not only not help, but make it worse.

The Trump administration must continue last week’s pivot and fully embrace it, or we risk terrible outcomes for Americans and the economy.