Reading Recessions With Proprietary Data

Thinking about the week ahead and unveiling a new proprietary data source...

Author’s Note: I recently enabled paid subscriptions. The plan is to continue to release free content where I can provide value to everyone. Then, I will include premium content for paid subscribers at the end of emails or as separate write-ups.

The proprietary trading signals I discuss today will be a paid feature going forward.

In the not-too-distant future, paid subscription prices will also be $25/mo, so it makes sense to subscribe now.

The weekend couldn’t have come at a better time. Facing a confusing reaction to the NFP report on Friday and a bloody day that capped off the worst week for the S&P500 since March 2023, it was a good time for a break.

I spent Friday night completely detached from the markets. But on Saturday, I woke up and got back to work. I was determined to figure out my view of where we were headed next week.

The real problem with where we are at as traders is this: Our positioning and trading if we are heading for a recession in the short term should be completely different than if we are just going to pass through a period of whipsaw data reports.

The simplest way to solve that is to answer the question, “Are we in a recession?”

I’ve looked in depth at the data available to us before, and the truth is, as much as we like to look at layoffs, job growth, JOLTs, jobless claims, GDP, etc, they all tend to be lagging indicators.

That means they won’t tell us we are heading for a recession until too late.

Hence, there were massive (over?) reactions to the data we got last week.

Let’s take another look at that data, discuss positioning and flows, and then discuss the indicators I’m working on to try to bridge our knowledge gap.

Last Week’s Data

The totality of the data is bad. There are a few bright spots, like GDP growth, retail sales, etc. Those have remained strong. However the recent business-cycle and employment readings are not looking good.

ISM Manufacturing has been a bearish survey for so long that it’s hard to know what to make of it. Still, this is not a good look, as the improvements we saw to start the year have decisively faded.

ISM Services was the bright spot last month, but the trend is clearly down.

