The Tariff Man

Tariffs tease again: What's next for markets?

Author’s Note: I will continue releasing free content where I can provide value to everyone. Posts will include premium content for paid subscribers at the end of emails or as separate write-ups. Free content will focus on macro views, whereas the paid content will focus more on the tactical trades I’m making.

Serious traders or investors should join Premium to get the best, most timely information.

First, a little housekeeping. I’m constantly thinking about how to make this newsletter better and I was hoping to get a little feedback from you guys. Please take a second and answer the poll.

Markets had a good week last week with the NDX and SPX both closing meaningfully higher.

The upward momentum was made even more dramatic by the fact that it came in the last 4 days of the week, as Monday closed pretty red.

Zooming out, we are around 17% off the lows in NDX and 14% off in SPX. Wow.

Importantly we are also above the “post-pause” S&P highs marked on yellow in the chart. That corresponds to roughly the 5500 level in ES, which is now a big psychological pivot point. People will be looking for ES to hold above 5500 to get bullish again, or fall below it to get bearish again.

We can expect some Soros-style reflexivity around that number. In other words, higher prices might beget higher prices for a while, and vice versa.

In The News

Headlines this week were interesting in the sense that there were as many “positive” headlines as possible without anything actually happening.

It’s pretty clear that the administration is afraid of the cat they’ve let out of the bag, and is now trying their best to put it back in.

Bessent came out today victory lapping about the stock markets going up. In general when a politician victory laps or dances on a grave, that’s a pretty good turning point. As an example, let’s look at how TSLA has done since Tim Walz told an audience he likes to check the stock price for a “pick me up” during the day (because of how badly it’s doing).

Heh.

Unlike Tim Walz, Bessent has a lot of levers to pull that directly affect the stock market. So to some degree, I think we need to take him at his word when he tells us he’s watching it, and takes credit for making it go up.

At the very least, it implies he isn’t eager to see it drop again, and Trump seems more and more content to trust the economy to the “money guys” over Navarro or others.

Trade Deals

Tangible trade deal progress remains elusive. Trump keeps saying he’s in talks with China while China keeps saying “we haven’t talked.”

It’s a situation so outrageous that it can only really be explained with a meme.

On the flip side, it looks like we might have a loose framework for a South Korea deal this week.

The market has been taking a lot on faith this week, but at some point soon we will need to see a signed piece of paper if the market is to believe in the trade deals.

Positioning

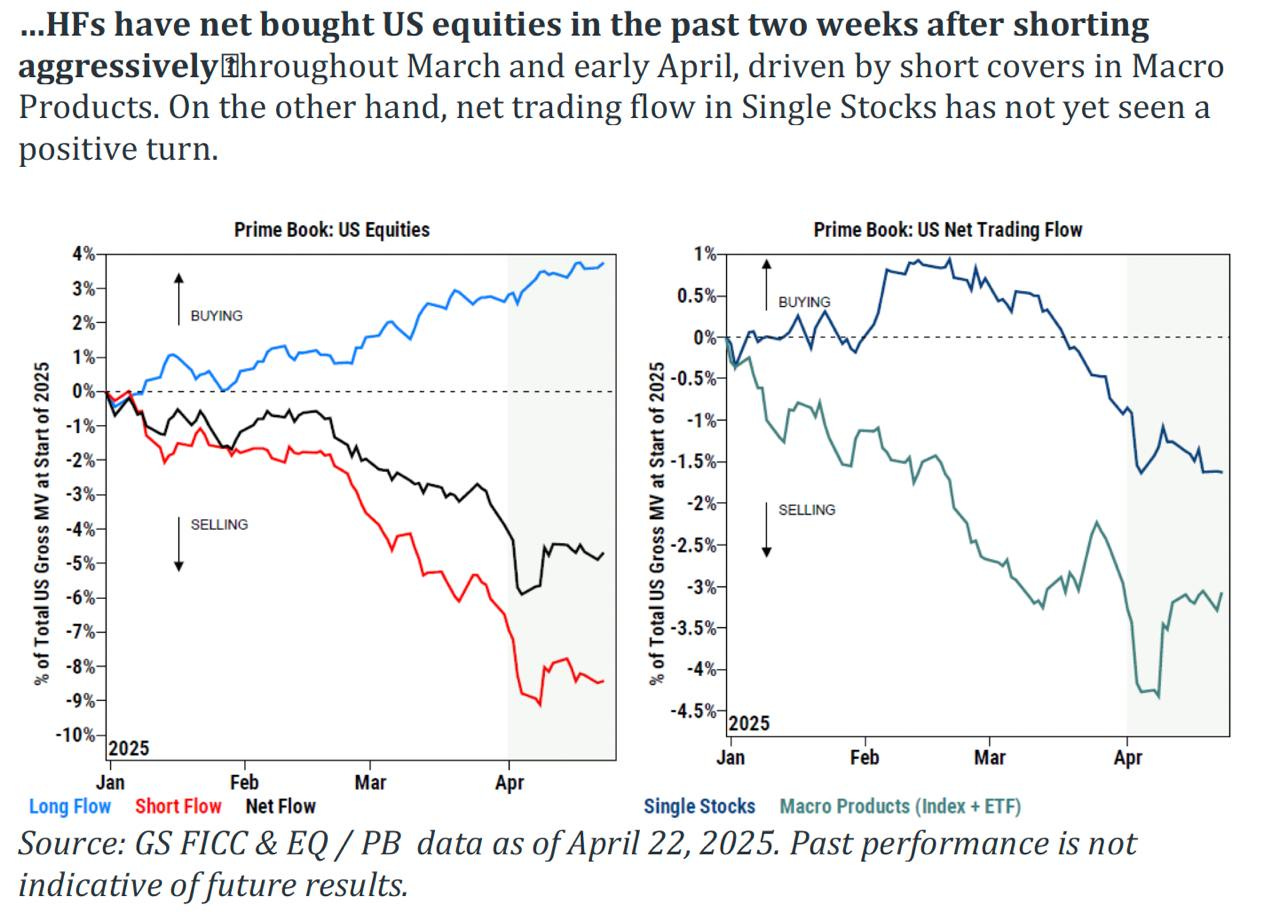

The move higher this week was driven largely by short covering, as everyone is afraid to be short when the tangible trade deal announcements actually start rolling in.