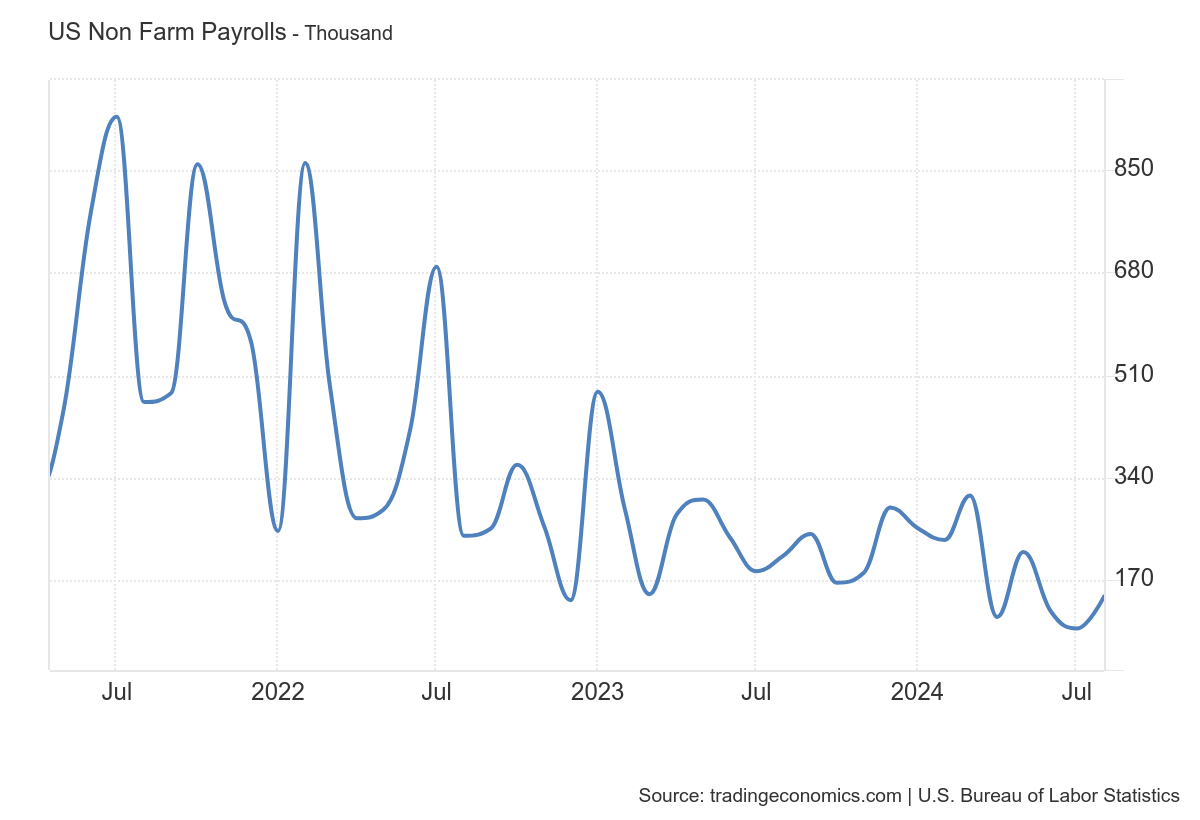

Nonfarm payrolls beginning to bounce along close to 100k. After revisions June and July are at 118k, and 89k, respectively. Gross levels.

The problem with all of these indicators is that they are not predictive, they are reactive.

Still, that doesn’t mean they are useless now. It means they were useless a month ago, but I feel the data clearly puts us in a binary situation where we are either in a growth scare or a recession.

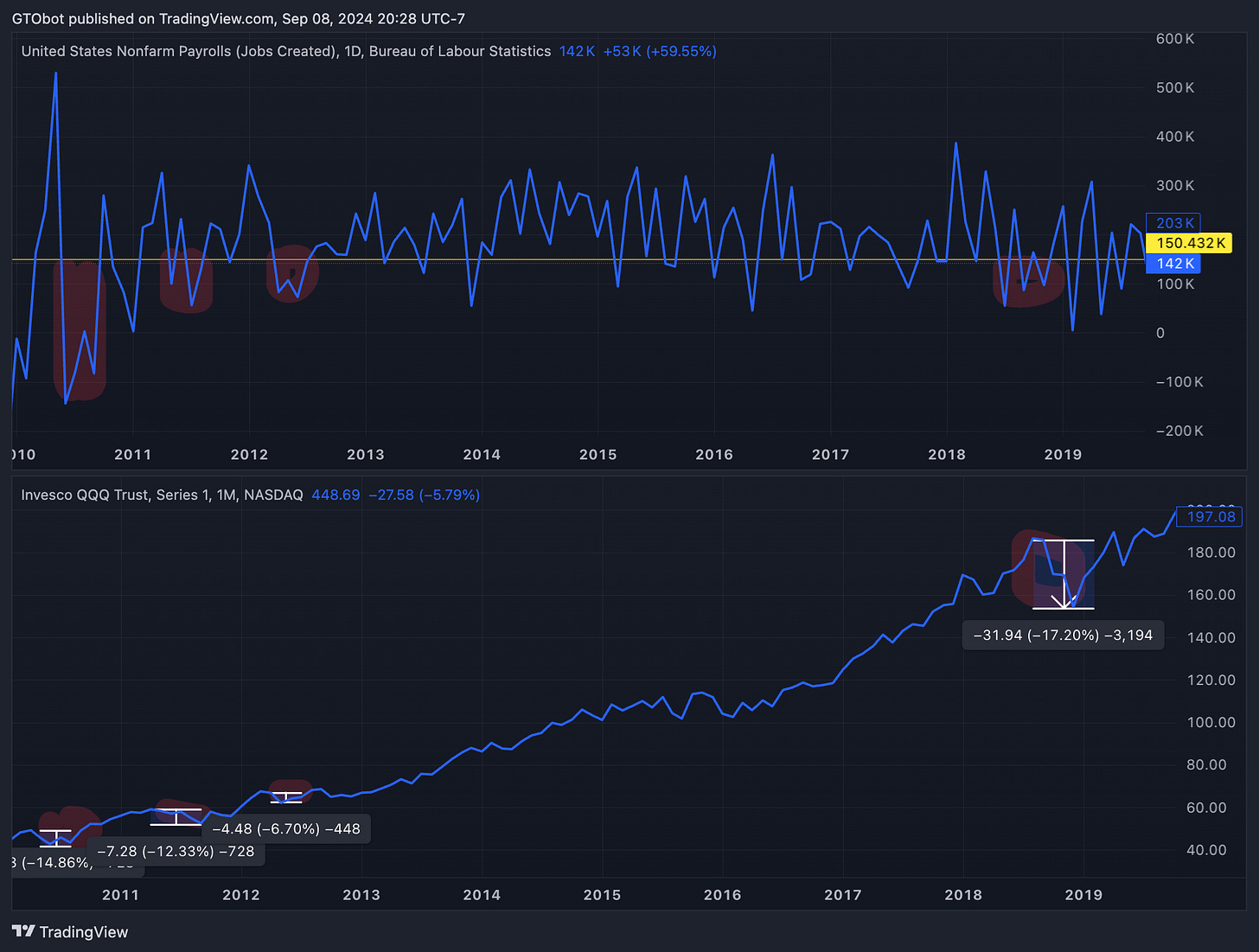

Take the period of 2012 to 2019 in NFP. That was a period of incredible outperformance for the Nasdaq (If only I’d been trading in college!).

I’ve highlighted a few periods where NFP prints were bad, which I believe indicates growth scares, and drawn the associated market reaction.

In every case I identified, equities underperformed.

Meanwhile, as of today, we are off the peak by about 7.8% in the Nasdaq.

This likely means that the bulk of the bloodshed is behind us. But critically, the flat returns and drawdowns lasted months in similar periods. There was plenty of time to add exposure back.

So you’re asking, “Should we hedge, should we sell?”

Read on…

Positioning

PauloMacro who I have cited many times in this newsletter, wrote another excellent piece today where he talked about positioning in equities, oil, and bonds. You should go check it out.

He talked a lot about seasonality, and noticed something I have been noticing as well: people are screaming about seasonality this month. I have never seen anything like it. It’s like they all just discovered the concept for the first time.

The fact that the sell-off has lined up so closely with the start of September is a little too much for me to miss.

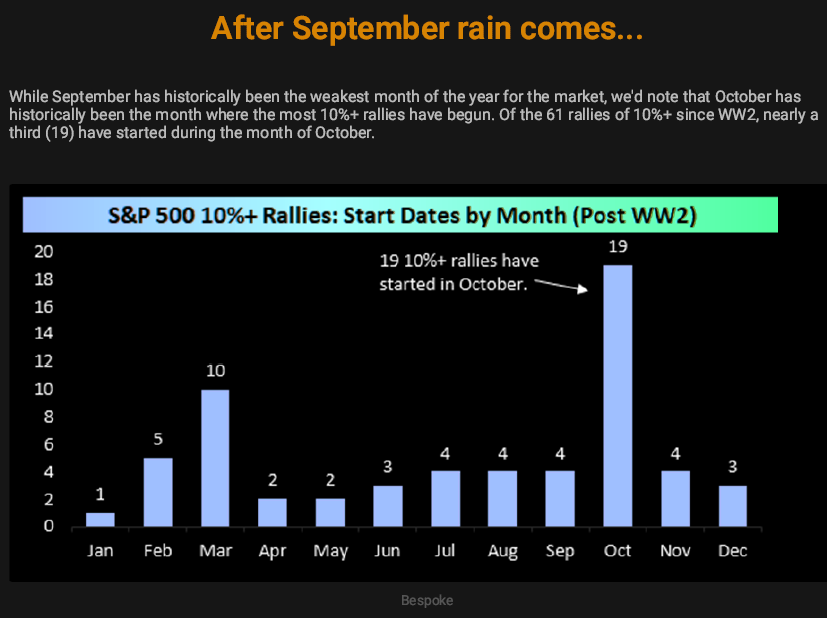

And the thing that most people are not talking about yet is that October is one of the best months for stocks.

It has kicked off more major rallies than any other month.

With a good flurry of September selling behind us, QQQ 7.8% off the highs, and a regime where we have been more aggressively front-running seasonality, it is not a bad place for a bounce.

My current plan is to wait for a bounce and add more hedges. The market will give us some sellable bounce, but the growth scare will continue dominating the narrative.

I also think that narrative will fade at least one more time, and we will continue selling off.

Proprietary Signals

This next part of the post contains a proprietary indicator I’ve been working on called the Fed Sentiment Index. I compile data and statements about the state of the economy and extract the sentiment using LLM technology.

If you want to read on, subscribe now.